TSMC founder doubts US competence in chip-making

(MENAFN- Asia Times) Taiwan Semiconductor Manufacturing Company (TSMC) founder Morris Chang told a symposium this week that the fundamentals underlying his semiconductor production company's world domination are not easy to replicate or transplant elsewhere – including in the United States

The company's plain-spoken founder warned in particular of challenges for the company's planned, new $12 billion fabrication plant in Phoenix, Arizona, which he and other senior executives and American officials had broken ground on less than a year ago.

TSMC cutting-edge semiconductors power phones, computers and controlling electronics in cars and wireless networks. TSMC has profited immensely from the current global chip shortage, caused in large part by previous US president Donald Trump's tech war against China.

The campaign has been carried over during the Biden administration, which includes hard bans on the export of any chip-making equipment made with US components to Chinese companies.

At a forum hosted by Taiwanese media outlets, Chang hailed the workhorse mentality of the Taiwanese working class, as well as the island's deep pool of high-caliber, industrious talent devoted to the chip sector.

At the same time, Chang pointed to an apparent comparative lack of talent in America's mostly moribund manufacturing sector.

'The United States stood out for cheap land and electricity when TSMC looked for an overseas site but we had to try hard to scout out competent technicians and workers in Arizona because manufacturing jobs have not been popular among American people for decades,' Chang said, according to a transcript of his speech viewed by Asia Times.

Chang also warned about sending Taiwanese managers overseas to run plants.

A security staff stands next to a logo of the Taiwan Semiconductor Manufacturing Co, (TSMC) in Taipei on July 16, 2014. Photo: AFP/Sam Yeh

'Computers of different brands can often be hooked together but not people of different culture,' he said, referring to the preponderance of Taiwanese and Taiwan-trained managers and technicians at TSMC.

'The fact that TSMC's top-flight executives can deliver top results in Taiwan is no guarantee of similar performance when they are posted overseas.' Only one Westerner sits on the company's 26-member board .

Taiwan's state-of-the-art infrastructure helps to rev up TSMC's operations and time-to-design and time-to-market capacities, he said.

Chang said the island's efficient and well-developed high-speed rail network and cobweb of expressways provided the vital 'circuitry' for TSMC's research and manufacturing between its headquarters in Hsinchu, near Taipei, and other plants across Taichung and Tainan.

'It was a breeze for us to rotate technicians and staff among the three fabs across the island and when employees change over from one location to another, they even do not need to move their homes thanks to Taiwan's bullet trains and highways and well-rounded transport and logistical support,' said Chang.

'It's unlikely we can replicate all these in Arizona.'

Chang made a foray into the chipmaking business in 1987 in Hsinchu, lured by the city's convenient location as well as government aid.

He said products made in the US would still be saddled with higher costs, even after federal and state governments had each chipped in with hefty investments and subsidies to make the Phoenix project possible.

Apple's 5-nm A14 chip that powers its latest iPhone flagship models, which Apple says rockets past other chips in performance, is made exclusively by TSMC. Photo: Handout

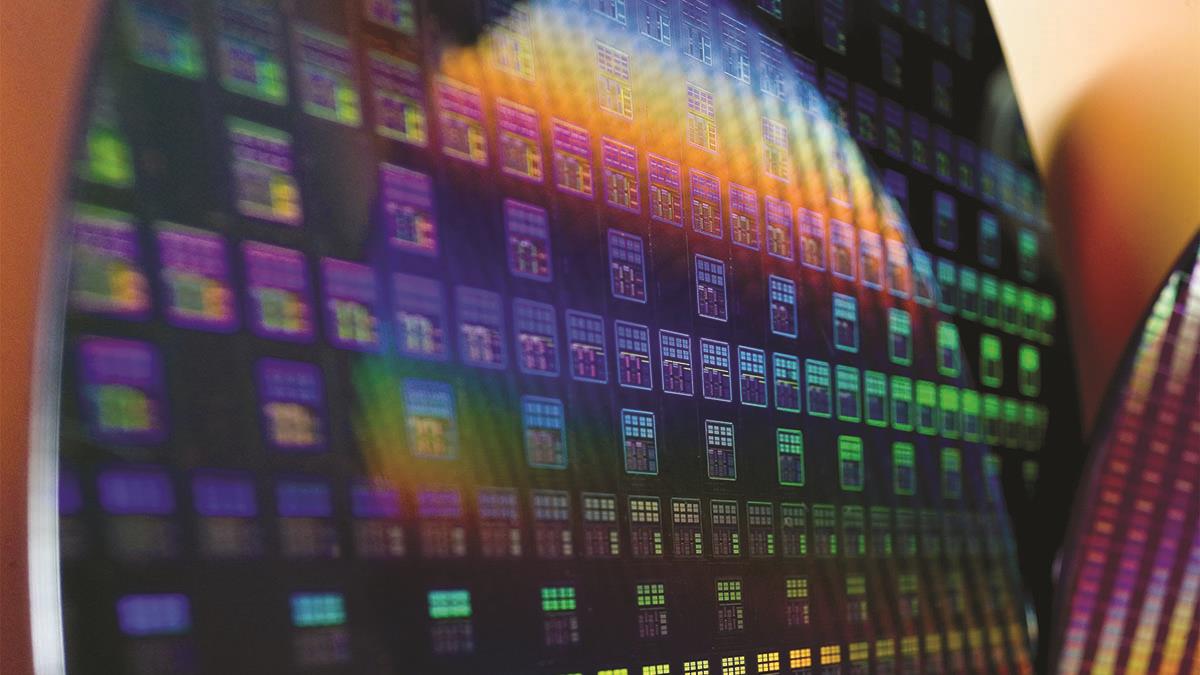

Taiwan's TSMC has agreed to build a $12 billion semiconductor fab in Arizona, which will help protect the US from any shocks to the global supply chain. Photo: TSMC

Chang's candid remarks about TSMC's new US base, delivered to an audience of domestic reporters, mark a striking departure from TSMC chairman Mark Liu's optimism about Arizona's chip-making potential.

Liu told US partners in a virtual industry summit earlier this month that the project would hold out high hopes of taking over part of the cutting-edge manufacturing capabilities of 5-nanometer chipsets from Hsinchu in about two years to ease the worsening global supply crunch.

Alex Capri, a visiting senior fellow and global supply chain specialist with the National University of Singapore's Business School, told German broadcaster Deutsche Welle that TSMC would continue to face 'squeezing' from the China-US rivalry but also beckoning from America as the Biden administration doubled down on its home-made semiconductor push.

'TSMC would have to respond, even if from a business point of view it's more expensive and less efficient to run factories overseas,' said the scholar, adding that Taiwan would still serve as the prime locus for much of TSMC's core research and production.

TSMC founder Morris Chang with Taiwanese President Tsai Ing-wen. Chang urges the island to further cement its lead in chip manufacturing to fend off challenges from South Korea and China. Photo: Handout

After suggesting that the US was unlikely to have the ingredients to recreate Taiwan's special mix, Chang in his talk pivoted to enthuse over the island's indispensable attributes.

'Chipmaking is among the very few sectors where Taiwan is ruling the roost across the globe, and, against the backdrop of geopolitics, the chips we make take on particular significance in consumer electronics, economy and national defense,' he said.

'We must not lose our hard-won primacy to contenders like Samsung and other firms in South Korea.'

He devoted much of his speech to beseech the island's government and stakeholders to help further entrench Taiwan's lead, vowing that TSMC would always 'treasure Taiwan.'

TSMC's lucrative business – 2020 revenues soared 25% to hit a new high of NT$1.33 trillion (US$47.3 billion) – stands in contrast to Beijing's tech self-sufficiency drive led by its mainland competitor SMIC.

Chang said the current global chipmaking hub race was currently only between Taiwan and South Korea and that despite Beijing's state subsidies of tens of billions of dollars TSMC's research and manufacturing capabilities would still be five years ahead of SMIC and its Chinese peers.

The main profile of the Big Island chip is machine learning and serving the HPC market. To this end it also uses TSMC's CoWoS technology, which puts the memory in an encapsulated graphics card, thus enabling very high memory bandwidth. Credit: Handout.

He said China should not seek to short-circuit indigenous research efforts since it could take decades before meaningful breakthroughs could be made.

The Shanghai-based SMIC's 7-nm chip trial production scheme is reportedly progressing at a snail's pace after it was hit by American sanctions and export controls banning its suppliers from furnishing equipment such as extreme ultraviolet lithography machines made with US ingenuity.

By any competitive measure, Chinese tech colossuses from SMIC to Huawei are still playing a prolonged catch-up in the chip contest.

Sebastian Hou, a chip specialist with the Hong Kong-based securities broker CLSA, noted in his report earlier this year that SMIC would be 'nine years and three generations' behind TSMC as the former could only mass-produce 14-nm chips.

Read more:

https://asiatimes.com/2021/01/chinas-new-bylaw-allows-huawei-to-sue-tsmc-for-chip-ban/

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment