Sustainable Finance Helps Data Centres Reduce Their Environmental Impact

sustainable finance products to help reach their environmental

goals In this article Pressure for data centre decarbonisation is mounting Green bond framework and impact metrics of companies with data centre operations Ramping up investments in renewable energy

Sustainable finance products now provide an effective tool for data centres to fund their decarbonisation efforts and reach key environmental goals Pressure for data centre decarbonisation is mounting

The pressure for data centres to accelerate decarbonisation has never been stronger. Environmental, Social, and Governance (ESG)-conscious investors and corporate clients of data centres are demanding lower emissions. Moreover, mandatory sustainability data disclosure is forcing data centre providers to manage their sustainability efforts more actively.

In the EU, with the Energy Efficiency Directive (EED) and Corporate Sustainability Reporting Directive (CSRD) coming into force (the latter requires c.50,000 companies to report their direct and indirect emissions from 2024 onwards), data centres (with an installed IT power demand of at least 100 kilowatts) will need to provide detailed public reports of their energy usage and performance. The EU Taxonomy also includes a reference to the European Code of Conduct on Data Centre Energy Efficiency. In the US, the signing of California's Climate Corporate Data Accountability Act (SB 253) and Climate-Related Financial Risk Act (SB 261) together require thousands of companies to report quality climate data. These acts will likely impact the Securities and Exchange Commission's highly anticipated climate disclosure rules, likely this year. Moreover, states such as Virginia and Oregon have proposed bills to strengthen data centre sustainability reporting and slash emissions by 60% by 2027.

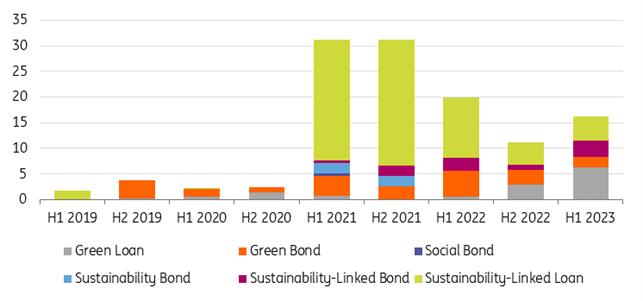

An effective tool for data centres to fund their decarbonisation efforts is to issue sustainable finance products. The technology sector has experienced a considerable jump in green loan issuance this year, as can be seen in the graph below. The sustained interest from the technology sector shows that there is a favourable environment for data centres to further explore sustainable finance options. Note that the slowdown in issuing volume from the records set in 2021 is in line with the trends seen in the global sustainable finance market.

Global issuance of sustainable finance products in the technology sector (US$bn)

ING Research based on Bloomberg New Energy Finance

Indeed, companies with substantial data centre operations have been using sustainable finance products to help reach their sustainability goals. Through an examination of company green bond frameworks, we found that common eligible projects for financing include (1) energy efficiency improvement, measured in power usage effectiveness (PUE); (2) renewable energy solutions; and (3) the greening of buildings, benchmarked by building efficiency certifications. These cover a good range of material climate issues for data centres.

What is not as common in these frameworks but requires increasing attention is water management, as our analysis shows a need for data centres to tackle risks around water stress and local community relationships. That said, when establishing its sustainable finance framework, a company needs to have a good breadth and depth of eligible project areas that address environmental concerns and not ignore any issues that can introduce more risks in the long term.

Green bond framework and impact metrics of companies with data centre operations Equinix Company data NTT Company data Digital Realty Company data Alphabet Company data Apple Company data Amazon Company dataImpact reporting-the disclosure of both use-of-proceeds allocation and the improvement of environmental impact-is a crucial practice to boost issuer sustainability credibility. For instance, Equinix allocated $3 of green bond use of proceeds as of June 2022, with almost 98% dedicated to lowering the design average annual power usage effectivenes to 1.45 or below. Equinix's annual average PUE decreased from 1.54 in 2019 to 1.46 in 2022. Comparatively, Alphabet's cumulative $5 of ESG bond allocation has been mainly toward green buildings (48%), clean energy (31%), and energy efficiency (18%). On the back of their green bonds, Alphabet has reported that 25mn tonnes of CO2 equivalent has been avoided through renewable energy power purchase agreements (PPAs), and 807,000 square metres of LEED Platinum-certified office space.

While the reported data already shows a fair level of company commitment to sustainability reporting, there is still great room for improvement. This includes:

- Disclosing more detailed data across metric categories. According to a survey by Uptime Institute covering more than 700 companies in the data centre industry, 88% of the respondents report IT or data centre power consumption, 71% report on PUE whereas only 41% report on water usage and 34% disclose renewable energy consumption. Choosing a good combination of absolute data (e.g. water usage amount) and ratios (e.g. water usage energy intensity), as well as further breakdowns of data by product, operation, project, or geography. Reporting separately on data centre decarbonisation results, but also contextualising data centre numbers in the bigger picture of a company's entire operations.

Finally, reporting metrics need to be updated as needed. For instance, if a company has been consistently achieving a low PUE number, then it might need to add further metrics to reflect ongoing sustainability efforts more precisely.

Most companies also acquire and publish third-party assurances of green bond allocations, and this will enhance investor confidence that the use of proceeds is indeed going into eligible green projects indicated in companies' sustainable finance frameworks. In an environment where greenwashing is increasingly criticised and less tolerated, it is important for issuers to provide assurances to investors that the proceeds of loans and bonds have been allocated to high-quality projects, with the desired associated impact.

Ramping up investments in renewable energyIn addition to the increased energy efficiency, data centres substantially rely on renewable energy-through the buying of power purchase agreements (PPAs) and direct investment-to achieve carbon neutrality targets. Google, Amazon, Meta and Microsoft have all committed to this goal and are among the largest corporate purchasers of renewable energy along with other data centre operators such as Equinix.

Top Corporate Power Purchase Agreement (PPA) buyers in 2023 (January to Mid-September, in MW) ING Research based on Bloomberg New Energy FinanceAs a result, large technology companies have mostly achieved 100% use of renewable electricity, while Equinix and Digital Realty powered 96% and 62% of their operations with renewable energy in 2022, respectively. It is also no surprise then that 21% of data centre executives say that the opportunity to buy more renewable energy is the biggest driver of data centre sustainability in the next five years.

The purchase of renewable energy and robust sustainable finance frameworks will further develop the sustainable finance market. First, data centre companies can choose to use sustainable finance to support the investment aimed at becoming more environmentally friendly. Second, the large demand for renewables (through power purchase agreements) can also spur clean electricity developers to finance capacity expansion.

One could perceive the procurement of green energy by data centres as a problem because it is a scarce commodity. Nevertheless, one reason the sector procures green energy is that margins allow it to do so. Moreover, the companies have the scale and willingness to sign large PPA contracts. It shows that the sector is relatively profitable and growing fast, which enables the transition to a green and digital economy.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment