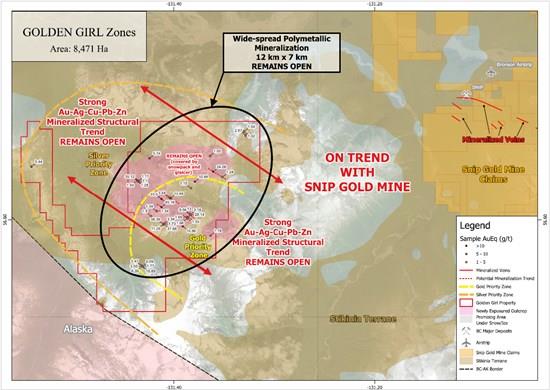

Gold Runner Options Golden Girl Property In British Columbia's Prolific Golden Triangle From B-All Syndicate

| Sample ID | Sample Type | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) | AuEq (g/t) |

| D751631 | Grab | 5.50 | 3261.82 | 1.09 | 8.78 | 0.45 | 45.16 |

| D751628 | Grab | 8.59 | 1769.68 | 2.86 | 17.40 | 10.60 | 38.39 |

| D751915 | Grab | 0.92 | 2531.45 | 1.89 | 3.40 | 10.40 | 35.12 |

| D751738 | Channel | 3.74 | 2105.45 | 0.88 | 5.48 | 7.42 | 31.66 |

| D751551 | Grab | 11.28 | 1465.23 | 0.23 | 0.51 | 0.41 | 28.14 |

| D751629 | Grab | 1.32 | 1828.17 | 2.10 | 7.18 | 0.27 | 25.60 |

| D751807 | Grab | 0.17 | 1558.66 | 0.37 | 8.07 | 14.15 | 24.06 |

| D751554 | Grab | 0.25 | 1114.15 | 0.63 | 1.22 | 0.09 | 13.66 |

| D751552 | Grab | 5.48 | 644.81 | 0.13 | 0.27 | 0.39 | 13.00 |

| D751735 | Channel | 0.44 | 812.73 | 0.65 | 2.45 | 1.82 | 11.29 |

| D751516 | Channel | 1.80 | 82.99 | 0.05 | 20.00 | 12.30 | 10.89 |

| D751723 | Float | 5.07 | 2.75 | 5.37 | 0.10 | 0.46 | 10.86 |

| D751919 | Chip | 10.51 | 24.31 | 0.01 | 0.06 | 0.11 | 10.84 |

| D751535 | Grab | 3.44 | 369.77 | 0.28 | 5.95 | 1.30 | 9.56 |

| D751617 | Grab | 0.74 | 215.28 | 0.03 | 20.00 | 5.11 | 9.09 |

| D751514 | Channel | 2.52 | 2.75 | 0.18 | 11.95 | 3.42 | 6.39 |

| D751886 | Grab | 0.02 | 337.96 | 0.16 | 1.59 | 4.65 | 5.74 |

| D751664 | Grab | 0.59 | 411.92 | 0.22 | 0.01 | 0.03 | 5.44 |

| D751614 | Chip | 0.23 | 75.70 | 0.02 | 3.46 | 6.69 | 3.89 |

| D751515 | Channel | 0.27 | 90.68 | 0.01 | 6.12 | 3.02 | 3.55 |

| D751543 | Grab | 0.25 | 230.57 | 0.34 | 0.54 | 0.49 | 3.44 |

| D751736 | Channel | 0.22 | 247.74 | 0.13 | 0.84 | 0.10 | 3.34 |

| D751663 | Grab | 0.60 | 127.98 | 0.21 | 2.00 | 1.62 | 3.18 |

| D751659 | Grab | 0.65 | 131.22 | 0.18 | 0.74 | 0.65 | 2.67 |

| D751612 | Chip | 0.08 | 37.65 | 0.02 | 2.93 | 4.30 | 2.47 |

| D751615 | Grab | 0.36 | 83.42 | 0.07 | 2.95 | 0.47 | 2.15 |

| D751906 | Grab | 0.08 | 70.23 | 0.03 | 2.11 | 2.61 | 2.15 |

| D751825 | Grab | 0.22 | 39.98 | 0.07 | 1.58 | 2.27 | 1.77 |

| D751737 | Channel | 1.27 | 33.97 | 0.04 | 0.12 | 0.02 | 1.73 |

| D751534 | Grab | 0.98 | 57.04 | 0.01 | 0.18 | 0.06 | 1.69 |

| D751513 | Talus | 0.13 | 95.98 | 0.02 | 0.59 | 0.65 | 1.55 |

| D751002 | Channel | 0.03 | 2.75 | 0.04 | 5.10 | 1.09 | 1.54 |

| D751508 | Chip | 0.47 | 31.23 | 0.68 | 0.01 | 0.01 | 1.54 |

| D751959 | Chip | 0.03 | 32.57 | 0.03 | 0.12 | 3.43 | 1.50 |

| D751645 | Chip | 0.09 | 73.95 | 0.38 | 0.05 | 0.04 | 1.34 |

| D751646 | Grab | 0.06 | 87.81 | 0.27 | 0.02 | 0.04 | 1.34 |

| D751003 | Channel | 0.02 | 33.09 | 0.01 | 2.41 | 1.17 | 1.28 |

| D751809 | Grab | 0.01 | 11.20 | 1.06 | 0.00 | 0.01 | 1.24 |

| D751547 | Channel | 0.05 | 53.39 | 0.08 | 0.84 | 0.97 | 1.21 |

| D751745 | Float | 0.83 | 6.46 | 0.27 | 0.01 | 0.01 | 1.19 |

| D751883 | Grab | 0.02 | 16.52 | 0.00 | 1.22 | 2.29 | 1.17 |

| D751922 | Float | 0.16 | 15.51 | 0.78 | 0.01 | 0.01 | 1.15 |

| D751899 | Channel | 0.01 | 14.97 | 0.00 | 0.70 | 2.51 | 1.10 |

| D751549 | Channel | 0.04 | 23.75 | 0.01 | 1.24 | 1.65 | 1.09 |

| D751546 | Channel | 0.05 | 41.31 | 0.02 | 0.93 | 1.08 | 1.06 |

| D751608 | Talus | 0.09 | 7.30 | 0.55 | 0.08 | 0.92 | 1.05 |

| D751509 | Grab | 0.25 | 21.33 | 0.50 | 0.01 | 0.01 | 1.02 |

Terms of the Option Agreement

The Terms of the Option Agreement are as follows:

the Company will pay a non-refundable deposit of $250,000 to B-All (the " Escrow Funds ") in trust and subject to the approval by the Canadian Securities Exchange (" CSE ") (the " Regulatory Approvals ") by September 2, 2026, as the initial payment under the Option Agreement, and if such approvals are not obtained by September 2, 2026 the Escrow Funds will be provided to B-All in full as a break fee; The company will issue to B-All 1,830,000 common shares of the Company at the closing price of the date of execution of the Option Agreement and 1,830,000 common share purchase warrants (" Warrants "), with such Warrants being exercisable within five (5) years from the date of issuance at an exercise price equal to the closing price of the common shares of the Company on the CSE on the day prior to issuance plus $0.01 per Warrant (the common shares and Warrants, shall herein be referred to as, the " Trigger Date Securities "), and the Trigger Date Securities shall be issued in escrow and remain in escrow until receipt of the Regulatory Approvals regarding any necessary approvals for the Option Agreement and if such approvals is not obtained, the Trigger Date Securities shall be cancelled and returned to treasury of the Company;The Company will incur a minimum of $1,500,000 in exploration expenditures, prior to October 1, 2027; Upon each of the 1st through 6th anniversaries, the Company will pay $250,000 in cash to B-All no later than the respective anniversary (1st through 6th) of the Regulatory Approvals and issue 1,830,000 common shares at a deemed price equal to the closing price of the Company shares on the CSE on the last trading day prior to such issuance date and 1,830,000 common share purchase warrants (respective " First through Sixth Anniversary Warrants ") exercisable within 5 years from the date of issuance at an exercise price equal to the closing price of the shares on the CSE on the last trading day prior to such issuance date plus $0.01 per each respective anniversary warrant;

the Company will incur a minimum of $3,000,000 in total exploration expenditures prior to October 1, 2029; the Company will issue to B-All, not later than the seventh anniversary of the Regulatory Approvals, 4,000,000 common shares at the closing price of the Company shares on the CSE on the last trading day prior to the date of issuance and 4,000,000 common share purchase warrants (" Seventh Anniversary Warrants ") exercisable within 5 years from the date of issuance at an exercise price equal to the closing price of the common shares of the Company on the CSE on the last trading day prior to the date of issuance plus $0.01 per Seventh Anniversary Warrant;

the Company will incur a minimum of $10,000,000 in Exploration Expenditures (including the previous annual expenditure amounts) not later than the seventh anniversary of the Regulatory Approvals (for total exploration expenditures of a minimum of $10,000,000) and filing and registering a work/assessment report under the Mineral Tenure Act for 100% of such exploration expenditures and delivering and filing on SEDAR+, not later than the seventh anniversary of the Regulatory Approval Date, a National Instrument 43-101 Technical Report on the Property (the " Initial NI 43-101 Report ") which is based on the results of all exploration expenditures incurred on the Golden Girl Property prior to December 31 of the immediately preceding calendar year and includes a resource estimate of gold equivalent mineral reserves (proven and probable) and gold equivalent mineral resources (measured, indicated and inferred categories) (such resource estimate being herein referred to as the " Initial Resource " and each ounce of gold equivalent reserves and resources set out in the Initial NI 43-101 Report and all other NI 43-101 technical reports published in respect of the Property or part thereof being herein referred to as an " Ounce "), and paying to the Syndicate within five (5) Business Days of the date of such delivery and SEDAR+ filing (in such names and amounts as shall be set out in the Syndicate List most recently provided by the Syndicate), USD $3.00 in respect of each Ounce contained in the Initial Resource. Having met and satisfied all of the above, Gold Runner will have exercised the Option.

If the option is exercised and the Company acquires the Golden Girl Property, there are additional bonus payments in cash that may be provided by the Company to B-All, based on additional Ounces defined in future National Instrument 43-101 Technical Report filed by the Company, subject to certain extensions.

Upon exercise of the Option, a royalty will be reserved to the Syndicate and the Company will pay the Royalty to the Syndicate (in cash or in kind [i.e. gold] at the option of the Syndicate); provided that the Company shall have the option to reduce the royalty from four percent (4%) to three Percent (3%) by paying USD $2,000,000 to the Syndicate not later than 24 months after the date of exercise of the Option.

The Option Agreement will be filed on SEDAR+ and the full terms of the Option can be found therein on the Company's SEDAR+ profile at .

Gold Runner CEO, Chris Wensley further states: "We are thrilled to have acquired the Golden Girl Option, and we are excited to begin work to build on the initial high grade poly metallic findings generated by the B-ALL Syndicate with a view to confirming a significant discovery. We are also very pleased to welcome the B-All Syndicate, Goliath Resources (TSXV: GOT), and Juggernaut Exploration (TSXV: JUGR) as significant corner stone shareholders as we move forward together."

Qualified Person

This News Release has been approved by Alan Morris, M.Sc., CPG #10550. Alan J. Morris is a Qualified Person as defined by NI 43-101 and has reviewed the scientific and technical disclosure included in this news release.

About Gold Runner Exploration Inc:

Gold Runner Exploration is an experienced exploration company focused on the exploration of gold and silver properties located in the prolific and Geopolitically stable mining districts of North Western British Columbia and Nevada.

The Rock Creek gold project is Gold Runner's flagship asset, with 74 unpatented lode mining claims wholly owned and controlled by the Company. Emboldened by the results coming out of Rock Creek, the Company strategically expanded the land position with the acquisition of the nearby Dry Creek prospect and the acquisition of the Falcon silver-gold prospect in September 2022. Between the three properties, all targeting similar mineralization and likely the same hydrothermal system, Gold Runner Exploration now holds 239 total claims in close proximity of one another. These three gold prospects are situated in a region with proven "world-class" gold deposits (including Midas, Jerritt Canyon, Betze-Post, Meikle, and Gold Quarry), where the potential of finding large, high-grade gold-silver deposits is favourable.

Gold Runner also holds a 10% carried interest in the Cimarron project located in the San Antonio Mountains of Nye County, Nevada, and comprises 31 unpatented lode mining claims, including control of 6 historically producing claims associated with the historic San Antonio mine. The property is located in the prolific Walker-Lane trend, approximately 44 km south of the "world-class" Round Mountain deposit.

About B-ALL Syndicate Ltd.

The B-ALL Syndicate is a highly specialized geologic team of project generators with a proven track record of success. The Syndicate is focused in unexplored areas of glacial and snowpack retreat providing new opportunity for material discovery in renowned geologic terrain. Projects generated by the same team include Goliath Resources' Surebet discovery on the Golddigger Property, Juggernaut Exploration's Big One discovery as well as multiple additional material discoveries. More information is available at .

For further information, please contact:

Chris Wensley, Director, Chief Executive Officer

Email: ...

Website:

Forward-Looking Information

This news release includes certain information that may be deemed "forward-looking information" under applicable securities laws. All statements in this release, other than statements of historical facts, including but not limited to those statements relating to the properties exploration work and its results and potential, interpretations prospecting and exploration activities, geological, geophysical, and geochemical surveys, studies and interpretations of historical exploration and geological information, permitting, licences, environmental laws and regulations, changes in government regulations and laws, obtaining social licence to explore and operate, community engagements, timing of exploration activities, economic, competitive, reliance on third parties, the actual results of operations, and other risks of the natural resources industry, and mineral resource and reserve potential, exploration activities and events or developments that the Company expects is forward-looking information. Although the Company believes the expectations expressed in such statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the statements. There are certain factors that could cause actual results to differ materially from those in the forward-looking information. These include the results of the Company's due diligence investigations, market prices, exploration successes, continued availability of capital financing, and general economic, market or business conditions, and those additionally described in the Company's filings with the Canadian securities authorities.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking information. For more information on the Company, investors are encouraged to review the Company's public filings at . The Company disclaims any intention or obligation to update or revise any forward- looking information, whether as a result of new information, future events or otherwise, other than as required by law.

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR ITS REGULATION SERVICES PROVIDER HAS REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

To view the source version of this press release, please visit

Source: Gold Runner Exploration Inc.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment