Taiwan's April Exports Came In Weaker Than Expected

| 4.3% | Taiwan's April export growth (year-on-year) |

| Lower than expected |

April export growth slowed to 4.3% year-on-year from 18.9% YoY, while import growth edged down slightly to 6.6% YoY from 7.1% YoY in March. Through the first four months of the year, exports have grown 14.6% YoY and imports have grown 7.5% YoY.

Weaker-than-expected exports and broadly in-line imports translated to a smaller-than-expected trade surplus of USD 6.5bn in April. After a very strong contribution from net exports to first quarter GDP growth, April's trade data release suggests that this boost will be smaller starting from the second quarter onward.

By category, export strength was almost entirely concentrated in one category, the information, communication, and audio-video product exports, which includes semiconductors. This category grew by 114.6% YoY in April, bringing the year-to-date growth to 121.6% YoY. In April, this category accounted for 31.3% of total exports. However, the majority of other categories mostly saw negative growth in April, with many seeing double-digit year-on-year declines; the steepest declines included optical and precision instruments (-33.3%), mineral products (-27.9%), and electronic product parts (-17.7%).

Taiwan's trade balance fell to 3-month low amid disappointing exports

Surge of exports to US insufficient to offset drag from exports to Mainland China and Hong Kong

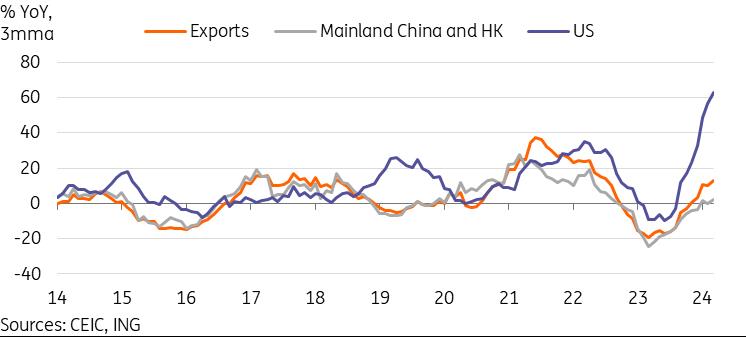

Since 2022, Taiwan's export growth to the US has significantly outpaced the headline export growth, and thus far in the year to date this growth has remained very impressive with exports to the US up 81.6% YoY in April, and up 64.1% YoY through the first four months of the year.

However, despite this torrid growth, the headline number has been mild as exports to other regions have been significantly weaker. Most notably, exports to Mainland China and Hong Kong, which still remain the largest export destination at a bit over 30% of total exports, saw growth slowing to -11.3% YoY in April, bringing the full-year growth to -3.7% YoY. April exports to Asia, the Middle East, and Oceania fell -10.4%, -22.3%, and -16.1% YoY, respectively.

In short, it looks like the fate of Taiwan exports is heavily tied to semiconductor sales to the US for now, leaving economic growth prospects intertwined with continued AI-driven demand.

Taiwanese exports look increasingly dependent on demand from the US

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment