LNG Surge Eases European Gas Market Supply Concerns

The European gas market has come under significant pressure this year as supply concerns ease. And while we continue to hold a bearish view on the European market in the medium to long term, we believe there's room for some upside in the short term, particularly if the 2025/26 winter turns out to be colder than usual.

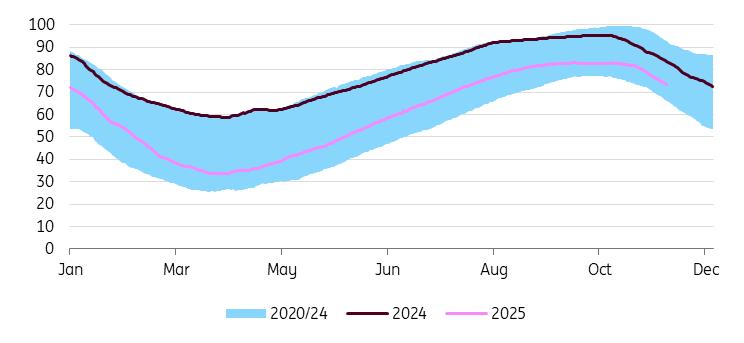

The EU entered the 2025/26 heating season failing to hit the Commission's storage target of 90% full by 1 November. This was due to the Commission relaxing storage rules earlier in the year, which effectively allowed the target to be met at any time between 1 October and 1 December. It means that if market conditions were unfavourable, the target could be lowered to 80%; if conditions were very unfavourable, this could be reduced even further to 75%.

The relaxation of storage targets eases upward pressure considerably, reducing the need for the region to buy gas at any cost to meet storage targets. The action allowed the Title Transfer Facility (TTF) forward curve to return to a more normal shape. Previously, storage targets were distorting the curve. The move by the Commission saw gas storage peaking at 83% full in mid-October. At the start of December, storage had fallen to 75% full, below both the 5-year average and last year's level of 85% for this stage of the year. Lower storage leaves Europe relatively more vulnerable going through the 25/26 winter, though.

For now, our balance sheet shows that the EU will exit the 25/26 winter with storage at around 25% full. This assumes we see record monthly imports of LNG in the winter. Obviously, plenty can, and likely will, change between now and the end of March 2026.

The longer-term outlook remains bearish for the global LNG market and European gas. The scale of LNG export capacity set to start will push the market into a large surplus. During the peak of the surplus, likely in 2027 and 2028, we might need to see prices trading down to levels where LNG plants reduce operating rates.

Basically, we would need to see the market trade down to the short-run marginal cost (SRMC) for US LNG producers. This is a moving level, depending largely on where Henry Hub is trading. Assuming a Henry Hub price of $4.50/MMBtu, it would work out to an SRMC of a little more than $6/MMBtu (EUR18/MWh).

EU gas storage heads deeper into winter tighter than usual (% full)

Source: GIE, ING Research Large speculative short in TTF is a risk

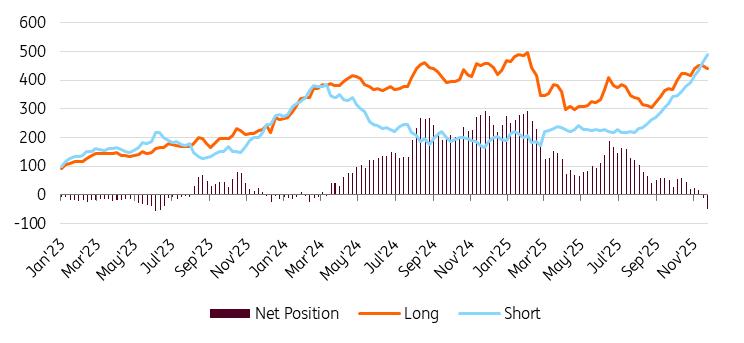

The weakness in the European gas market has been largely driven by speculators. They have become increasingly bearish towards the market despite lower-than-average storage going into the winter. Weak Asian LNG demand, relaxed European Commission targets, and the ramping up of new LNG export capacity appear to have dominated market sentiment.

Investment funds have aggressively sold TTF, moving from a net long of 292TWh in February to a net short of 50TWh by the end of November. This is the largest net short since June 2023. Digging deeper into the data, the gross short position is at a record high of 491TWh, more than 100TWh above the previous record high.

This leaves some positioning risk for the market. If there happen to be any supply shocks or extended cold spells through the 25/26 winter, particularly given tighter-than-usual storage, it could spark a fairly large short-covering rally.

Investment funds increasingly bearish towards TTF (TWh)

Source: ICE, ING Research Russian natural gas ban will see the EU buying more LNG

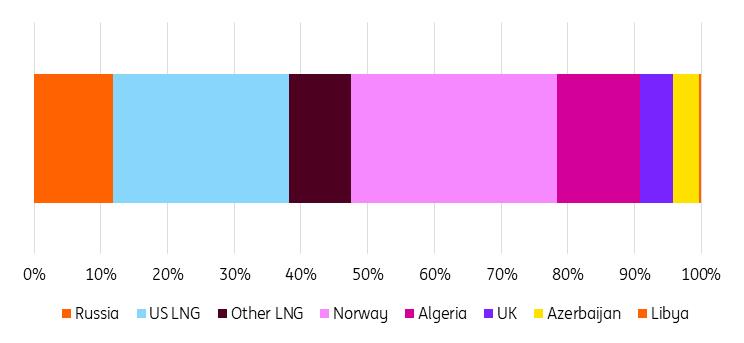

Despite the US trying to work towards a peace deal between Russia and Ukraine, the EU is pushing ahead with its phase-out of Russian fossil fuels. In its nineteenth sanction package against Russia, the EU agreed on the ban on Russian LNG imports, with short-term contracts to be banned by 25 April 2026. Supplies under long-term contracts will need to come to a stop by 1 January 2027.

The EU has imported around 17bcm of Russian LNG over the first 11 months of 2025, which is about 13% of total LNG imports. The LNG ban should be more manageable for the global market, with trade flows adjusting. Admittedly, though, Russian LNG volumes from Yamal might find it more difficult to reroute to Asia, particularly in the winter months, when the Northern route is shut down by ice.

Not content with just the ban on LNG, the EU more recently moved ahead with a ban on Russian pipeline gas. The ban on short-term pipeline gas imports comes into effect from 17 June 2026; pipeline flows under long-term contracts have to end by 30 September 2027.

There's room for this to be extended to 1 November should the region struggle with storage levels. The only Russian pipeline gas currently coming into the EU is via the Turkstream pipeline. It amounts to 15bcm per year, of which a little more than 10bcm would be under a long-term contract. The loss of these supplies will push the EU to rely even more on LNG supplies. Given the ramp-up of export capacity in the US, it will likely be the US which fills most of this gap. Over the course of 2025 and 2026, the US has around 55bcm of LNG export capacity ramping up. Whether this is sufficient depends on whether we see any recovery in Chinese LNG demand in 2026.

Progress on peace talks would be a clear downside risk for the market, particularly if we see an end to the war in Ukraine. While we believe Russian natural gas will not flow back to Europe in the event of a peace deal, the scenario cannot be fully ruled out. We covered what the different scenarios could look like here.

Russian gas and LNG make up around 12% of total EU gas imports (%)

Note: Covers the first three quarters of 2025 Source: Bruegel, ING Research China driving the weakness in Asian LNG demand

China's LNG demand has been weak this year. Imports in 2025 are set to be around 16% lower year-on-year. There are a number of factors weighing on demand. First, the bulk of Chinese gas demand comes from the industrial sector (in the region of 40%), so any industrial weakness will weigh on demand. China's official manufacturing PMI has been in contractionary territory in nine of the past 11 months. Second, China worked to increase domestic production, which has grown 6.3% YoY. Finally, pipeline gas imports continue to grow – up 7.6% YoY.

Looking ahead, there's a push to continue increasing pipeline flows into China. Russia is keen to progress with Power of Siberia 2, which could bring 50bcm of additional pipeline gas to China. Obviously, it would be unlikely that we see these flows anytime soon, given the need to build the pipeline. However, there appear to be steps being taken to expand the capacity of pipelines currently operating or set to start up imminently. If China turns increasingly to pipeline gas, it shifts the demand outlook dramatically for the LNG market. It would raise additional concerns about oversupply, given the amount of LNG export capacity which is set to start up by the end of this decade.

US natural gas storage comfortable... for nowThe US natural gas balance is very comfortable going into the 2025/26 winter. Storage is a little more than 5% above the 5-year average, while essentially unchanged from year-ago levels. However, the US gas market is set to tighten in 2026. It is looking as though natural gas inventories could go into the following heating season (2026/27) with storage levels at their lowest since 2022.

US LNG exports have hit record highs recently, with plants ramping up. This is set to only continue through 2026, which will tighten the US gas balance. The power sector is likely to continue to contribute to demand growth. The sector has seen consistent growth in recent years. With the build-up in data centres, there's no reason for this trend to stop.

On the supply side, US natural gas production has grown strongly this year at 4.5bcf/day or4.3% YoY. However, with the weakness in oil prices and given that a large share of natural gas production is associated with production, gas output in 2026 is expected to be flatter.

We have been supportive of Henry Hub prices for some time. However, the more recent run-up in prices appears to have got ahead of actual fundamentals. We expect Henry Hub to average US$4.20/MMBtu in 2026, up from an estimated US$3.60/MMBtu for 2025.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment