Predicting Stock Returns Using Firm Characteristics

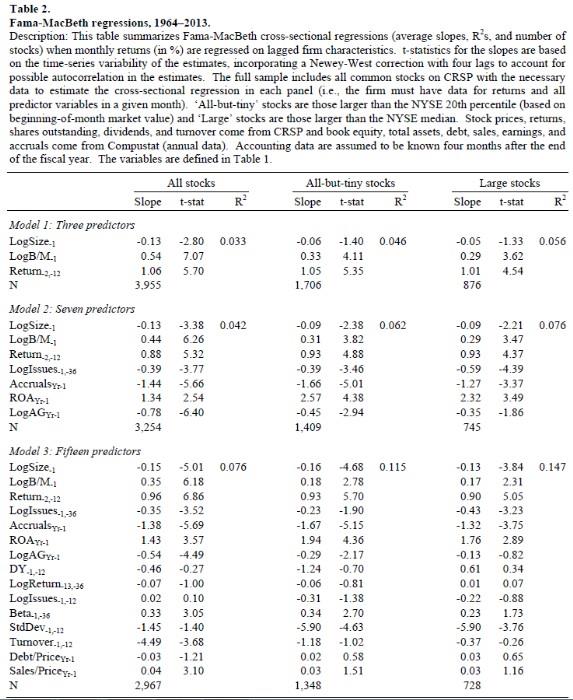

One of the reasons we've brought up this debate is due to the fact that 'factor' loadings (from regressions) are arguably not as helpful as portfolio characteristics. In other words, knowing a portfolio P/E ratio is more informative for forecasting expected returns than knowing the HML factor loading is .6.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment