Falling Allowance Supply To Tighten EU Carbon Market

Allowances under the EU ETS are set to fall significantly in 2026, although, if we look at the current auction calendar for 2026, it does not reflect this, with auctioned volumes set to fall by less than 1% YoY. However, the auction calendar for 2026 does not take into consideration several adjustments that we will see.

First, we are likely to see volumes reduced with allowances placed into the Market Stability Reserve (MSR) between 1 September 2026 and 30 August 2027.

Second, there will be some cancellation of maritime allowances in 2026, which will be equivalent to the difference between the number of allowances surrendered and verified emissions for the sector. This cancellation will result in a reduction in auction volumes.

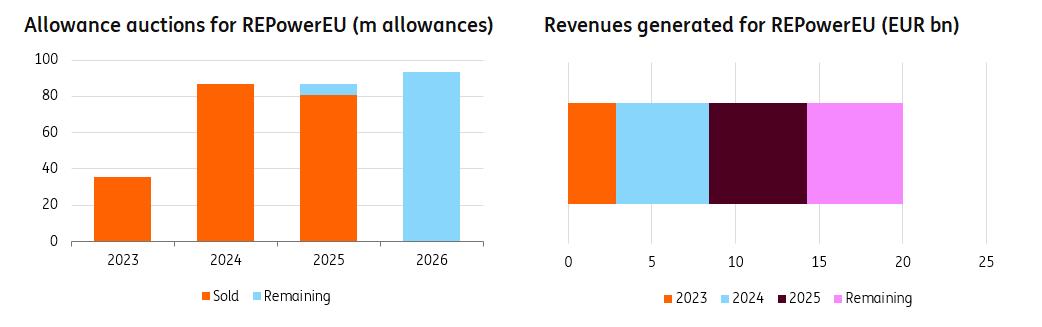

Finally, 93.3m allowances are set to be auctioned in 2026 for REPowerEU. However, we believe this full volume will not need to be auctioned to hit the Commission's EUR20bn revenue target under REPowerEU.

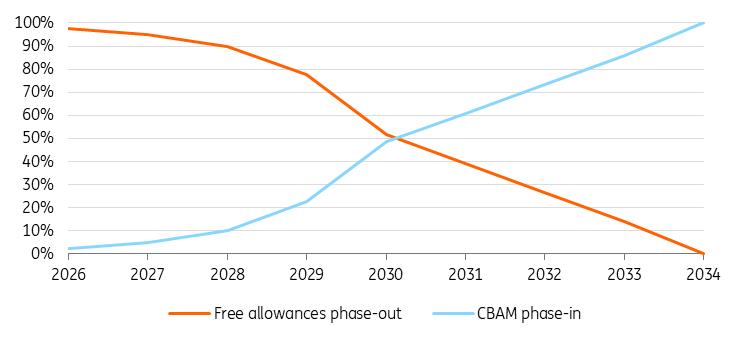

Meanwhile, we will start to see the phase out of free allowances for Carbon Border Adjustment Mechanism (CBAM) sectors and the full phasing out of free allowances for the aviation sector.

Combining all these factors suggests a steeper decline in supply next year, which should be supportive for prices. We expect EUAs to average EUR83/tonne in 2026, up from an average of around EUR75/tonne in 2025.

Aviation free allowances disappear, while further shipping emissions coveredA supportive factor for the EUA market going into 2026 will be the ending of free allowances for the aviation sector, leaving the sector to auction for volumes. The full phase-out of allowances does increase the potential for hedging demand from the sector. Meanwhile, the maritime industry is set to see 100% of its emissions covered from next year, up from 70% in 2025. As more of the shipping sector's emissions fall under the ETS, the potential for increased hedging demand from the industry grows.

CBAM to come into full force in 2026CBAM comes fully into effect in 2026, which will see importers of goods from CBAM sectors needing to gradually pay a carbon tax representing the embedded emissions within these imports. Any carbon price paid during the production of imports can be deducted. At the same time, domestic CBAM sectors will gradually see the phasing out of their free allowances from 2026 until 2034.

However, the Commission has made some changes to CBAM this year in an attempt to make it less onerous. First, importers importing less than 50 tonnes of CBAM goods per year will be exempt. Second, CBAM charges will be delayed until 2027, so essentially, certificates for 2026 will only need to be surrendered in 2027.

There are clear risks still lingering over CBAM. In recent years, noise over EU competitiveness, or the lack of it, has grown. Therefore, we could see growing pressure from member states for the bloc to try to balance its decarbonisation ambitions with trying to regain its competitiveness. Both Germany and Austria have been pushing for a delay in the phase-out of free allowances for CBAM sectors beyond 2034, given concerns over the impact it will have on industry.

Free allowance phase-out for CBAM sectors starts in 2026 (%)

Source: EC, ING Research Further allowances to be placed into MSR in 2026

Following the surplus in the EU carbon market in 2024, almost 276m allowances will be placed into the Market Stability Reserve (MSR) between 1 September 2025 and 30 August 2026. This is the seventh consecutive year that the MSR has seen intakes. In fact, the MSR has only seen intakes since it was introduced in 2018, reflecting the persistent surplus the market has faced.

Meanwhile, the total number of allowances in circulation (TNAC) is set to remain above the 833m allowance threshold for the MSR, suggesting that we will see a further reduction in auction volumes between 1 September 2026 and 30 August 2027. This reduction will not be reflected in the 2026 auction calendar yet, but the exact amount will become clearer over the second quarter of next year, which will lead to a reduction in auction volumes in the latter part of next year.

EU Commission on track to exceed REPowerEU revenue targets in 2026The European Commission has raised a total of EUR14.3bn through the auctioning of allowances for REPowerEU. This leaves only EUR5.7bn to be raised by the end of 2026 to reach the EU target of EUR20bn.

Between 2023 and 2025, the EU will have auctioned almost 209m allowances for REPowerEU. And the auction calendar for 2026 shows a further 93.3m allowances to be auctioned. However, if we assume a price of EUR80/t near to current spot prices but below our 2026 forecast, we do not need to see this full volume auctioned to hit the EUR20bn revenue target. Instead, we would only need to see in the region of 65m allowances auctioned in 2026, around 28m allowances less than currently planned. Therefore, this could leave supply even tighter than expected, providing some further support to EUAs through next year.

In addition, in the longer term, it is important to remember that these volumes auctioned for REPowerEU were volumes brought forward from 2027 onwards, so it also leaves the market relatively tighter in the years ahead.

EU set to easily achieve EUR20bn revenue target for REPowerEU from allowance auctions

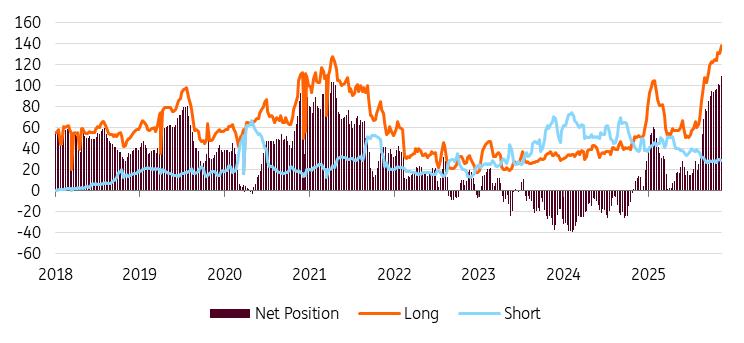

Source: EEX, EC, ING Research Large fund long in EUAs leaves positioning risk for the market going into 2026

While the outlook for the EUA market is constructive, it does appear as though investment funds have got a bit carried away with the outlook, particularly with a number of risks growing in the market. Investment funds have gone from essentially holding a flat position in EUAs at the end of last year to a record net long of almost 110k contracts. The bulk of this increase occurred following the US and EU agreeing on a trade deal, with the eventual tariff that the US imposed on imports from the EU significantly less than the 30% initially threatened. This would have eased some concerns over trade tensions weighing on EU industrial production.

However, looking deeper into the positioning data shows that the gross long held by investment funds hit a record high in November 2025. This does leave some positioning risk in the market, particularly if there is any easing in the bloc's climate ambitions.

Investment funds set to enter 2026 with a record net long (k contracts)

Source: ICE, ING Research There are downside risks facing the EUA market

There are clear downside risks facing the EUA market. As already mentioned, there have been some member states pushing for a delay in the phase-out of free allowances under CBAM, highlighting concerns within the region over the competitiveness of European industry. If these concerns grow, we cannot fully rule out steps that may delay the EU's decarbonisation ambitions, which may mean the bullish outlook for EUAs may need to be dialled back.

Already this year we have seen the EU decide to delay the implementation of ETS2, which will cover road transportation and buildings, from 2027 to 2028. While part of the delay was political, there was also a social element, given concerns over higher energy costs.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment