Taiwan Test Case For Investing In China Chipmaking

A Hon Hai Technology Group company's investment in China's Tsinghua Unigroup has drawn the attention of Taiwanese regulators and raised new questions about semiconductor-related technology transfers to mainland China.

Tsinghua Unigroup is China's largest semiconductor company while Hon Hai Precision Industry, the core company of the Hon Hai Technology Group, is the world's largest electronics contract manufacturer.

Headquartered in Taipei, Hon Hai Precision Industry, also known as Foxconn, is best known as the primary assembler of Apple iPhones.

Foxconn Industrial Internet, a Hon Hai subsidiary headquartered in Shenzhen and traded on the Shanghai Stock Exchange, recently invested in Tsinghua Unigroup through a Chinese investment fund without informing the Investment Review Committee of Taiwan's Ministry of Economic Affairs.

Established in March this year, Xingwei (Guangzhou) Industrial Investment Partnership is one of 10 funds making up Beijing Zhiguangxin Holding Co, which now owns 100% of Tsinghua Unigroup.

That could earn Hon Hai a NT$25 million (US$836,000) fine, on top of which the Investment Commission might not approve the investment.

Under Taiwanese law, any Taiwanese company that plans to invest more than US$50 million (NT$1.5 billion) in China must receive the ministry's approval in advance. The investment reportedly amounted to 5.4 billion Chinese yuan (US$797 million), far exceeding that legal limit.

Moreover, any investment in a“sensitive” economic sector must be reviewed by Taiwan's Investment Commission. Sensitive sectors include semiconductor design, manufacturing, test and packaging – i.e., the complete semiconductor production process.

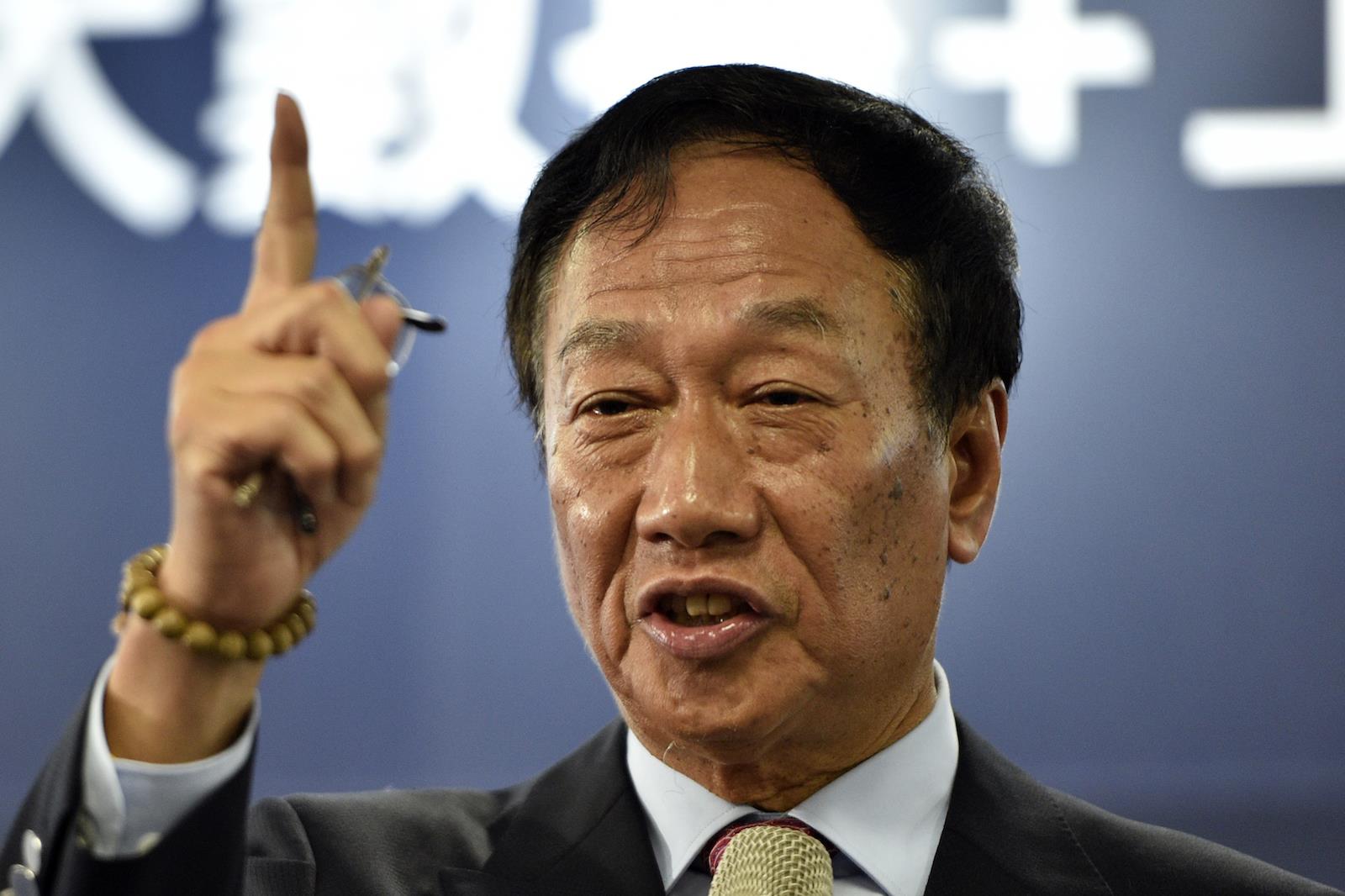

Foxconn is in the de facto middle of the Hon Hai Technology investment controversy. Photo: Handout

For its part, Foxconn Industrial Internet claimed in a public statement that“FII is an independent company, listed on the Chinese stock market. The company raised capital in China and used the proceeds to invest in third-party private equity funds, with an aim to explore new technologies and investment targets to fuel the company's future expansion.”

Hon Hai Precision owns 83.5% of Foxconn Industrial Internet, so how independent is it?

According to Taiwanese press reports, Hon Hai is now cooperating with the Ministry of Economic Affairs. After a comprehensive review of the investment plan and its implications, the Investment Review Committee will make a final recommendation.

If it is determined that there is no threat to Taiwan's semiconductor industry, the plan should be accepted. How big a fine Hon Hai will have to pay, if any, will also be determined.

Founded at Tsinghua University in Beijing in 1988, Tsinghua Unigroup is both China's largest semiconductor company and its largest supplier of cloud computing and other IT hardware and software solutions. Its semiconductor subsidiaries include NAND flash memory maker Yangtze Memory Technologies Co (YMTC) and mobile phone chip designer UNISOC.

YMTC is the world's newest maker of NAND flash memory chips, ranking fifth after Samsung, SK Hynix, Kioxia/Western Digital and Micron with a global market share of about 5% in 2021. Its technology has improved to the point where Apple is testing its products and anti-China American politicians are advocating that it be sanctioned.

UNISOC is the world's fourth largest designer of mobile telecom processors after Mediatek, Qualcomm and Apple. Its global market share was about 9% in 2021.

After running up unsustainable debts in a headlong rush to expand its business, Tsinghua Unigroup defaulted on several bond payments in 2020. It was then forced into a court-supervised restructuring, from which it has now emerged under new ownership.

Hon Hai was founded in 1974 by Terry Gou, who ranks with Morris Chang of Taiwan Semiconductor Manufacturing Company Ltd (TSMC) as one of Taiwan's most successful and influential entrepreneurs.

Gou resigned from his position as chairman and CEO of Hon Hai in 2019 in order to run for Taiwan's presidency but dropped out of the race after failing to be nominated to represent the opposition Kuomintang (KMT). He remains on the Hon Hai board of directors.

Terry Gou, chairman of Taiwan's Foxconn, during a press conference in New Taipei City in 2017 upon announcing his intention to run for the presidency of Taiwan on a ticket from the Beijing-friendly opposition Kuomintang party. Photo: AFP

Gou was replaced by his special assistant Young Liu, under whose leadership Hon Hai is expanding in three major industries – electric vehicles, digital health and robotics – and three technologies – AI, semiconductors and next-generation telecommunications. Diversification away from dependence on the cell phone market was initiated by Gou.

In addition to Apple, Hon Hai manufactures products for Amazon, Microsoft, Cisco, Dell, Nintendo, Sony, Nokia, Acer, Xiaomi and other major companies. It is the largest private sector employer in China, with about 1.3 million employees working at a dozen factories. In 2021, it ranked 22nd in the Fortune Global 500.

Foxconn Industrial Internet is a key part of Hon Hai's diversification drive. Established in 2015, it designs and manufactures telecom and cloud service equipment, precision tools and industrial robots, and provides related services.

In its own words, it“is dedicated to building a new, advanced manufacturing plus industrial internet system, with technological platforms centered on cloud computing, mobile terminals, internet of things (IoT), big data, artificial intelligence, high-speed networks and robots.”

According to Taiwanese press reports, Foxconn Industrial Internet recently bought four semiconductor test and packaging factories in China from Taiwan's Advanced Semiconductor Engineering (ASE). As in the case of Tsinghua Unicom, the investment was made through a Chinese investment fund.

It should be clear from these brief descriptions that Hon Hai is as much a Chinese as a Taiwanese company and that Hon Hai Precision and Foxconn Industrial Internet play important roles in the advancement of China's manufacturing economy.

Furthermore, mainland China including Hong Kong is Taiwan's largest export market, accounting for 42% of total shipments in 2021, compared with 15% to the US. Taiwan ran a trade surplus with both, representing 8% of its total trade in the case of China and 35% for the US. Integrated circuits (ICs) and other electronics make up the largest share of Taiwanese exports.

As such, it would be nearly impossible for Taiwan to decouple economically from China. In this context, Hon Hai's investment in Tsinghua Unigroup has demonstrated its commitment to the Chinese semiconductor industry. The Taiwanese government will now determine the degree to which that commitment may be realized.

Follow this writer on Twitter: @ScottFo83517667

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment