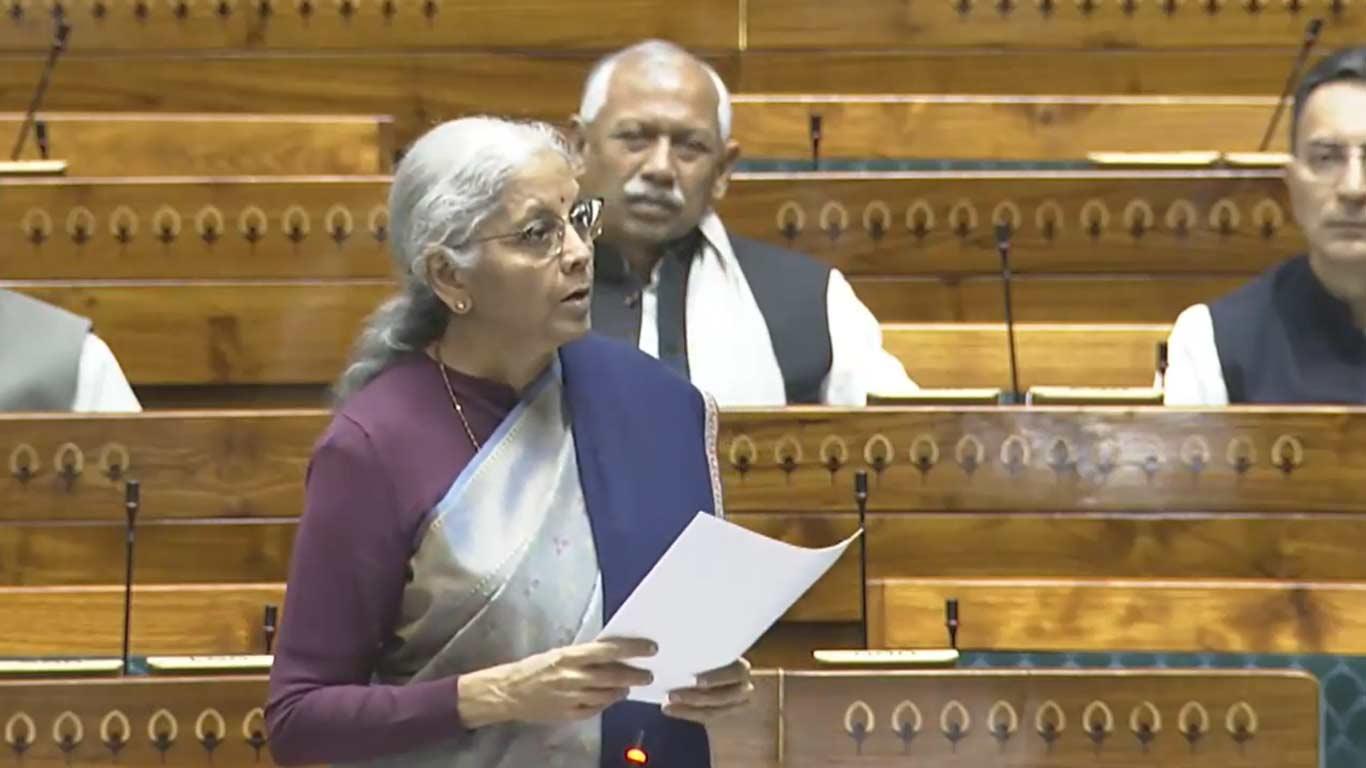

Govt Working With Regulators To Block Illegal Digital Loan Apps: FM Sitharaman

Regulatory Coordination and App Blocking Framework

In a written reply to the Lok Sabha, Finance Minister Nirmala Sitharaman said the Government has been working continuously with regulators to identify, restrict and block illegal digital loan apps operating across various online platforms.

The RBI has, since July 1, 2025, operationalised a public directory of Digital Lending Apps (DLAs) deployed by its regulated entities, enabling citizens to verify whether an app is legitimately linked to a licensed lender.

The Minister noted that once unauthorised apps are identified, the Ministry of Electronics and Information Technology (MeitY) is empowered to direct their blocking under Section 69A of the Information Technology Act, 2000, following due process under the 2009 Blocking Rules.

Strengthening Oversight and Consumer Safeguards

The Government underscored a series of steps aimed at preventing the recurrence of fraudulent digital lending operations.

These include the RBI's Digital Lending Directions, 2025, issued on May 8, which set mandatory norms on data privacy, recovery practices and grievance redressal for regulated entities, lending service providers and associated applications.

Authorities are also working with major internet intermediaries and messaging platforms to monitor and limit the proliferation of illegal lending apps.

Cyber Monitoring and Public Grievance Channels

The Indian Cyber Crime Coordination Centre (I4C) under the Ministry of Home Affairs continues to analyse suspicious lending applications, while citizens can report cyber incidents and illegal loan apps through the National Cybercrime Reporting Portal and the 1930 helpline.

In addition, the SACHET portal and State Level Coordination Committees provide channels for the public to lodge complaints on unauthorised deposit-taking or lending activities.

Awareness Campaigns and Risk Mitigation

RBI and banks have been conducting public awareness campaigns through SMS alerts, radio messages and training programmes under the electronic-banking awareness and training (e-BAAT) initiative, focusing on fraud prevention and risk mitigation.

The reply indicated that these collective measures form the basis of ongoing efforts to safeguard consumers and strengthen oversight of the digital lending ecosystem.

(KNN Bureau)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment