403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Morocco loosens its currency peg in bid to attract investors

(MENAFN- Gulf Times) Morocco will loosen its currency peg in a long-awaited move aimed at strengthening its economy and avoiding financial imbalances that forced a slew of emerging nations into sharp devaluations.

Bank al-Maghrib, as the central bank is known, will allow the dirham to fluctuate 2.5% above or below its official rate, significantly widening the band from 0.3% each way. While the central bank set the dirham's band at 8.9969 to 9.4524 against the dollar yesterday, according to data compiled by Bloomberg, it hadn't announced the reference rate by 9.45am in Rabat.

Economists and business people said Morocco was unlikely to join the long list of countries from Egypt to Uzbekistan that allowed their currencies to plummet in recent years, because the central bank was sitting on ample reserves and the dirham is already fairly valued. Gross domestic product expanded faster than the majority of countries in the Middle East and North Africa in 2017, according to International Monetary Fund estimates.

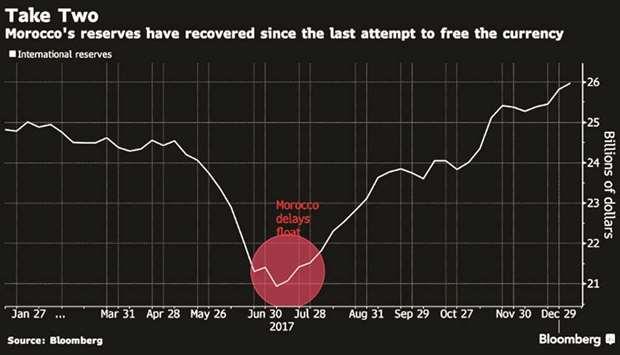

The plan to loosen the peg, which is supported by the IMF and is the centrepiece of Morocco's ambitions to transform itself into North Africa's dominant financial and trade hub, was postponed from last year, when fears of a weaker dirham triggered a rush for dollars and euros, causing a $3bn drop in reserves in three months. The central bank announced on Friday that the move was back on and confirmed that the band would be widened to five%.

'The state is listening to importers' views. There is better visibility now than we had in July, when a lack of information about the fluctuation band sparked speculative deals on the dirham, said Chakib El-Alj, who manages the Casablanca-based grain-importer Gromic.

Morocco's announcement came days after Angola ditched a currency peg in place since 2016 in an effort to revive an economy hit by the slump in oil prices four years ago.

Unlike commodity-exporting countries, which have floated or devalued to end crippling foreign exchange shortages, Morocco is an importer of grain and oil and has benefited from lower global prices. It relies on exports, remittances and tourism for its hard currency earnings.

The main risk Morocco faces is a combination of poor harvests and surging global commodity prices that could raise costs for the government and prices for consumers in a country that has seen bouts of unrest since the Arab Spring protests that swept the region in 2011.

The central bank says the fixed exchange rate regime has helped to keep inflation, expected to average 0.7% in 2017, under control as the government reduced state subsidies on refined oil products.

In Egypt, which floated its pound in November 2016, the currency quickly halved in value, pushing inflation above 30%. But Morocco, which has an investment-grade credit rating an expanding private sector, is not facing such wide imbalances.

The economy grew 4.1% in 2017, according to central bank estimates. Foreign reserves have stabilised at a level sufficient to cover more than five months of imports.

The dirham is pegged to a two-currency basket weighted 60% to the euro and 40% to the US dollar. The wider band is the first phase in Morocco's currency liberalisation, which it hopes will encourage foreign investment and make Moroccan exports more competitive abroad.

Ahmed Derrab, secretary-general of Morocco's association of citrus producers, said a more flexible exchange rate was necessary to boost competitiveness and should not pose major risks for exporters as long as authorities move cautiously.

'We are serene because this is only the beginning of what is going to be a gradual liberalisation process, he said. 'This is controlled flexibility.

Bank al-Maghrib, as the central bank is known, will allow the dirham to fluctuate 2.5% above or below its official rate, significantly widening the band from 0.3% each way. While the central bank set the dirham's band at 8.9969 to 9.4524 against the dollar yesterday, according to data compiled by Bloomberg, it hadn't announced the reference rate by 9.45am in Rabat.

Economists and business people said Morocco was unlikely to join the long list of countries from Egypt to Uzbekistan that allowed their currencies to plummet in recent years, because the central bank was sitting on ample reserves and the dirham is already fairly valued. Gross domestic product expanded faster than the majority of countries in the Middle East and North Africa in 2017, according to International Monetary Fund estimates.

The plan to loosen the peg, which is supported by the IMF and is the centrepiece of Morocco's ambitions to transform itself into North Africa's dominant financial and trade hub, was postponed from last year, when fears of a weaker dirham triggered a rush for dollars and euros, causing a $3bn drop in reserves in three months. The central bank announced on Friday that the move was back on and confirmed that the band would be widened to five%.

'The state is listening to importers' views. There is better visibility now than we had in July, when a lack of information about the fluctuation band sparked speculative deals on the dirham, said Chakib El-Alj, who manages the Casablanca-based grain-importer Gromic.

Morocco's announcement came days after Angola ditched a currency peg in place since 2016 in an effort to revive an economy hit by the slump in oil prices four years ago.

Unlike commodity-exporting countries, which have floated or devalued to end crippling foreign exchange shortages, Morocco is an importer of grain and oil and has benefited from lower global prices. It relies on exports, remittances and tourism for its hard currency earnings.

The main risk Morocco faces is a combination of poor harvests and surging global commodity prices that could raise costs for the government and prices for consumers in a country that has seen bouts of unrest since the Arab Spring protests that swept the region in 2011.

The central bank says the fixed exchange rate regime has helped to keep inflation, expected to average 0.7% in 2017, under control as the government reduced state subsidies on refined oil products.

In Egypt, which floated its pound in November 2016, the currency quickly halved in value, pushing inflation above 30%. But Morocco, which has an investment-grade credit rating an expanding private sector, is not facing such wide imbalances.

The economy grew 4.1% in 2017, according to central bank estimates. Foreign reserves have stabilised at a level sufficient to cover more than five months of imports.

The dirham is pegged to a two-currency basket weighted 60% to the euro and 40% to the US dollar. The wider band is the first phase in Morocco's currency liberalisation, which it hopes will encourage foreign investment and make Moroccan exports more competitive abroad.

Ahmed Derrab, secretary-general of Morocco's association of citrus producers, said a more flexible exchange rate was necessary to boost competitiveness and should not pose major risks for exporters as long as authorities move cautiously.

'We are serene because this is only the beginning of what is going to be a gradual liberalisation process, he said. 'This is controlled flexibility.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment