Kuwait- Boursa indexes close in red volume swells

In addition, Boursa Kuwait lost during the last week around K.D. 650 million of its market capitalization, as it reached by the end of the week K.D. 28.01 billion, down by 2.27% from its level in a week earlier, where it was K.D. 28.66 billion. Also, the market cap gains since the beginning of the current year contracted to reach 10.26% compared to its value at end of 2016, where it reached then K.D. 25.41 billion. (Note: The market cap of the listed companies in the primary market is calculated based on the average number of outstanding shares as per the latest available official financial data).

The red colour continued to prevail over the market indicators for the second consecutive week, as it continued recording grouped losses amid a continuation of the selling trend in controlling the trading activity in light of the absence of positive motivators that contribute in supporting the traders' spirits and push them to buy. The selling pressures witnessed by the market during most of the last week's sessions concentrated on the leading stocks in particular, which appeared clearly from the performance of the Weighted and KSX-15 indices, as it ended all the week's sessions in the red zone, which increased its weekly losses, whereas the losses of KSX-15 Index reached by the end of the week 3.29%, while the decline in the Weighted Index reached 2.36%, and the Price Index ended the week's trading down by 1.13%.

In addition, the green colour was not absent from the market indices during the last week, as some daily sessions witnessed random purchasing operations and quick speculations executed on some small-cap stocks, which pushed the Price Index to record some daily gains that lightened, to a certain extent, its weekly loss.

As per the daily trading activity, Boursa Kuwait initiated the first trading session of the week with a drop in all its indicators, especially the weighted ones that were negatively affected by the continuous selling operations on the leading and heavy stocks, especially in the Telecommunication sector, the most declining sector by the end of the session.

The Boursa continued recording losses for its three indices on the second session, however at stronger pace, as a result to the increased selling pressures on the leading stocks accompanied by the decrease in the number of small-cap stocks too, which caused all the market sectors to drop, except for two sectors where no activity was recorded on its stocks.

On the mid-week session, the Boursa witnessed an increased selling pressures on many leading and small-cap stocks together, and its three indices continued its negative performance and declines to low levels, especially the Price Index that ended the session at its lowest level since last January.

Moreover, Wednesday and Thursday's sessions witnessed the appearance of the green colour for the first time, however fluctuation was mastering, whereas the Price Index was able to detour to the green zone and end the two sessions with some gains, supported by the random purchasing operations that included some small-cap stocks, which relatively contracted its weekly losses; while the Weighted and KSX-15 indices could not redirect its path and continued recording losses amid the continued selling operations that targeted the leading stocks.

For the annual performance, the Price Index ended last week recording 13.92% annual gain compared to its closing in 2016, while the Weighted Index increased by 10.23%, and the KSX-15 recorded 9.08% growth.

Sectors' Indices

All of Boursa Kuwait's sectors ended last week in the red zone except the Health Care sector's index which closed with no change from the previous week. The Oil & Gas sector headed the losers list as its index declined by 3.72% to end the week's activity at 993.20 points. The Insurance sector was second on the losers' list, which index declined by 3.64%, closing at 1,070.77 points, followed by the Banks sector, as its index closed at 930.76 points at a loss of 2.30%. The Consumer Goods sector was the least declining as its index closed at 976.07 points with a 0.23% decrease.

Sectors' Activity

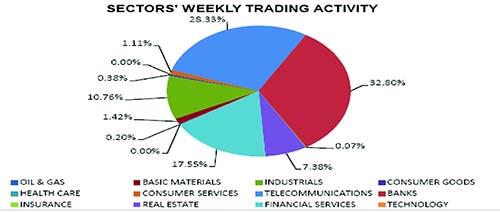

The Financial Services sector dominated a total trade volume of around 138.38 million shares changing hands during last week, representing 34.45% of the total market trading volume. The Real Estate sector was second in terms of trading volume as the sector's traded shares were 23.09% of last week's total trading volume, with a total of around 92.74 million shares.

On the other hand, the Banks sector's stocks were the highest traded in terms of value; with a turnover of around K.D 25.47 million or 32.80% of last week's total market trading value. The Telecommunications sector took the second place as the sector's last week turnover was approx. K.D 22 million representing 28.33% of the total market trading value.

For more information, please visit our website: www.bayaninvest.com

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment