Qatar - High global inflation set to moderate over medium-term

Doha: The combination of robust global demand growth with pandemic-related supply constraints for goods and services has led to a significant rise in consumer prices. In fact, global inflation, as measured by the consumer price index (CPI) of the Organization for Economic Cooperation and Development (OECD), spiked 5.8 percent year-on-year (y/y), a rate not seen in decades. Importantly, rapid inflation is taking place across most advanced economies except for Japan.

Against this backdrop, investors and economists are debating whether the world is on the cusp of a new long-standing inflationary cycle. The debate is already leading to a U-turn in the policy guidance of several central banks. Policymakers are moving from accommodation to“normalization” or even tightening. This even led to a more“hawkish” stance of the US Federal Reserve and the European Central Bank.

At the time of writing, global inflationary concerns are particularly salient as the recovery remains strong and supply bottlenecks are pervasive in key markets. In our view, however, while prices are expected to remain elevated over the next few months, inflation should nevertheless moderate over the medium-term. We highlight three main reasons to support our analysis.

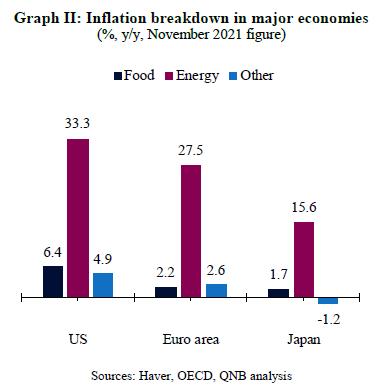

First, while prices across the board have been rising, a significant share of the pickup on headline inflation figures in recent months came from the energy complex, led by higher oil and gas prices. However, in the absence of any new shocks, there is limited room for continued energy price acceleration over the medium term. Oil and gas prices have already fully recovered from the excessively low prices in 2020. Moreover, the faster than expected pick up in global demand seems to be already reflected in current energy prices. In addition, we believe that continued positive economic momentum is already factored into the plans of OPEC+ and US producers, which should boost their output to match additional global demand.

Therefore, in the absence of major unexpected geopolitical events, we do not expect to see significant surprises on the demand or supply side of energy markets this year.

As a result, energy prices should be more stable, helping to moderate global inflation. Second, there are already signs that parts of the supply chain constraints are easing.

The improvement, particularly strong in Southeast Asia, should moderate some of the disruption to global supply chains, as factories re-open and output resumes. High frequency data from Emerging Asia pointed to a strong recovery in activity in recent months, indicating a significant relief from Covid-19 and Delta-variant related supply woes.

This is a key development, as“Factory Asia,” the supply-chain complex around the manufacturing centres in Northeast and Southeast Asia, comprises the core node for global trade. Importantly, Omicron is so far proving to be less disruptive for supply chains.

Furthermore, when it comes to shipping constraints, there has been some positive developments. Prices for the transportation of dry bulk materials have already declined by almost 60% while air-freight rates declined by 20% and freight rates for container transportation stabilized over the last several weeks.

Third, there is still significant spare capacity in the global economy. Across several countries, total industrial capacity utilization and the employment-to-population ratio are still below their pre-pandemic levels.

This suggests that, globally, there is still some room for additional manufacturing demand and employment growth before the economy start to overheat to the point of creating permanent inflationary pressures. All in all, global inflation is expected to moderate in 2022, driven by a stabilisation of energy prices, the easing of supply-chain disruptions and the existence of economic spare capacity globally.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment