Economic Survey: Can Profits Continue To Be India Inc's Primary Source Of Funds?

The Economic Survey for FY25-26, tabled in Parliament on Thursday, said India's commercial sector is increasingly tapping alternative financing to offset a moderation in bank credit. Faster monetary policy transmission has made market-based instruments a viable alternative for large corporations, it said.

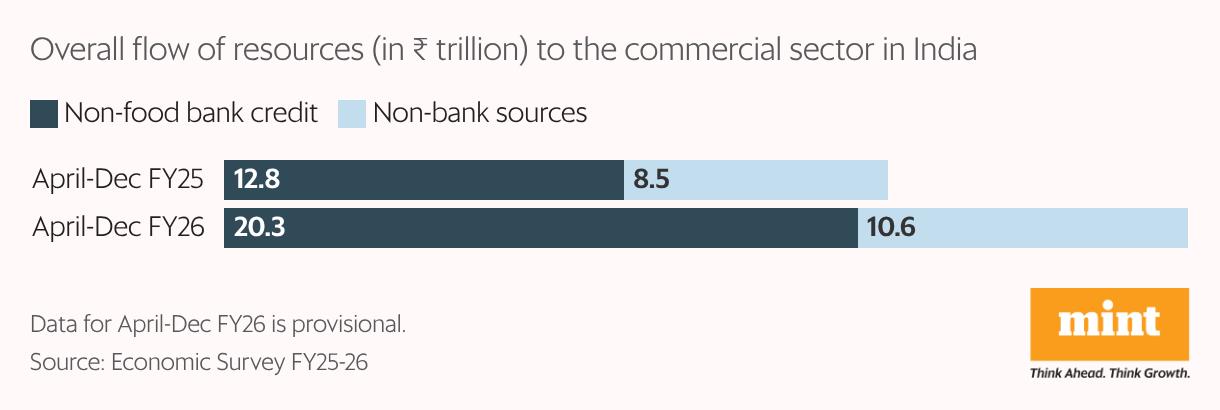

Rising profitability has also allowed firms to leverage internal resources for expansion, collectively reducing their traditional reliance on bank lending, the Survey added. Between April and November 2025, non-bank funding grew sharply, rising 29% year-on-year, far outpacing the 18% growth in non-food bank credit.

Even as bank credit growth slowed in early FY26, the flow of funds to the commercial sector did not dry up. Higher non-bank lending stepped in to fill the gap, effectively offsetting the slowdown in bank credit, the Survey noted.

Also Read | In chart: Economic Survey highlights India's power

Within non-bank funding, growth from foreign sources outpaced domestic growth. As of 31 December 2025, foreign sources surged by 38% y-o-y, doubling the 19.1% growth from domestic sources. This foreign influx was primarily driven by a dramatic rise in external commercial borrowings (ECBs)-which climbed from ₹5,000 crore to ₹27,700 crore-and a 67% jump in foreign direct investment (FDI). Meanwhile, domestic growth was fueled by corporate bond issuances, which saw a staggering 263.3% increase on a yearly basis, the survey added.

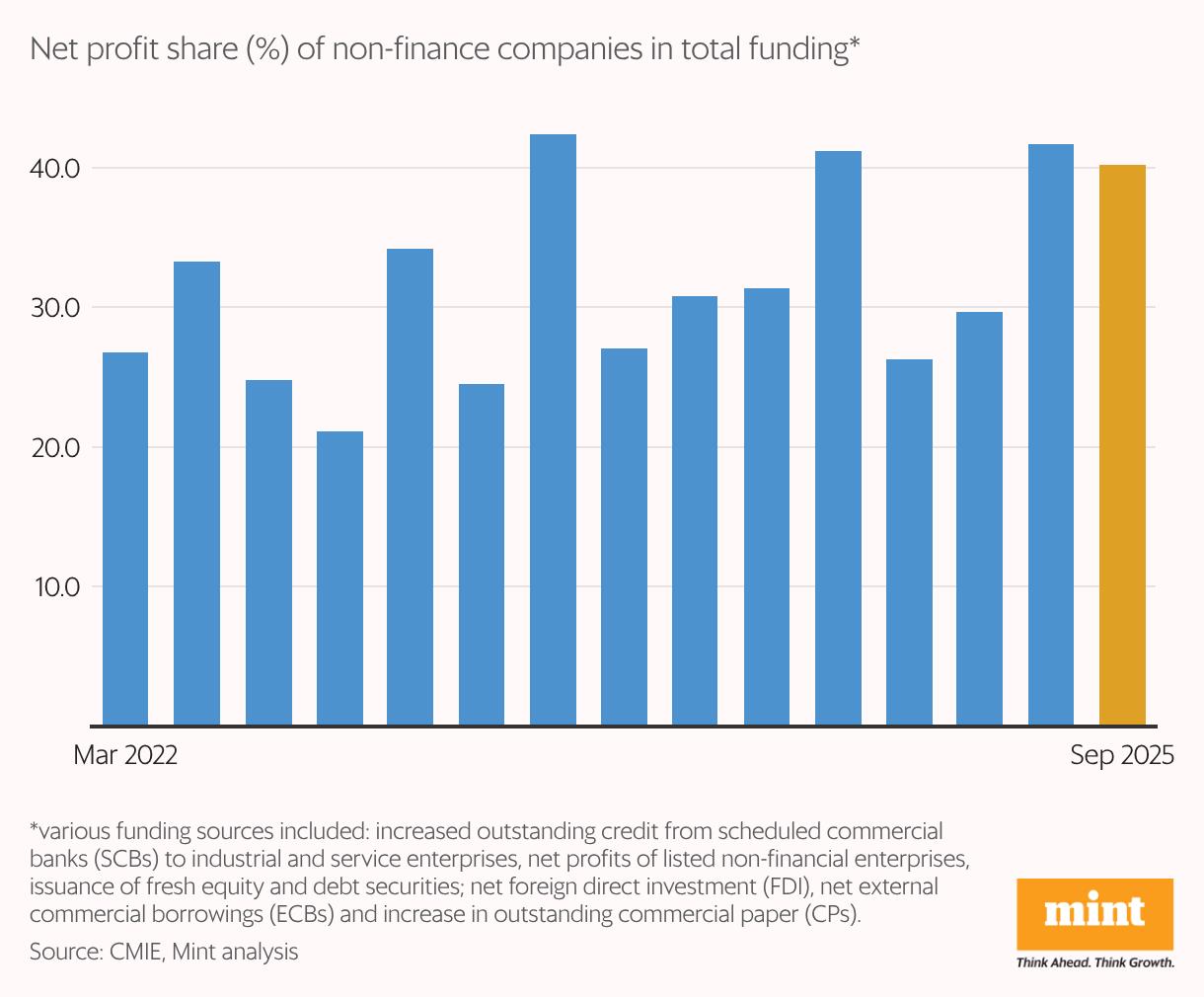

Also Read | Economic Survey calls for multi-pronged push to sustain Profit powerA separate Mint analysis of CMIE data revealed that net profits-or internal accruals-remain the primary funding source for Indian corporates. In the September quarter, non-financial companies recorded a massive ₹3 trillion in net profits, accounting for nearly 40% of all funds raised. This 54.5% year-on-year surge marked the strongest profit growth in four years.

Beyond these internal accruals, the broader funding landscape was supported by increased bank credit to the industrial and services sectors, fresh equity and debt issuances, net FDI, net ECBs, and a rise in outstanding commercial paper (CP).

Chart 2:

Companies prioritized internal cash generation as their primary financing lever, ensuring their balance sheets remained robust and unburdened, experts said.

But is this internal-financing lever staring to weaken? Early results for the December quarter revealed a disrupted profit narrative as Q3 expenses surged. A spike in labour and input costs squeezed margins just as revenue recovery was gaining traction.

Analysts suggested that while the immediate impact of the new labour codes may deliver a one-time accounting hit, rising raw material costs present a more persistent structural risk. In this environment, the reliability of internal accruals as a primary funding source faces a stern test.

Also Read | Economic Survey seeks faster insolvency resolution, flags low MSME case upt Back to banks?That pool of internal accruals may now be shrinking, said Vivek Kumar, economist at Quant Eco. With margins under pressure and companies keen to conserve cash, corporates could increasingly turn to bank borrowing, Kumar noted.

He added that global FDI flows are weakening amid geopolitical uncertainty, while overseas borrowing has become less attractive, as reflected in rising Japanese bond yields.“The steady depreciation of the rupee adds another layer of risk. All this could nudge firms further towards bank credit in the coming months," he said.

Against this backdrop, Madan Sabnavis, chief economist at Bank of Baroda, said he expects mid-sized corporations to drive demand for banking credit as policy rate cuts begin to translate into lower lending rates.

However, Santanu Chakrabarti, banking and financials analyst at BNP Paribas, argued that long-term financing conditions still remain tight, as 5- and 10-year government bond yields are still elevated. This could deter larger corporations from tapping bank credit for big projects, even as profit pressures mount.

“Greater clarity on a US-India trade deal would be a more decisive catalyst for investment and credit demand," Chakrabarti said. He said he expects bank credit growth of around 13% in FY27, driven largely by micro, small and medium enterprises and retail borrowers.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment