(MENAFN- GetNews) According to a new report by Grand View Research, Inc., The global polymer foam market size was valued at USD 113.89 billion in 2020 and is projected to expand at a CAGR of 3.8% from 2020 to 2027. Growing applications in various industries, such as packaging, furniture and bedding, and automotive industries, are expected to drive the type demand.

The global polymer foam market size is expected to reach USD 153.8 billion by 2027, according to a new report by Grand View Research, Inc., expanding at a CAGR of 3.8% over the forecast period. Rising demand from automotive and building and construction industries is likely to drive the market. Polymer foams are widely utilized in combination with other materials in various composite constructions, high-resilience foam seating, rigid insulation panels, automotive components, carpet underlays, upholstery stuffing, and packaging, among other applications.

Rigid types are primarily used as an insulation material in construction and refrigeration applications. They are energy-efficient and help in cutting energy costs. Flexible types are mainly used as a cushioning material in transportation, furniture, bedding, carpet underlay, and packaging, among others.

The market for polymer foam is fragmented in nature with various regional players, such as CIRES SpA, Sealed Air, Vulcan Corporation, and Premier Foam, and well-established global manufacturers, including DowDuPont Inc.; BASF SE; and Armacell International S.A. Majority of the manufacturers are based in North America and Europe and therefore these regions witness high competition. Market players offer a wide variety of polymer foams based on polyurethane, polyethylene, polyether, and expanded polystyrene and serve a broad range of markets, such as construction, wind energy, automotive, mass transportation, marine, and packaging.

COVID-19 outbreak has a significant impact on construction projects. As per the survey by Associated General Contractors of America, the pandemic has delayed projects for 28% of contractors. Polymer foams are widely utilized in the construction industry and are being impacted by the pandemic. We are accounting for these factors and will include updated insights in the report.

Rising focus on development of biodegradable foams owing to stringent environmental regulations across the globe has opened new market opportunities for manufacturers. Manufacturing cost of these biodegradable types is still higher than petroleum-based chemicals. Therefore, it will take a couple of years for manufacturers to completely adopt this variant.

To Request Sample Copy of this report, click the link:

https://www.grandviewresearch.com/industry-analysis/polymer-foam-market/request/rs4

On the basis of type, polystyrene foam was the largest segment in 2020 and accounted for 31.8% of the global revenue. Expanded polystyrene-based products have excellent shock absorbing properties and are preferred in storing, packaging, and transporting of electrical equipment, cooked food, and perishable goods. They are also preferred in various marine floatation applications, including construction of floating docks, surfboards, and boat stands.

Polymer Foam Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa

Further key findings from the report suggest:

- On the basis of type, polyolefin is estimated to emerge as one of the fastest-growing segments over the forecast period as product penetration has increased over the past few years in the flooring and automotive industries. Companies such as Sekisui Alveo AG, Armacell International S.A., and Borealis AG produce polyolefin foams in rolls and sheets that are environmentally friendly, versatile, and lightweight

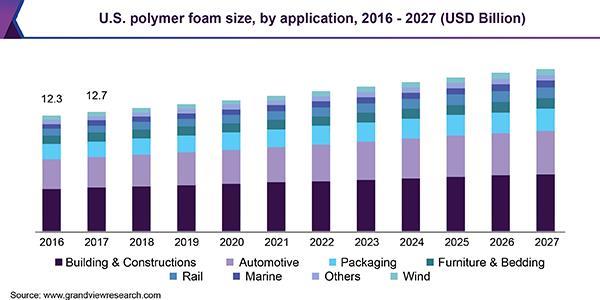

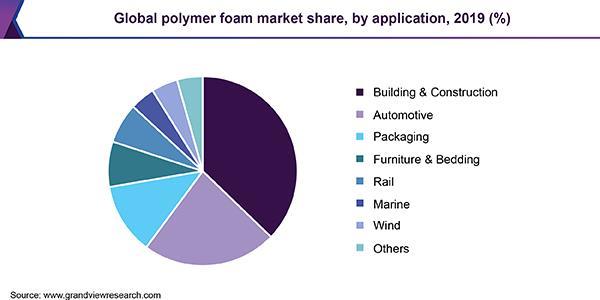

- Building and construction was the largest application segment in 2020 and accounted for 37.9% of the overall volume

- Asia Pacific is estimated to witness the highest growth over the forecast period on account of surging demand from the manufacturing sector in countries like India, China, and Indonesia

- Key players operating in the market for polymer foam include BASF SE, Woodbridge Foam Corporation, Borealis AG, Sealed Air Corporation, Zotefoams PL, Armacell International S.A., and Recticel Group.

Polyolefin foams, including polypropylene and polyethylene, are expected to witness significant expansion in the forthcoming years. Traditionally, low melt strength of these products, particularly polypropylene, limited the growth of this segment in the global polymer foam market. Several technologies including post-reactor radiation and compounding modifiers method have been introduced by various polyolefin manufacturers, such as Borealis and LyondellBasell Industries Holdings B.V. The aim is to improve the strength of polyolefins to meet the requirements of wind energy applications, including spar webs and shell panels, and marine applications like vibration control and cushion seats.

Asia Pacific is anticipated to witness the fastest growth over the forecast period owing to the burgeoning growth in construction, automotive, and wind energy industries in China and India. Growth of the automotive and building and construction industries in Europe is expected to drive the demand for polymer foam over the forecast period.

Polyurethane foam dominated the polymer foam market in 2020 in terms of revenue and is expected to maintain its dominance throughout the forecast period. The type is used in various applications, including furniture, cushions, and carpets. It has a wide customer base owing to its superior capabilities, such as lightweight, low heat and sound transfer, high-energy dissipation, and insulation. Increasing demand for residential and commercial space in Southeast Asian countries such as Singapore, Korea, and Indonesia is further expected to fuel product demand in construction applications.

Have some specific queries about this report, our team of analyst will be glad to help!

Expanded polystyrene foam is one of the lightest materials and on account of its high strength to weight ratio, it is used in packaging applications as it results in low fuel consumption and transport cost savings. It can also be used in rail applications, such as construction of train station platform extensions and rail embankment. Increasing number of rail infrastructure construction projects in Asia Pacific and Middle East and Africa is expected to drive the demand for polystyrene foam over the forecast period.

Building and construction was the largest application segment with a market share of 37.3% in terms of revenue in 2020 owing to rising applications of polymer foam for insulation purposes, flooring, pipe, molding, and in wire and cables. Furniture and bedding will remain the second largest segment owing to increasing applications, such as carpet padding, fibers, chair cushions, mattress padding, and furniture.

Environmental benefits of polymer foam include high recyclability, clean incineration for pollutant filtration, reduced wastage, and greater sustainability. However, several governments and federal agencies are increasingly raising concerns regarding the detrimental health effects of isocyanates utilized in polyurethane production.

Significant technological advancements, such as introduction of bio-based polyols and non-toxic isocyanates, are also likely to promote polymer foam demand in several applications. Existing and new market entrants are thus compelled to innovate or improve their current production processes to gain higher margins in this extremely competitive industry. Major multinationals such as Bayer and Dow Chemical Company have developed innovative manufacturing processes and raw materials to reduce dependence on conventional fossil-fuel based resources and to improve production yield.

Access complete Polymer Foam Report Portfolio By Grand View research, Inc.

Emerging markets across Asia Pacific are gearing up their polymer foam production facilities to meet ever-growing demand from burgeoning population. Countries with high GDP growth rates, such as China and India, are expected to witness rapid expansion in automotive, construction, pharmaceuticals, and manufacturing sectors. These factors are likely to foster demand for polymer foam in several related applications.

Grand View Research has segmented the global polymer foam market on the basis of type, application:

Polymer Foam Type Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

- Polyurethane

- Polystyrene

- PVC

- Phenolic

- Polyolefin

- Melamine

- Others

Polymer Foam Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

- Packaging

- Building & Constructions

- Furniture & Bedding

- Automotive

- Rail

- Wind

- Marine

- Others

Check out special pricing options for sectional purchase and startup companies

The market is characterized by forward integration through raw material production, polymer foam manufacture, and distribution to various application industries. Integration across the stages of the value chain results in continuous raw material supply, as well as low manufacturing costs. R & D initiatives by a few companies to enhance their type specifications and market reach is expected to further augment the type demand in the years to come.

About Grand View Research

Grand View Research, Inc. is a U.S. based market research and consulting company, registered in the State of California and headquartered in San Francisco. The company provides syndicated research reports, customized research reports, and consulting services. To help clients make informed business decisions, we offer market intelligence studies ensuring relevant and fact-based research across a range of industries, from technology to chemicals, materials and healthcare.

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist - U.S.A.

Email: Send Email

Phone: 1-415-349-0058, Toll Free: 1-888-202-9519

Address: 201, Spear Street, 1100

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/polymer-foam-market

MENAFN1104202000703268ID1100008914