403

Sorry!!

Error! We're sorry, but the page you were

looking for doesn't exist.

Silver Forecast Today - 19/01: Major Support (Video & Chart)

(MENAFN- Daily Forex)

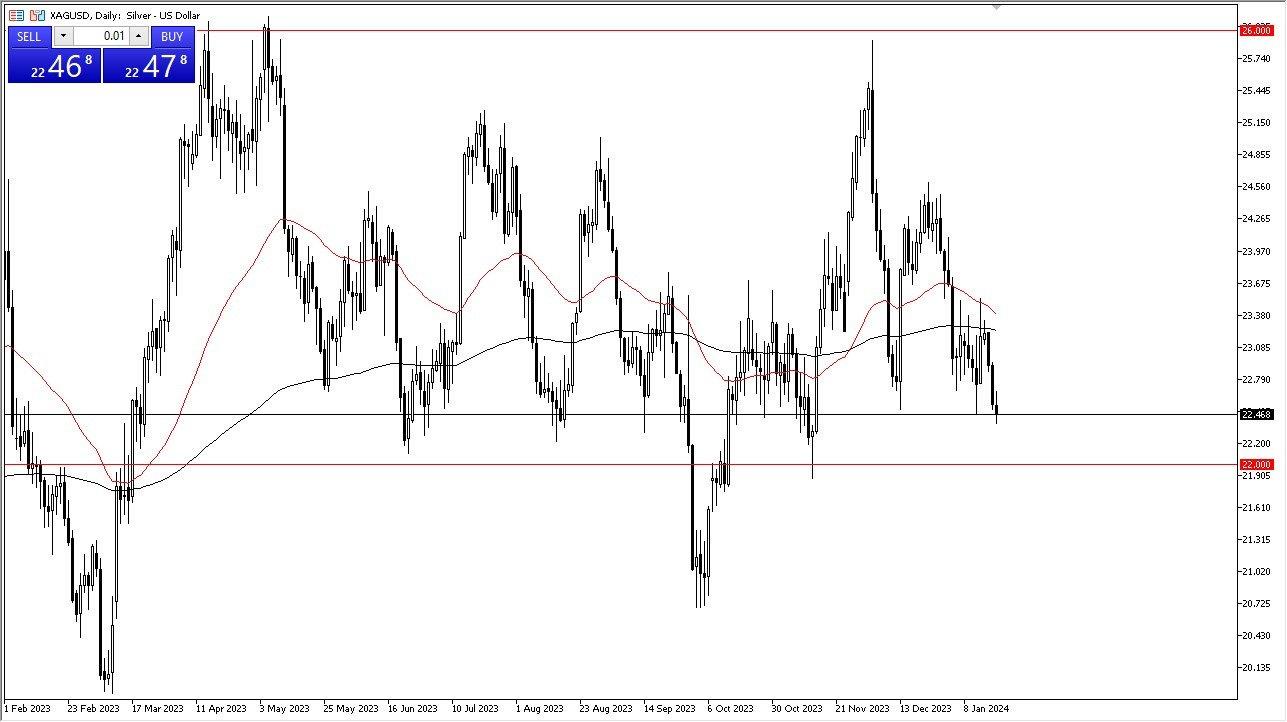

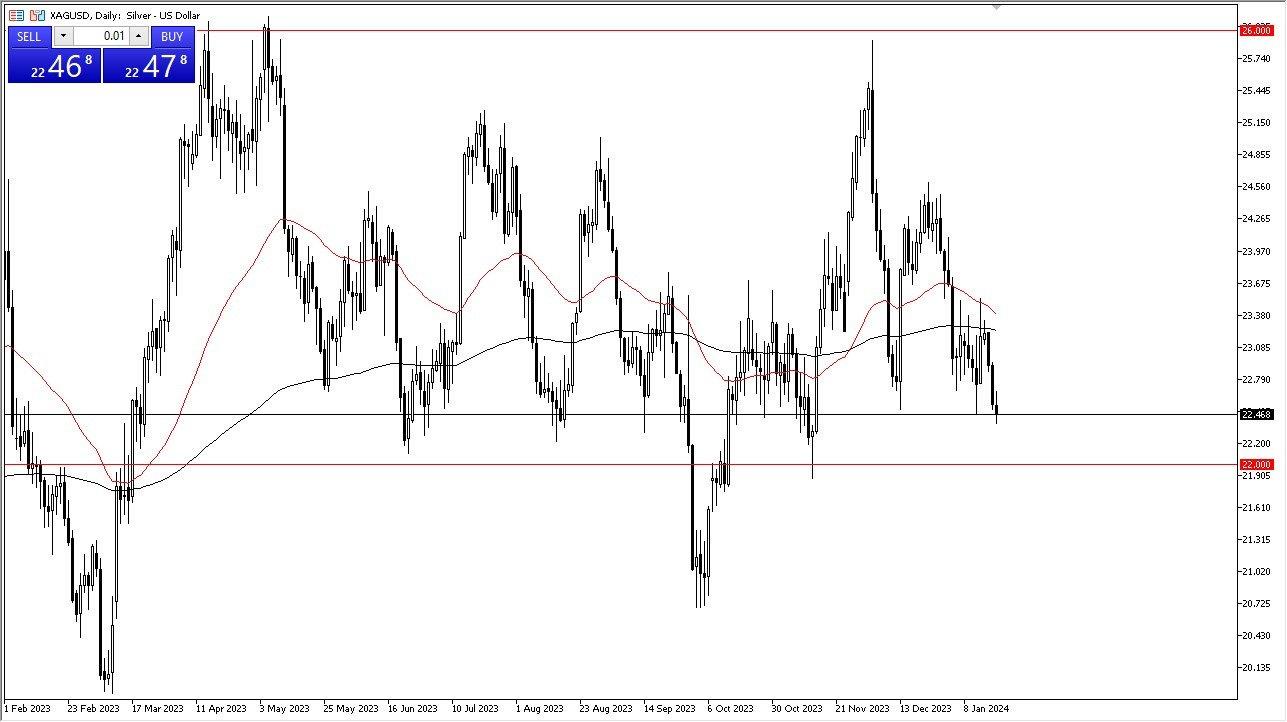

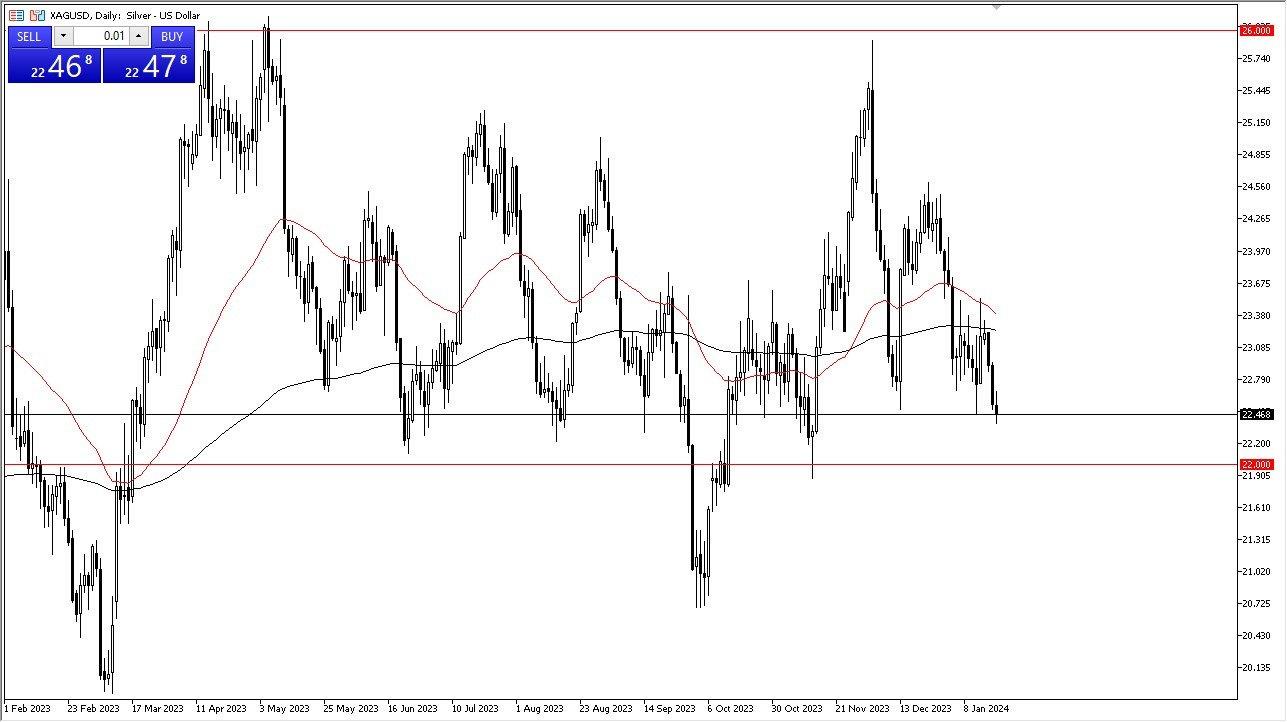

Silver Remains VolatileKeep in mind that silver is extraordinarily volatile , and you have to be very cautious about your position sizing. But ultimately, I think this is also a situation where things are going to be very noisy, pay attention to bond yields in the United States, because if they start to drop that will help silver, just as a falling US dollar will be due to the fact that the silver market has such a huge negative correlation to the green bank. In the meantime, I think we have a lot of noisy behavior just waiting to happen. And of course, we have to pay close attention to the idea that industrial demand may or may not start to drop.The 200 day EMA above is, I believe, a significant resistance barrier near the $23.20 level. If we can break that, then it opens up a move to the $24 level, maybe the $24.50 level. We are closer to the bottom of the overall range than the top, so I do think that there are a lot of people out there willing to pick up cheap silver. If we break down below the $22 level, we could drop another dollar down to the $21 level, but right now, that doesn't look very likely, and I think a bit of a bounce is more likely than not. Forex Brokers We Recommend in Your Region See full brokers list 1 Read full review Get Started Regardless of what you think about the longer-term directionality of the silver market, you need to be very cautious with your position sizing as the volatility of silver continues to be a major issue. There are a cross current of multiple issues right now that continue to throw the market around, and you need to be cognizant of multiple factors simultaneously. This is part of what makes silver so difficult to trade, but at the same time, you should also keep in mind that we are getting closer to the idea of“cheap silver.”

Ready to trade our daily Forex analysis ? We've made this forex brokers list for you to check out.

- Silver has gone back and forth during the course of the trading session on Thursday in early trading, but I think we're still stuck in the same range that we have been in for a while. The $22.50 level, I think, is the beginning of significant support that extends down to the $22 level. The $22 level is an area that I think is the bottom of an overall large consolidation area that extends all the way up to the $26 level.

Silver Remains VolatileKeep in mind that silver is extraordinarily volatile , and you have to be very cautious about your position sizing. But ultimately, I think this is also a situation where things are going to be very noisy, pay attention to bond yields in the United States, because if they start to drop that will help silver, just as a falling US dollar will be due to the fact that the silver market has such a huge negative correlation to the green bank. In the meantime, I think we have a lot of noisy behavior just waiting to happen. And of course, we have to pay close attention to the idea that industrial demand may or may not start to drop.The 200 day EMA above is, I believe, a significant resistance barrier near the $23.20 level. If we can break that, then it opens up a move to the $24 level, maybe the $24.50 level. We are closer to the bottom of the overall range than the top, so I do think that there are a lot of people out there willing to pick up cheap silver. If we break down below the $22 level, we could drop another dollar down to the $21 level, but right now, that doesn't look very likely, and I think a bit of a bounce is more likely than not. Forex Brokers We Recommend in Your Region See full brokers list 1 Read full review Get Started Regardless of what you think about the longer-term directionality of the silver market, you need to be very cautious with your position sizing as the volatility of silver continues to be a major issue. There are a cross current of multiple issues right now that continue to throw the market around, and you need to be cognizant of multiple factors simultaneously. This is part of what makes silver so difficult to trade, but at the same time, you should also keep in mind that we are getting closer to the idea of“cheap silver.”

Ready to trade our daily Forex analysis ? We've made this forex brokers list for you to check out.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Market Research

- Manuka Honey Market Report 2024, Industry Growth, Size, Share, Top Compan...

- Modular Kitchen Market 2024, Industry Growth, Share, Size, Key Players An...

- Acrylamide Production Cost Analysis Report: A Comprehensive Assessment Of...

- Fish Sauce Market 2024, Industry Trends, Growth, Demand And Analysis Repo...

- Australia Foreign Exchange Market Size, Growth, Industry Demand And Forec...

- Cold Pressed Oil Market Trends 2024, Leading Companies Share, Size And Fo...

- Pasta Sauce Market 2024, Industry Growth, Share, Size, Key Players Analys...

Comments

No comment