403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

EUR/USD Analysis 03/12: Bulls Await A Stimulus (Chart)

(MENAFN- Daily Forex) EUR/USD Analysis Summary Today

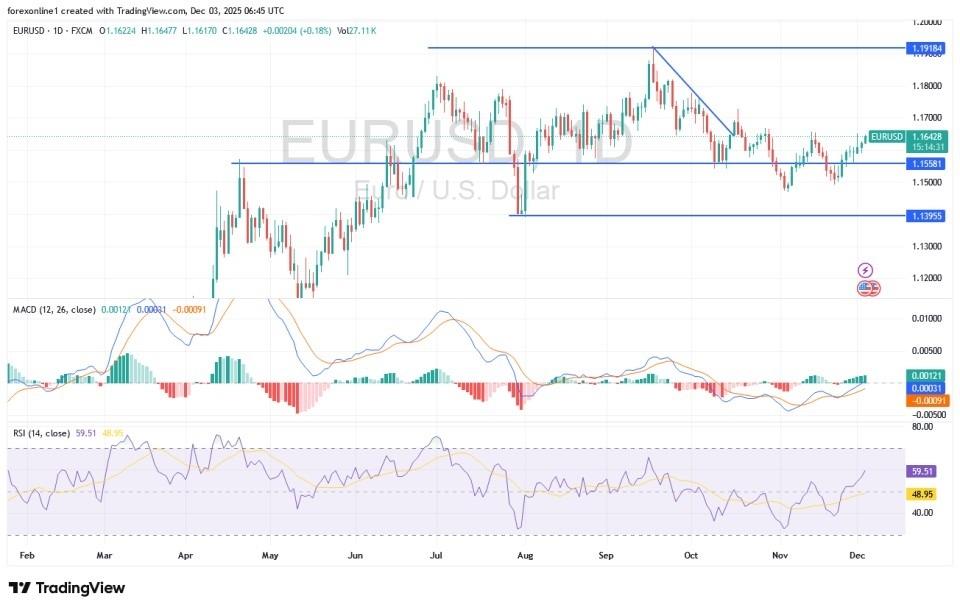

- Overall Trend:: Neutral. Support Levels for EUR/USD Today: 1.1560 – 1.1480 – 1.1420. Resistance Levels for EUR/USD Today:: 1.1670 – 1.1740 – 1.1830.

- Buy EUR/USD from the support level of 1.1520 with a target of 1.1700 and a stop-loss at 1.1460. Sell EUR/USD from the resistance level of 1.1720 with a target of 1.1500 and a stop-loss at 1.1800.

Across reliable trading company platforms, the Euro began the week with a strong attack against the British Pound and the US Dollar, but analysts at Barclays believe that the selling wave seen in the GBP/EUR pair in 2025 will reverse.

EURUSD Chart by TradingViewTrading Advice:The Euro/Dollar's bullish direction is anticipating strength factors that it has not yet received, so expect its losses to resume until that occurs.Ready to trade our EUR/USD daily forecast? Here's a list of some of the top forex brokers in Europe to check out.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment