Highest Stock Valuation In History

The Broad Market Index was down 4.77% last week and 54% of stocks out-performed the index.

This is the last update for the 2nd quarter Securities and Exchange Commission (SEC) reporting period. The early financial statements for the third quarter are for companies with fiscal quarter ending in August and will begin next week.

We continue to see a strong 2nd quarter acceleration in corporate cash with sales growth high, profit margins rising and overall profitability up at the average company.

How MicroStrategy Was Transformed From A Software Firm To A Bitcoin PlayMicroStrategy and its CEO, Michael Saylor, have played a significant role in news headlines about bitcoin since he transformed the company from a software firm into primarily a bitcoin play. That worked well for a while, but in 2022, things haven't gone so well. In fact, MicroStrategy has lost $2 billion on its bitcoin bet Read More

Get The Full Ray Dalio Series in PDF

Get the entire 10-part series on Ray Dalio in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues

Q2 2022 hedge fund letters, conferences and more

Table of Contents show- 1. Overall Corporate Growth Is Still Strong

- 2. However, Growth Is Falling On Average

- 3. Growth Outlook

- 4. Investment Alternatives

- 5. Otos. io SEC Reporting Database

- 6. S&P 500 Index Quarterly Recap

- 7. Otos.io In Action

The addition over the past two weeks of 70 new companies changed the composition of the broad market a bit and only added more strength on average. With average sales growth of 18% and profit margins rising, corporate cash is accelerating at a rate that is unsustainable even with inflation at 8.5%.

However, Growth Is Falling On AverageThere is no possibility of reducing inflation with corporate growth so strong. The fact that current growth rates are so high supports the unrealistic expectation that is reflected in, still, the highest valuation for stocks in history.

Growth has been falling on average and more frequently for a year. It is a drop in the frequency of improvement in sales growth that signals the top and we have been selling stocks and raising cash as the rising sales growth metric fell from 83% of companies at the peak last year to 27% in the most recent period.

Growth OutlookGrowth will continue to fall, and our strategies are braced for that with only accelerating companies as portfolio stocks and a large cash position. The best-case scenario would be a steep and broad decline in corporate growth.

Recent evidence suggests the opposite, where even though growth has been falling for a year, companies are benefiting from inflation with both premium sales growth and a rising gross profit margin. Inflation is firmly embedded and only a very aggressive tightening of money policy has a chance of slowing that any time soon.

That is why the stock market is vulnerable to a steep decline now. Falling growth and rising interest rates are a double negative for stocks. And there is no place to hide. As we have seen, rising interest rates depress the value of all assets.

Investment AlternativesShort duration bonds (cash alternatives) are our best choice now since they benefit from rising interest rates. And we need to get growth into the portfolio ASAP. The signal that we can reduce our cash and buy stocks back will be an increase in the frequency of rising sales growth.

That improving metric has marked the bottom of every growth decline in the data record. We should see that improvement in 2023. Meanwhile it is a question of how steep the growth drop will be and more importantly, how best to prepare.

Otos. io SEC Reporting DatabaseThe recent SEC filing update is 100% complete. The volume of SEC filings will decrease in coming weeks.

Otos.io makes it possible to make an active decision for every stock that passes your preference search. Once you are logged in: try clicking your portfolio avatar.

It creates a better-than-this search that finds all companies that have at least one attribute that is better than the portfolio average.

Request a Notos, or make a transaction to indicate your decision. As we go through the quarterly update Otos manages, learns and accommodates your decisions and preferences, alerting you to any requested developments.

A better-than-this search for a selected attribute is available from the avatar factors link on every company page. Otos is displaying benchmark indexes, sector and industry groups. All accessible from your profile page.

This avatar represents your current portfolio updated for the recent annual financial statements filed with the SEC.

The animation represents the changes in avatar attributes over past 14 months. The avatar attributes and correlations with share price are accessible from the company report page.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

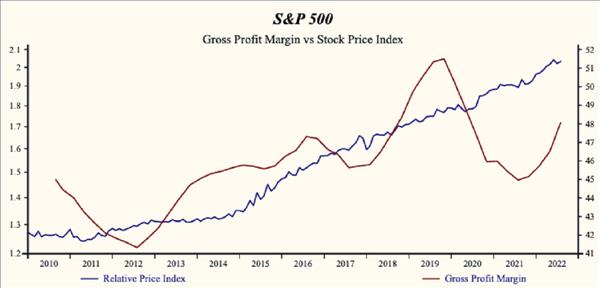

S&P 500 Index Quarterly RecapMonday, September 19, 2022: The share price index of the S&P 500 Index has advanced by 63% relative to the Otos Total Market Index since the May, 2011 low. Current relative price to sales is about mid-range in the record of the Index.

Last week the share price index of the S&P 500 Index fell by 5.0% compared to a 4.8% decline for the Otos Total Market Index. Gaining stocks in the S&P 500 Index numbered 22 or 4.6% of the Index total compared to a 4.9% gaining stocks frequency across the 3979 stocks in the Otos U.S. stocks universe.

We have collected second quarter 2022 sales data for 467 of the 479 comparable record companies in the S&P 500 Index representing 98% of the capital value. The Index capital weighted average sales growth rate is 17.0%. The proportion of Index market capital accounted for by rising sales growth companies is down to 16.0%, compared to 40.3% last quarter.

Currently, sales growth is high in the record of the S&P 500 Index but lower than last quarter. The proportion of total market capital accounted for by rising gross profit margin companies is down to 40.7% compared to 48.9% last quarter.

The Index is recording a rising gross margin. Inventories are up, diminishing the chance of a future increase in the gross margin. SG&A expenses are low in the record of the Index and rising and Interest costs are falling.

That implies that the Index has limited scope for further cost containment and rising costs are slowing the EBITDA growth rate relative to sales. The gross margin is rising at a faster rate than SG&A expenses, producing a rising EBITDA margin.

Otos.io In ActionMaintain portfolio companies with high sales growth and rising profit margins (tall green MoneyTree in a golden pot).

Learn more and sign up for our Otos NOtos notifications at OTOS.io and experience your financial reality as FREEDOM AND EMPOWERMENT.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment