Kuwait, Oman to see fastest growth in 2019

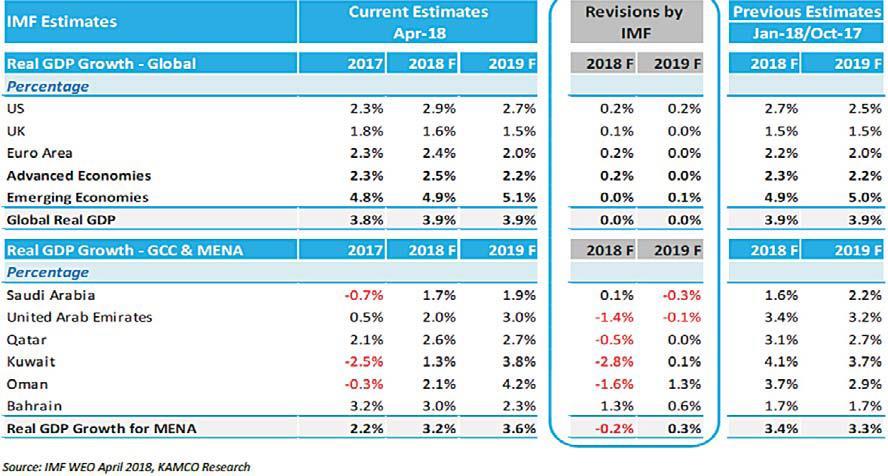

KUWAIT CITY, April 23: IMF kept global growth estimates for the current year and next year stable in its World Economic Outlook (WEO) released in April 18, from its last update in January 18. Real GDP growth projections for 2018 and 2019 are expected to come in at 3.9% each year, but the IMF altered regional growth estimates from their January 18 estimates.

Global GDP growth for 2017 was also revised by 10bps to 3.8% in April-18 from 3.7% estimated in January 18, as two-thirds of the countries accounting for 75% of global growth witnessed growth from 2016. Growth revisions for the MENA region was mixed, as 2018 GDP was brought down by 20 bps to 3.2% in IMF's Apr-18 WEO, due to the ongoing fiscal adjustment and geopolitical risks that weigh on oil exporters.

Nevertheless for 2019, IMF pushed GDP growth for the region up by 30bps to 3.6%, ascribed to a resumption of higher oil output post the expiration of OPEC production cuts. In terms of country upgrades, IMF expects stronger momentum in domestic demand and structural reforms to result in higher growth for Egypt in 2018 (5.2%) and 2019 (5.5%), as estimates were revised upwards by 70bps and 20bps from October 17 estimates.

For Saudi Arabia, the higher oil output is forecasted to be more than offset by the ongoing fiscal consolidation measures in 2019, as GDP growth was brought down by 30bps to 1.9%. In 2018, stronger oil prices are expected to aid a recovery in domestic demand, and contribute to a GDP growth of 1.7% (+10 bps).

However for 2018, barring Saudi Arabia and Bahrain (+130bps), the IMF revised GDP forecasts for other GCC countries downwards as compared to Oct-17 estimates. For 2019, GDP forecasts of Oman (4.2%), Kuwait (3.8%) and Bahrain (2.3%) were raised, while the GDP growth for the UAE was brought down by 10 bps to 3.0% .

Higher oil prices are expected to result in better current account balances in the GCC over 2018 and 2019. IMF expects Kuwait's current account surplus in GDP terms to be the highest in the region at 5.8% of GDP in 2018, improving by 720bps from their Oct-18 update, while 2019 current account surplus in GDP terms is forecasted to improve by 500 bps (3.6%). KAMCO Research expects higher oil prices to give GCC countries more flexibility in terms of their ongoing fiscal consolidation plans.

However, we continue to expect initiatives to bolster the GCC non-oil economy to be less synchronized than the previous years, as individual GCC countries are likely to use different fiscal tools to shore up their state finances. Advanced Economies are now expected to grow 20bps faster in 2018 (2.5%) than expected in IMF's Jan-18 WEO update, while estimates for 2019 (+2.2%) were kept stable.

The growth of Emerging Market & Developing Economies was kept stable for 2018 (4.9%), while the estimate for 2019 was pushed up by 10bps (+5.1%), as compared to Jan-18 estimates.

The higher growth of Advanced Economies in 2018 seen currently by the IMF as compared to Jan-18 projections, is driven mainly by upward revisions in the GDP growth of the US and the Euro Area.

US growth was revised 20 bps higher each for 2018 (2.9%) and 2019 (2.7%), as a result of a higher base of economic activity in 2017, higher projected external demand and the impact of recent fiscal policy changes. GDP growth for the Euro area was revised upwards in 2018 by 20bps to 2.4% led by higher growth expected from Germany, France, Italy and Spain, as compared to Jan-18 estimates, while 2019 estimates were unchanged.

The higher forecasts by the IMF is ascribed to the stronger-than-expected domestic demand across the Euro area, along with supportive monetary policy and external demand prospects. The higher estimates for Emerging Market and Developing Economies in 2019 is largely ascribed to a 40bps upward revision in the GDP growth of Brazil, higher growth in the MENA region (+30bps) and South Africa (+80bps).

Global trade growth estimates were pushed up by the IMF for 2018 (+50 bps) and 2019 (+30 bps) to 5.1% and 4.7% respectively, as the cyclical rebound in global trade from 2017 is expected to continue, driven by a recovery in advanced economy investment and domestic demand, along with improved investment growth rates in commodity exporters amongst emerging market and developing economies.

IMF assumes average oil prices to improve by USD 9.6/bbl in 2018 (USD 62.3/bbl) based on oil price futures; from an average of USD 52.7/ bbl achieved over 2017.

In 2019 however, a decline to USD 58.2/bbl is forecasted. The current oil price forecasts by the IMF for 2018 and 2019 represent an increase from January 18 estimates. IMF's oil price assumptions are however below consensus mean and median analyst estimates for 2018 and 2019 which are around USD 65/bbl.

Inflation estimates for GCC countries were revised downwards in 2018, barring the UAE, where the introduction of VAT and indexed energy costs are behind the upward revision of 2018 CPI inflation estimate of 4.2% (+130bps) in our view. For the GCC region in 2019 we expect GDP growth, newer initiatives for non-oil growth and further fiscal consolidation measures to focus on oil price cues from the extension of OPEC oil production cuts post December 2018

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment