Stock Market Rebound Boosts Americans' Financial Satisfaction to Record High: AICPA Index

Stock Market Rebound Boosts Americans' Financial Satisfaction to Record High: AICPA Index

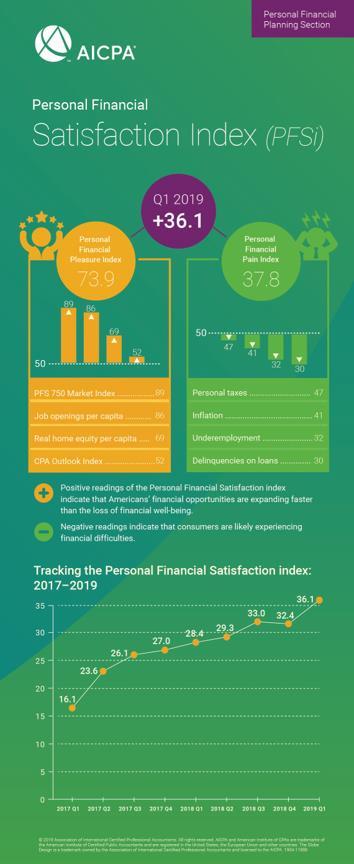

NEW YORK - April 25, 2019 (Investorideas.com Newswire) After a sharp decline in the stock market in the fourth quarter of 2018, stocks surged in the first quarter of 2019. Combined with near record high job openings, the market pushed Americans' personal financial satisfaction to a new record high, according to the AICPA's Q1 2019 Personal Financial Satisfaction Index ( PFSi ). The PFSi bounced back from its first decline in two years to reach its sixth record high in seven quarters.

The PFSi is calculated as the Personal Financial Pleasure Index (Pleasure Index) minus the Personal Financial Pain Index (Pain Index), with positive readings signaling that Americans are feeling more financial pleasure than pain. The Q1 2019 PFSi measured 36.1, an 11.3 percent (3.7 points) increase from the prior quarter. The increase was due to a 2.4-point increase in the Pleasure Index combined with a 1.3-point decrease in the Pain Index (a decline in the Pain Index improves the PFSi overall).

The Pleasure Index, at 73.9, is up 3.3 percent (2.4 points) from the previous quarter, and it is up 27 percent (7.7 points) from the year ago level. This is the 10th record high for the Pleasure Index in the last 11 quarters. The quarterly gain was primarily driven by a 11.3 percent (9.1 point) jump in the PFS 750 Market Index, an AICPA proprietary stock index comprised of the 750 largest companies trading on the US Market adjusted for inflation and per capita. The end of 2018 saw the PFS 750 Market Index experience a sharp downturn, but it managed to bounce back in Q1 2019 to just shy of its all-time high. And due to the sharp quarterly gain, the PFS 750 Market Index is once again the biggest contributor to financial pleasure, as it has been for all but two quarters in the past decade.

"The recent rebound is a perfect example of why it's important to resist the urge to time the stock market and instead remain focused on the long-term goals of your financial plan," said Kelley Long, CPA/PFS member of the American Institute of CPAs' Consumer Financial Education Advocates. "If you had moved into more conservative assets after the stock markets year-end performance, you would have missed out on all of Q1's big gains. Don't be tempted to respond every time the market fluctuates. Instead, stay the course with a financial plan that incorporates the risk tolerance you are comfortable with and aligns with your personal financial goals."

The job market is seeing continued positive performance, further supporting Americans' financial pleasure. Job openings have exceeded the number of unemployed Americans since March 2018. Though the Job Openings Per Capita Index is virtually flat with the previous quarter level, it is still holding near its record high set in Q3 2018. Compared to this time last year, it has increased 16.3 percent (12 points) which includes gains in almost every sector based on data published by the Bureau of Labor Statistics.

The positive gains to the overall PFSi were boosted by the lower overall value of the Pain Index which decreased 3.4 percent (1.3 points) from the prior quarter. The Pain Index is down 9.9 percent (4.1 points) compared to this time last year. In fact, all four factors declined from a year ago, led by a 21.6 percent (8.4 point) drop in loan delinquencies, followed by a 12.9 percent (4.8 points) drop in Underemployment and a 5.5 percent (2.4 point) drop in the Inflation Index. Pain from taxes saw the smallest change, only dropping 2.1 percent (1 point) compared to this time last year.

More Americans are paying their mortgages on time than they have in nearly two decades. As a result, loan delinquencies dropped 5.5 percent (1.8 points) from the previous quarter, with the improvement mostly driven by mortgages. This loan delinquency factor is at its lowest level since the end of 2007. However, it is noteworthy that this factor is still slightly above what was typical between 1994 through 2003.

In Q1 2019, pain from personal taxes remained approximately flat compared to the previous quarter, increasing only a slight 0.6 percent (0.3 points). After the Tax Cuts & Jobs Act led to an initial decline of 7.5 percent (3.9 points) in Q1 2018, the quarterly levels have been relatively flat. Compared to the year-ago level, pain from taxes is down a modest 2.1 percent (1 point). Even with this decline, the factor continues to be an outsize contributor to financial pain. In fact, over the last three years, the personal taxes factor has been the largest contributor to financial pain for 9 of 12 quarters. The personal taxes value uses information from the Bureau of Labor Statistics on income tax, tax on realized net capital gains and taxes on personal property.

"No one wants to pay any more taxes than they owe. Now is the perfect time to use the information in your tax return and underlying documents to build a tax-efficient financial plan. This was the first year with most provisions of the new tax law on the books. As many have discovered, the changes went far beyond a reduction to income tax brackets. If you haven't already considered the new tax law changes, now is the opportune time to review and update your financial plan," said Michael Landsberg, CPA/PFS member of the American institute of CPAs' Personal Financial Planning Executive Committee.

The tax component of the Pain Index is particularly important when measuring financial satisfaction because it impacts so many Americans. When income taxes change, Americans tend to notice because it impacts their take home pay. Further, when tax season comes around, Americans hope for a lower tax burden which for some can be reflected in a higher refund. For the 2017 tax year, Americans received an average tax refund of $2,899. In the 2018 tax year, the first under the new law, the average tax refund has been down very slightly and sits at $2,795 at the time the Q1 PFSi is released, according to the IRS .

"If you wound up receiving a sizable refund from the IRS, it may be prudent to adjust your payroll withholding. Otherwise, you are essentially giving the government an interest free loan instead of using that money to improve your own financial situation," said Landsberg.

Additional Findings from the Q1 2019 PFSi:

- The AICPA CPA Outlook Index, which captures the expectations of CPA executives in the year ahead for their companies and the U.S. economy, is approximately unchanged from the prior quarter, however, it has decreased 8.2 percent (4.6 points) from the previous year.

- The Real Home Equity Per Capita index, based on data issued for October, is 2.7 percent above the prior year value and 0.6 percent ahead of the previous quarter level. It is still 11.5 percent below its 2006 all-time high.

- Underemployment, at 32 points, is 12.9 percent (4.8 points) lower than the prior year level and 4.7 percent (1.6 point) down from the Q4 level. In comparison, its peak value was 84.3 corresponding to 17.1 percent in the fourth quarter of 2009 (versus the current 7.3 percent). It is now almost 14 percent below its average value in the two years before the great recession.

- The blended inflation measure for Q1 is 1.75 percent, which is still below the Federal Reserve's 2 percent target for inflation. In terms of the index, the Q1 index value is 41, down 5.5 percent from the year ago level and down 5.1 percent from the Q4 level. Inflation is the most volatile factor contributing to the PFSi, and with absolute levels so low, small changes result in large percent gains. The Q1 measure relies on the February level.

Additional information on the PFSi can be found at: www.aicpa.org/PFSi .

Methodology

The Personal Financial Satisfaction Index (PFSi) is the result of two component sub-indexes. It is calculated as the difference between the Personal Financial Pleasure Index and the Personal Financial Pain Index. These are comprised of four equally weighted factors, each of which measure the growth of assets and opportunities, in the case of the Pleasure Index, and the erosion of assets and opportunities, in the case of the Pain Index.

About the AICPA's PFP Division

The AICPA's Personal Financial Planning (PFP) Section is the premier provider of information, tools, advocacy, and guidance for CPAs and other professionals who specialize in providing estate, tax, retirement, risk management, and investment planning advice to individuals, families, and business owners. The primary objective of the PFP Section is to support its members by providing resources that enable them to perform valuable PFP services in the highest professional manner.

CPA financial planners are held to the highest ethical standards and are uniquely able to integrate their extensive knowledge of tax and business planning with all areas of personal financial planning to provide objective and comprehensive guidance for their clients. The AICPA offers the Personal Financial Specialist (PFS) credential exclusively to CPAs who have demonstrated their expertise in personal financial planning through testing, experience and learning, enabling them to gain competence and confidence in PFP disciplines.

About the American Institute of CPAs

The American Institute of CPAs (AICPA) is the world's largest member association representing the CPA profession, with more than 431,000 members in 137 countries and territories, and a history of serving the public interest since 1887. AICPA members represent many areas of practice, including business and industry, public practice, government, education and consulting. The AICPA sets ethical standards for its members and U.S. auditing standards for private companies, nonprofit organizations, federal, state and local governments. It develops and grades the Uniform CPA Examination, offers specialized credentials, builds the pipeline of future talent and drives professional competency development to advance the vitality, relevance and quality of the profession.

The AICPA maintains offices in New York, Washington, DC, Durham, NC, and Ewing, NJ.

Media representatives are invited to visit the AICPA Press Center at www.aicpa.org/press .

About the Association of International Certified Professional Accountants

The Association of International Certified Professional Accountants (the Association) is the most influential body of professional accountants, combining the strengths of the American Institute of CPAs (AICPA) and The Chartered Institute of Management Accountants (CIMA) to power opportunity, trust and prosperity for people, businesses and economies worldwide. It represents 667,000 members and students across 184 counties and territories in public and management accounting and advocates for the public interest and business sustainability on current and emerging issues. With broad reach, rigor and resources, the Association advances the reputation, employability and quality of CPAs, CGMAs and accounting and finance professionals globally.

More Info:

Disclaimer/Disclosure: Investorideas.com is a digital publisher of third party sourced news, articles and equity research as well as creates original content, including video, interviews and articles. Original content created by investorideas is protected by copyright laws other than syndication rights. Our site does not make recommendations for purchases or sale of stocks, services or products. Nothing on our sites should be construed as an offer or solicitation to buy or sell products or securities. All investment involves risk and possible loss of investment. This site is currently compensated for news publication and distribution, social media and marketing, content creation and more. Contact each company directly regarding content and press release questions. Disclosure is posted for each compensated news release, content published /created if required but otherwise the news was not compensated for and was published for the sole interest of our readers and followers. More disclaimer info: https://www.investorideas.com/About/Disclaimer.asp Learn more about publishing your news release on the Investorideas.com newswire https://www.investorideas.com/News-Upload/

Additional info regarding BC Residents and global Investors: Effective September 15 2008 - all BC investors should review all OTC and Pink sheet listed companies for adherence in new disclosure filings and filing appropriate documents with Sedar. Read for more info: https://www.bcsc.bc.ca/release.aspx?id=6894 . Global investors must adhere to regulations of each country.

Please read Investorideas.com privacy policy: https://www.investorideas.com/About/Private_Policy.asp

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment