Trust Wallet Users Hit By $7 Million Chrome Hack

Thousands of users of Trust Wallet suffered losses estimated at about $7 million after a malicious browser extension masquerading as the official Trust Wallet add-on circulated on Google Chrome's extension store, prompting renewed scrutiny of security gaps in decentralised finance tools and browser marketplaces.

The attack centred on a fake extension designed to mimic Trust Wallet's legitimate Chrome interface. Once installed, the malicious software harvested private keys and seed phrases, allowing attackers to drain digital assets directly from user wallets. Because Trust Wallet operates as a non-custodial service, users retain full control of their funds, a design choice that offers autonomy but leaves limited safeguards once credentials are compromised.

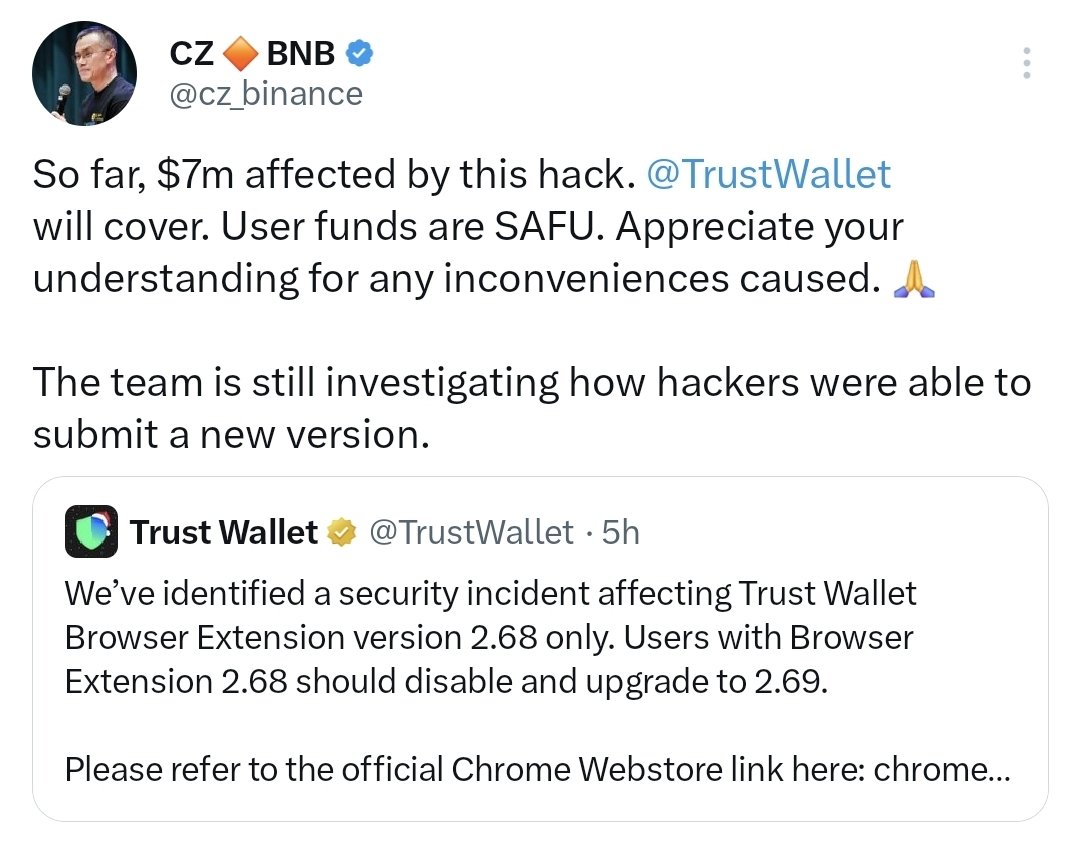

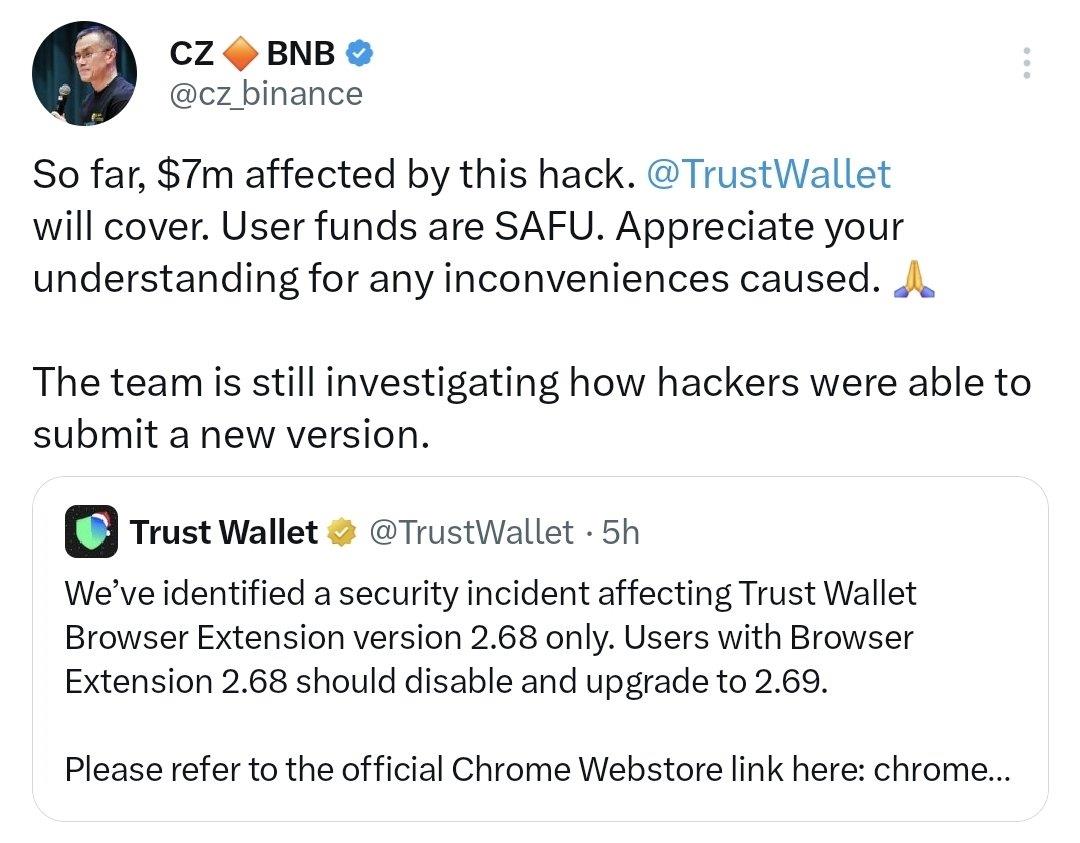

Changpeng Zhao, co-founder of Binance, which owns Trust Wallet, confirmed the breach and said affected users would be reimbursed. Zhao stated that internal reviews showed the losses stemmed from the fraudulent extension rather than vulnerabilities in Trust Wallet's core infrastructure. He added that the company had begun compensating victims while coordinating with browser security teams to prevent similar incidents.

Trust Wallet, which claims tens of millions of users globally, said the counterfeit extension exploited brand recognition and user trust rather than software flaws. The legitimate Trust Wallet browser extension had not been compromised, according to the company, and the official codebase remains secure. Still, the episode has raised questions about the effectiveness of vetting processes within browser extension ecosystems and the broader risks faced by retail crypto users.

Security researchers tracking the incident said attackers relied on social engineering and search optimisation tactics to push the fake extension into visibility. Users searching for Trust Wallet on Chrome were reportedly directed to the malicious listing, which closely resembled the genuine product in design and description. Once installed, the extension silently transmitted sensitive data to remote servers controlled by the attackers.

See also Stellar Gains Institutional Footing with U.S. Bank PilotThe losses, estimated at around $7 million, were spread across hundreds of wallets, with some individual users reporting six-figure sums drained within minutes. Blockchain analysis firms noted that the stolen assets were quickly funnelled through multiple addresses and decentralised exchanges, complicating recovery efforts. While some funds were traced, the irreversible nature of blockchain transactions meant that reimbursement depended entirely on the wallet provider rather than technical clawbacks.

Google said it removed the fraudulent extension after it was flagged, but the timeline between upload, discovery and takedown has drawn criticism. Cybersecurity experts argue that browser extension stores have become a growing attack surface for crypto-related fraud, as malicious actors exploit the speed at which new extensions can be published and updated. Unlike mobile app stores, extension marketplaces often rely heavily on automated checks, which can be bypassed by well-crafted malware.

The incident also highlights structural challenges in decentralised finance. Non-custodial wallets like Trust Wallet are designed to eliminate reliance on intermediaries, a principle widely promoted after major exchange collapses. However, this design places the burden of security largely on end users, who must distinguish legitimate software from impostors. Industry analysts note that as crypto adoption expands, attackers increasingly target the weakest link: user behaviour.

Trust Wallet said it has intensified warnings to users, urging them to download software only from verified links on its official website and to treat browser extensions with caution. The company is also reviewing additional safeguards, including stronger verification badges and clearer guidance within the Chrome ecosystem, though it acknowledged that ultimate control over extension approval lies with browser operators.

See also Global Markets Recoil as Japanese Yields SpikeFor Binance, the reimbursement pledge appears aimed at containing reputational fallout. Zhao said compensating users was necessary to maintain trust, even though the losses did not arise from a failure of Binance or Trust Wallet systems. Market observers said the decision could set a precedent, with wallet providers facing growing expectations to cover losses linked to third-party platforms.

Regulators have also taken note. Consumer protection authorities in several jurisdictions have been examining crypto-related scams that exploit mainstream platforms, arguing that the boundary between decentralised products and centralised distribution channels creates regulatory blind spots. While no enforcement action has been announced in this case, the episode adds to pressure on technology companies to tighten controls around financial software.

Arabian Post – Crypto News Network

Notice an issue? Arabian Post strives to deliver the most accurate and reliable information to its readers. If you believe you have identified an error or inconsistency in this article, please don't hesitate to contact our editorial team at editor[at]thearabianpost[dot]com. We are committed to promptly addressing any concerns and ensuring the highest level of journalistic integrity.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment