Credditt Announces Relaunch Of Online Loan Request Platform For Borrowers With Challenged Credit

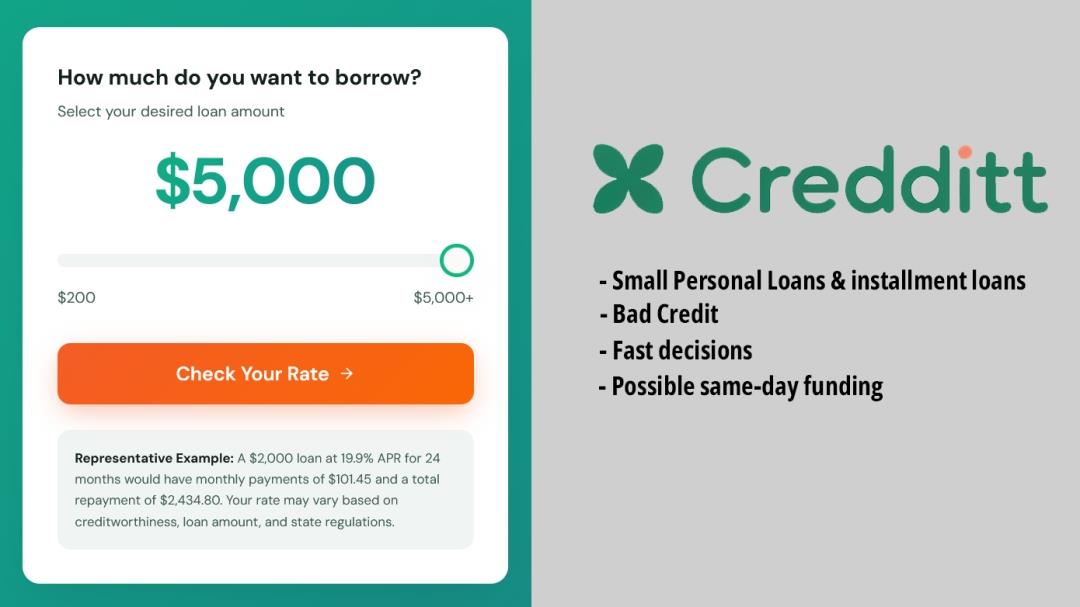

"Credditt loan platform image showing a $5,000 loan request, with bad credit considered and fast decision features."

Wilmington, USA - Credditt today announced the relaunch of its online loan request platform, allowing consumers to get small personal loans and installment loans with bad credit considered, without a hard credit check upfront. The updated service supports loan requests of up to $5,000, with fast decisions and simple eligibility requirements.

The relaunch comes as the consumer credit market shows signs of recovery following several years of inflation pressure and elevated interest rates. As borrowing conditions begin to stabilize, more consumers are seeking responsible short-term and installment loan options that do not rely solely on traditional credit scores.

Why the Relaunch Matters Now

After a prolonged period of tightened lending standards, lenders are gradually returning to the market with revised risk models and alternative approval criteria. Borrowers with limited or poor credit histories have often faced reduced access during this period. Credditt's relaunch is designed to address this gap by connecting applicants to lenders that evaluate multiple financial factors beyond credit score alone.

Platform Features and Loan Request Options

-

Fast Loan Decisions Most applicants receive a decision within minutes after submitting a request.

Loan Amounts Up to $5,000 Requests may range from smaller short-term needs to larger installment loans, depending on eligibility and state guidelines.

No Hard Credit Check Upfront: Loan Options uses a soft credit inquiry, allowing applicants to review offers without impacting their credit score.

Possible Same-Day Funding Some lenders may fund approved loans the same business day, subject to bank processing times.

Simple Eligibility Requirements Typical requirements include legal age, an active bank account, and verifiable income.

No Cost to Apply There is no application fee to submit a loan request or review potential offers.

Options for Bad or Low Credit The platform includes lenders that consider subprime and non-traditional credit profiles.

Terms Vary by State and Lender APR, repayment periods, and loan amounts depend on lender criteria and state regulations.

Company Statement

“We've taken a fresh look at how borrowers search for loan options,” said Todd, CEO of Credditt.“Many people were shut out of credit during the high-inflation period. As conditions begin to improve, our goal is to make it easier to explore loan options with clear terms, fast decisions, and no obligation just to check what's available. We're hopeful that 2026 will be a better year for borrowers as rates ease and financial pressure stabilizes.”

Installment Loans With Fixed Repayment Structures

Credditt's platform includes installment loan options that feature fixed payments over a set repayment period. This structure is intended to help borrowers plan monthly expenses more predictably, particularly when managing ongoing financial obligations. Terms, loan amounts, and APR vary by lender and state regulation.

Personal Loans for Flexible Use

The platform also supports personal loan requests that can be used for a variety of purposes, including everyday expenses or larger planned costs. Loan eligibility and amounts depend on individual financial profiles, and all offers are subject to lender review.

Loan Options for Bad or Limited Credit

For applicants with poor or limited credit history, Credditt works with lenders that apply alternative evaluation criteria. These lenders may consider income consistency, employment status, and recent banking activity in addition to traditional credit data.

Emergency Loan Requests for Urgent Needs

Credditt highlights emergency loan options designed for time-sensitive financial situations. While approval and funding speed are not guaranteed, some lenders may offer faster processing depending on applicant qualifications and banking timelines.

No-Obligation Loan Requests

Submitting a loan request through Credditt is free of charge and does not require accepting any offer that may be presented. Applicants can review terms, repayment details, and disclosures before choosing whether to proceed with a lender.

How It Works

Applicants submit a single online request through Credditt's platform. The system matches the request with potential lenders based on location, income, and credit profile. Available offers, if any, are presented for review, and applicants can choose whether to proceed directly with a lender.

About Credditt

Credditt is an online loan request platform that connects consumers with third-party lenders offering personal loans and installment loan options. Founded to improve access for borrowers with diverse credit backgrounds, the company focuses on transparent loan discovery, soft credit checks, and simple online requests.

Applicants can now submit a loan request and review available options directly through the Credditt website.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment