Why It's Useless For The Federal Reserve To Target Inflation

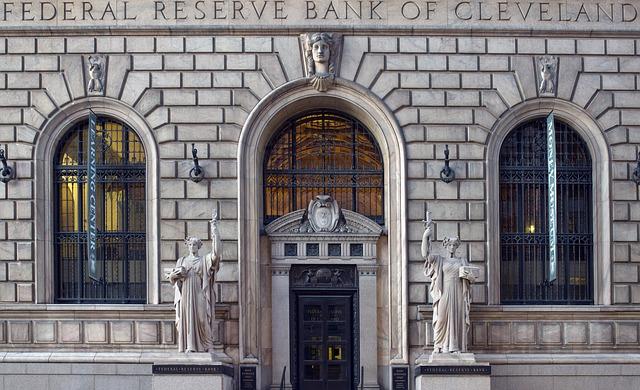

One of the leading policy guideposts for central banks and many monetary policy proponents nowadays is the idea of 'inflation targeting.' Several major central banks around the world, including the Federal Reserve in the United States, have set a goal of two percent price inflation. The problem is, what central bankers are targeting is a phantom that does not exist.

Get The Full Ray Dalio Series in PDF Get the entire 10-part series on Ray Dalio in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues.

We respect your

/ PixabayPerhaps we can best approach an understanding of this through an appreciation of some of the writings by members of the Austrian School of Economics on matters of monetary theory and policy. Carl Menger (1840-1921), the founder of the Austrian School in the 1870s, had explained in his Principles of Economics (1871) and his monograph on 'Money' (1892), that money is not a creation of the State.

Money Emerges from Markets, Not the StateA widely used and generally accepted medium of exchange emerged 'spontaneously' – that is, without intentional planning or design – out of the interactions of multitudes of people over a long period of time, as they attempted to successfully consummate potentially mutually advantageous exchanges.

For example, Sam has product 'A' and Bob has product 'B'. Sam would be happy to trade some amount of his product 'A' for some quantity of Bob's product 'B'. But Bob, on the other hand, does not want any of Sam's 'A', due to either having no use for it or already having enough of 'A' for his own purposes.

Rather than forego a desirable trading opportunity, we can easily imagine Sam believing that Bob might be willing to take some other commodity or product in trade for his product 'B', if only Sam had some of whatever it is. So Sam might decide to first trade an amount of his product 'A' for a quantity of Bill's product 'C'. Not because Sam has any need for it himself, but because he anticipates that if he were to have some amount of 'C', Bob would gladly take it in trade for some his product 'B', which is what Sam actually wants to acquire.

In this instance, product 'C' has been used by Sam as a medium of exchange – something purchased by Sam not for any immediate and direct use himself, but as something to be traded away, again, in exchange for what Sam really wants to obtain: an amount of product 'B', given that the owner of product 'B' had no desire or use for Sam's original product 'A'.

For any commodity to emerge as the money-good, it first had to have a use and a value as an ordinary marketable good.

Over time, individuals discovered that some goods possessed a variety of qualities, characteristics, and attributes that made them more useful than others in this role of a medium of exchange – particular goods that were in wider and greater demand than others; goods that were more easily divisible into amounts reflecting agreed-upon terms of trade without losing their desired features as useful goods; more durable goods, so they may be stored for future exchange opportunities without a significant decrease in their marketable qualities; and goods that were more conveniently transported to where advantageous trades might be possible at some point in the future.

Individuals, in their own self-interest, would find it advantageous to first exchange their own, less marketable goods for such other more marketable ones before searching for trading opportunities to acquire the goods they actually wanted. Having possession of a relatively more marketable and salable good would increase the likelihood of being able to obtain from others those goods that were desired for various consumption or production purposes.

Observing the successes of some in this endeavor, Carl Menger said, would reinforce others to also demand the same more marketable good to use as a medium of exchange. Or as Carl Menger explained in his, Investigations in the Methods of the Social Sciences (1883):

The Value of Money and the Market-Based Medium of ExchangeMenger's analysis of the market-generated origin of money became the starting point for later Austrians analyzing the nature, workings and problems of money in society. This was particularly true of Ludwig von Mises (1881-1973), in his, The Theory of Money and Credit (1912; 2nd revised ed., 1924). One of Mises' main concerns was to explain the determination of the value of money and how changes in money's general purchasing power were brought about.

For any good or commodity to emerge as the money-good in a society, it clearly first had to have a use and a value as an ordinary marketable good for either direct consumer use or indirect production application. Otherwise, in the past, no one would have seen an advantage to obtain it, then plan to trade it away for something else they actually wanted to buy, since there would be no one else who would want it and take it in trade.

But once this particular commodity was being used, also, as a medium of exchange, Mises argued, part of its market value was now based upon its demand for and use as a 'money,' besides its separate value and demand as an ordinary good.

Goods are traded for money, and then money is traded for goods.

Indeed, Mises reasoned, over time the money demand and value for this commodity might come to overshadow and supersede its original non-monetary uses and demands. In the extreme, if this good through use, custom, habit and tradition had become the money-good in a society, it could even lose its original non-monetary uses and values and still have its demand and market-based value as the generally accepted and most widely used medium of exchange.

Of course, looking over the centuries, the most widely used and generally accepted commodities for such money purposes have been gold and silver. Not that other goods have not also served as monies at different times and different places, but gold and silver often have been the predominant ones in many parts of the world, and especially in 'the West' with the development of capitalist or market-based institutions of trade and finance.

Money's Exchange Value and the Demand for Cash BalancesBut what is the 'value' or purchasing power of money in the marketplace?

Money, the Austrians argued, is an unusual good in the arena of exchange. As a particular good comes to be more widely

1,, -

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment