Asia Pacific Stocks Fall, Yen Gains as Viacom Signals China Exit

Talking Points VIACOM, HANG SENG INDEX, TENCENT, ASX 200, JPY, CSI 300

Stock benchmarks fell while JPY jumped on Viacom's possible exit from Chinese operations Tencent drives Hang Seng Index's tumble while Japan's bank holiday creates illiquidity Chinese trade, Japanese CPI, and banks' fourth-quarter earnings season in the spotlight Asia Pacific equities declined across the board after Viacom announced that it may be selling its stake in Chinese operations. The mass media conglomerate cited issues with scaling its business in China, and may have been influenced by recent difficulties for American corporations operating in Beijing in the wake of the ongoing US-China trade war.Market sentiment soured as a result of this news, with the Hang Seng Index losing more than 1% as the Chinese technology giant Tencent led the decline, dropping as much as 8% during Monday's trading session. Viacom's statement now throws the future of existing large-scale partnerships with Tencent into question.

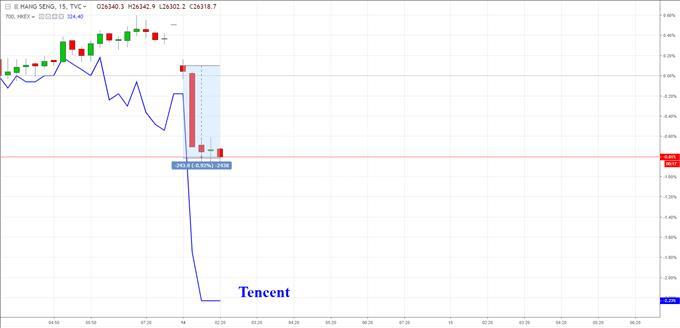

Hang Seng Index vs. Tencent (15-minute)Declines in the Shanghai Composite, ASX 200 , and CSI 300 may have been worsened due to regional illiquidity, as Tokyo is closed for a bank holiday. However, Nikkei 225 futures are pointing downwards while the anti-risk Japanese Yen gained, rising 0.26% following the slump in market mood.

JPY/USD Chart vs. ASX 200, CSI 300, Shanghai Composite, and Nikkei 225 futures (15-minute)Looking ahead, December's Chinese trade data may dominate market moves, possibly showing more evidence of damage caused by tit-for-tat tariffs with the United States. In addition, Japanese inflation is set to be released later this week. Equities will also closely eye the release of banks' 4Q earnings, starting later on in today's trading session.

Forex Trading Resources Join a free Q & A webinar and have your trading questions answered Just getting started? See our beginners' guide for FX traders Having trouble with your strategy? Here's the #1 mistake that traders make See how currencies are viewed by the trading community at the DailyFX Sentiment Page --- Written by Megha Torpunuri, DailyFX Research Team

DailyFX

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment