Asia AM Digest: Yen May Rise as China Retaliates to US Tariffs

The escalating actions between the two largest economies are bringing the two closer and closer to a trade war with more expected to come. When the US enacted the tariffs last week, the White House noted that the country will pursue more in the event that the targeted country engages in retaliatory measures. Keep in mind that back in April, Trump was once considering about $100 billion in levies.

This is further compounded by comments from US Trade Representative Robert Lighthizer, who also spoke at the end of last week. He announced US restrictions on investments from China that are due to come in the next two weeks. For now, China's actions were imposed with an intent of equal scale and intensity to the ones enacted by the US. Mr. Lighthizer hopes that their actions can lead to further negotiations.A Look Ahead Asian Shares at Risk, Yen May Gain At this week's open, FX markets were off to a rather quiet start with the anti-risk Japanese Yen heading cautiously higher. , the Yen is likely to gain as focus shifts back to trade war fears and away from last week's key central bank rate decisions. If Asian stocks decline on those concerns today, we may see the Japanese Yen appreciate while the sentiment-linked Australian and New Zealand Dollars decline.

Prior Session Recap Crude Oil Falls Along With The Canadian Dollar Crude oil prices fell sharply on Friday which may have been for a couple of reasons. First, markets could have been taking bets ahead of this week's OPEC meeting where . We also had comments from Russian Energy Minister Alexander Novak who said that members will be discussing possible output adjustments at said meeting.Uncertainty over whether or not this may happen could have weighed on the commodity. Trade war fears due to escalating tensions between the US and China probably also pushed down on oil since it could end up in lower demand for it. Not surprisingly, these combinations boded ill for the Canadian Dollar which is vulnerable to the commodity and rising trade war tensions given the ongoing NAFTA negotiations.

As far as stocks went, shares in Europe and in the US were lower by the end of the day. However, there was a slight pullback on Wall Street as the S & P 500 finished just 0.10 percent lower. Meanwhile, the Australian and New Zealand Dollars were mostly down across the board. The Euro rose a day after the ECB rate decision as .DailyFX Economic Calendar: Asia Pacific (all times in GMT)

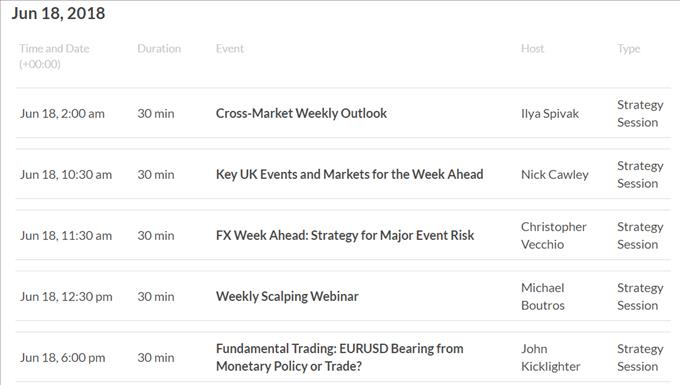

DailyFX Webinar Calendar to register (all times in GMT)IG Client Sentiment Index Chart of the Day: AUD/USD

to learn more about the IG Client Sentiment IndexRetail trader data shows 66.9% of AUD/USD traders are net-long with the ratio of traders long to short at 2.02 to 1. In fact, traders have remained net-long since Jun 05 when AUD / USD traded near 0.76686; price has moved 2.6% lower since then. The percentage of traders net-long is now its highest since May 28 when AUDUSD traded near 0.75456. The number of traders net-long is 18.4% higher than yesterday and 10.9% higher from last week, while the number of traders net-short is 28.3% lower than yesterday and 29.2% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/USD-bearish contrarian trading bias.Five Things Traders are Reading: by Paul Robinson, Market Analyst by John Kicklighter, Chief Currency Strategist by Daniel Dubrovsky, Junior Analyst by David Cottle, Analyst by Ilya Spivak, Senior Currency Strategist --- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or on Twitter

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment