403

Sorry!!

Error! We're sorry, but the page you were

looking for doesn't exist.

Oil Rises as Hopes Fade For OPEC+ Supply Boost

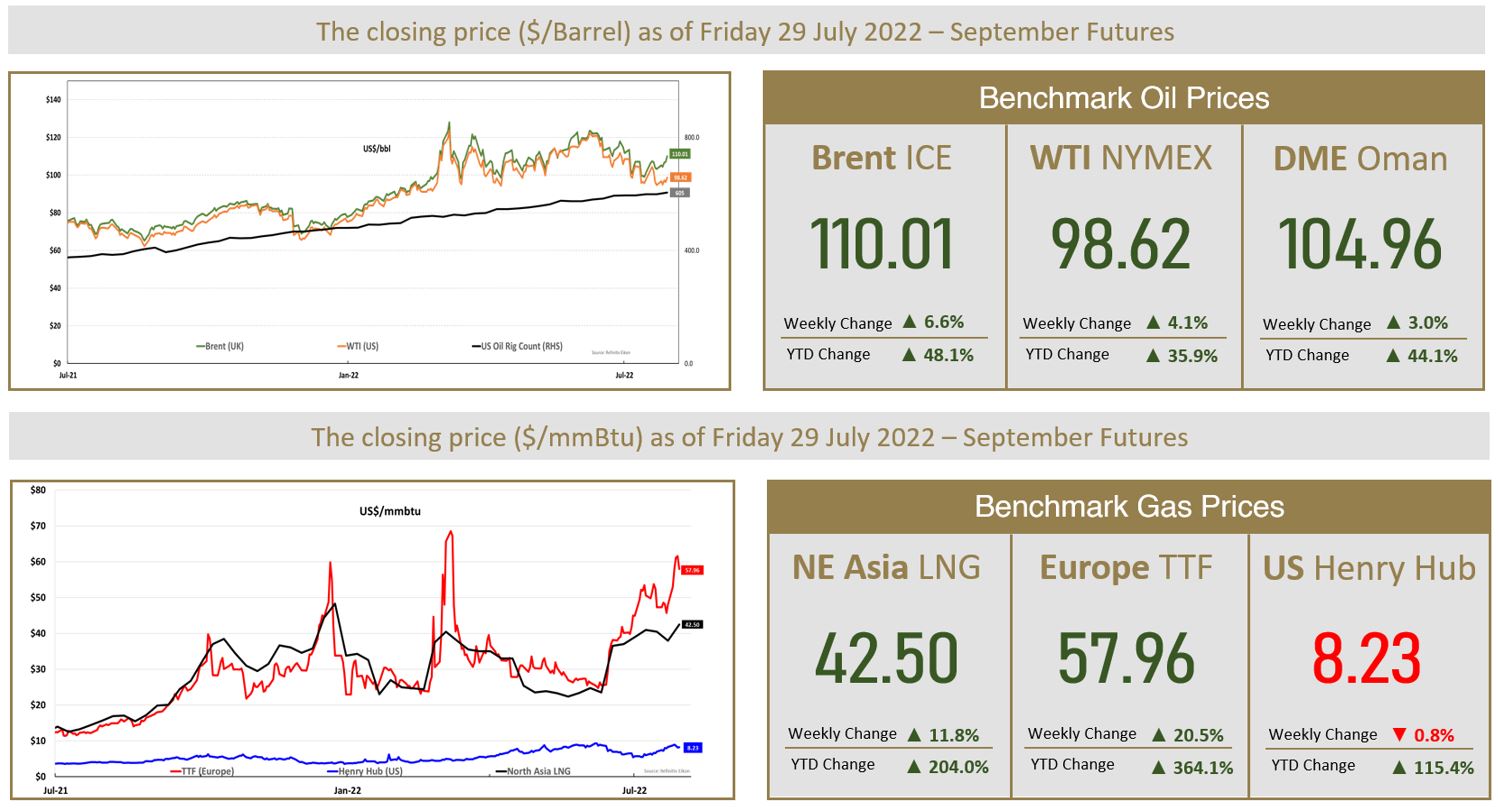

(MENAFN- The Al-Attiyah Foundation) Oil prices rose on Friday as attention turned to the upcoming OPEC+ meeting and dimming expectations that the producer group will imminently boost supply. brent crude futures contract jumped $2.87 a barrel to settle at $110.01 a barrel. U.S. West Texas Intermediate (WTI) crude futures settled at $98.62 a barrel, rising by $2.20 a barrel. For the week, Brent futures gained 6.6% while WTI was up by 4.1%. Investors will next watch the Aug. 3 meeting of the Organization of the petroleum Exporting Countries (OPEC) and allies led by Russia, together known as OPEC+. Sources said that OPEC+ will consider keeping oil output unchanged for September when it meets next week, despite calls from the United States for more supply, although a modest output increase is also likely to be discussed. Analysts said it would be difficult for OPEC+ to boost supply, given that many producers are already struggling to meet production quotas. The OPEC+ group produced almost 3 million barrels per day less crude than foreseen by its quotas in June as sanctions on some members and low investment by others crippled its ability to ease the world’s energy crisis.

Asia Spot Prices Jump on Further Nord Stream Cuts

Asian spot LNG prices jumped last week, after further reductions by Russia to Nord Stream 1 flows renewed concerns over market tightness, as buyers compete for cargoes to meet summer demand in Asia and maintain stock build in Europe. The average LNG price for September delivery into north-east Asia was estimated at $42.5 per mmBtu, up $4.5 or 11.8% from the previous week, industry sources said. Meanwhile, European gas prices at the Dutch TTF hub hit a four-month high following Russian gas cuts and now hover near $58 per mmBtu. These prices are a manifestation of fears that European storage will not be full enough as winter starts, given that no significant LNG capacity will be added this year to help offset weaker Russian pipeline supplies to Europe. In the U.S., natural gas futures gained about 1% on Friday on forecasts for hotter weather through mid-August than previously expected, which should force power companies to burn more gas rather than injecting the fuel into storage for the winter. The gas price increase came even though output was on track to reach a record high in July and the ongoing outage of the Freeport LNG export plant in Texas leaves more gas in the United States.

By: The Al-Attiyah Foundation

Asia Spot Prices Jump on Further Nord Stream Cuts

Asian spot LNG prices jumped last week, after further reductions by Russia to Nord Stream 1 flows renewed concerns over market tightness, as buyers compete for cargoes to meet summer demand in Asia and maintain stock build in Europe. The average LNG price for September delivery into north-east Asia was estimated at $42.5 per mmBtu, up $4.5 or 11.8% from the previous week, industry sources said. Meanwhile, European gas prices at the Dutch TTF hub hit a four-month high following Russian gas cuts and now hover near $58 per mmBtu. These prices are a manifestation of fears that European storage will not be full enough as winter starts, given that no significant LNG capacity will be added this year to help offset weaker Russian pipeline supplies to Europe. In the U.S., natural gas futures gained about 1% on Friday on forecasts for hotter weather through mid-August than previously expected, which should force power companies to burn more gas rather than injecting the fuel into storage for the winter. The gas price increase came even though output was on track to reach a record high in July and the ongoing outage of the Freeport LNG export plant in Texas leaves more gas in the United States.

By: The Al-Attiyah Foundation

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment