B2B Payments And Same Day ACH Key Factors In ACH Network Quarterly Growth'

HERNDON, Va., May 12, 2022 /PRNewswire/ -- The ACH Network experienced overall growth in the first quarter of 2022, even as recent forms of pandemic-related government assistance have ended. Growth in the first quarter was fueled by business-to-business (B2B) payments, and the increase to the Same Day ACH dollar limit.

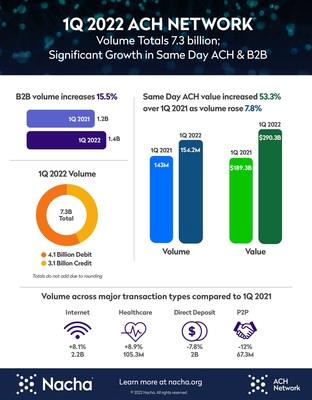

B2B payments increased by 15.5% from the first quarter of 2021, with more than 1.4 billion ACH B2B payments made. That also is a 35.5% increase from the first quarter of 2020, when COVID-19 initially closed many workplaces.

First quarter 2022 ACH Network results

'Many businesses and organizations have come to realize that ACH payments are not just the new normal, but the best way of doing business, given their reliability and convenience,' said Jane Larimer, Nacha President and CEO.

The Same Day ACH per payment limit increased to $1 million on March 18, 2022, contributing to a 53.3% increase in Same Day ACH dollar value over a year earlier, to $290.3 billion, along with a 7.8% volume increase to 154.2 million payments.

'The payments community has welcomed the new $1 million limit and put it to immediate use,' said Larimer. 'The ACH Operators and financial institutions have worked hard to make Same Day ACH the successful modern payment option that it is.'

Overall volume on the ACH Network totaled 7.3 billion payments, up 2.2% from a year earlier, and moving $18.5 trillion, a 7.1% increase. This growth occurred even in the absence of the pandemic-related assistance payments that existed in 2021, when economic impact payments were being made and expanded unemployment benefits were available.

'Adding 154 million payments in a single quarter, with additional value of $1.2 trillion, speaks to the strength of the ACH Network, as it meets the needs of consumers, businesses and governments to make and receive payments,' said Larimer.

About Nacha Nacha governs the thriving ACH Network, the payment system that drives safe, smart, and fast Direct Deposits and Direct Payments with the capability to reach all U.S. bank and credit union accounts. More than 29 billion ACH Network payments were made in 2021, valued at close to $73 trillion. Through problem-solving and consensus-building among diverse payment industry stakeholders, Nacha advances innovation and interoperability in the payments system. Nacha develops rules and standards, provides industry solutions, and delivers education, accreditation, and advisory services.

| Contact: | Dan Roth |

| Nacha | |

| 703-561-3923 | |

| [email protected] |

SOURCE Nacha

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment