Asia 2026: 2 Key Questions For India, From Trade To Rates

We assign a 70% probability to a trade deal being struck between India and the US, considering the progress made on several contentious issues outlined below:

Addressing ties with Russia: India's crude oil imports from Russia have declined meaningfully, while imports from the US have surged, signalling a deliberate diversification of suppliers. According to US export data, India's oil imports from the US are expected to be around 575k barrels per day (bpd) in October, while November is projected to reach 400k-450k bpd, marking a sharp rise from the year-to-date average of about 300k bpd. In a notable development, Reliance Industries (RIL) announced that it has stopped importing Russian crude for its Jamnagar refinery

Addressing trade surplus concerns: India has signed a long-term contract to import 2.2 million tonnes of liquefied petroleum gas (LPG) from the US Gulf Coast in 2026, representing nearly 10% of India's annual LPG imports. This marks the first structured American energy deal to which India has agreed. It's significant given LPG accounts for roughly 41% of India's refined petroleum product imports. While US LPG may be cheaper, freight costs remain a trade-off. To mitigate shipping risks, Indian state refiners are reportedly negotiating delivered terms rather than free on board (FOB).

Benefits to Indian agriculture: The Trump administration recently cut tariffs on imports of 200 food products, including tea, spices, mangoes, and beef. India's agricultural sector accounts for 12% of total exports and should therefore benefit from the withdrawal of reciprocal tariffs on agricultural products.

Looking ahead, we expect the Indian rupee to strengthen if trade deal uncertainty eases. Despite signs of growth moderation, India is still likely to deliver the highest growth in the region in 2026, which should support foreign institutional investor (FII) equity inflows. Additionally, India has been one of the biggest beneficiaries of global supply chain diversification, which should continue to bolster the INR through steady FDI inflows. Debt markets have also attracted sustained foreign interest, supported by persistently low CPI inflation, favourable bond dynamics, strong fiscal discipline, and expectations of potential rate cuts.

What could trigger an Reserve Bank of India rate cut?With headline inflation firmly below 5%, the Reserve Bank of India's decision to maintain the policy rate has surprised markets. We expect a 50bp rate cut from the RBI in 2026. We believe the following three factors would prompt a shift in short order:

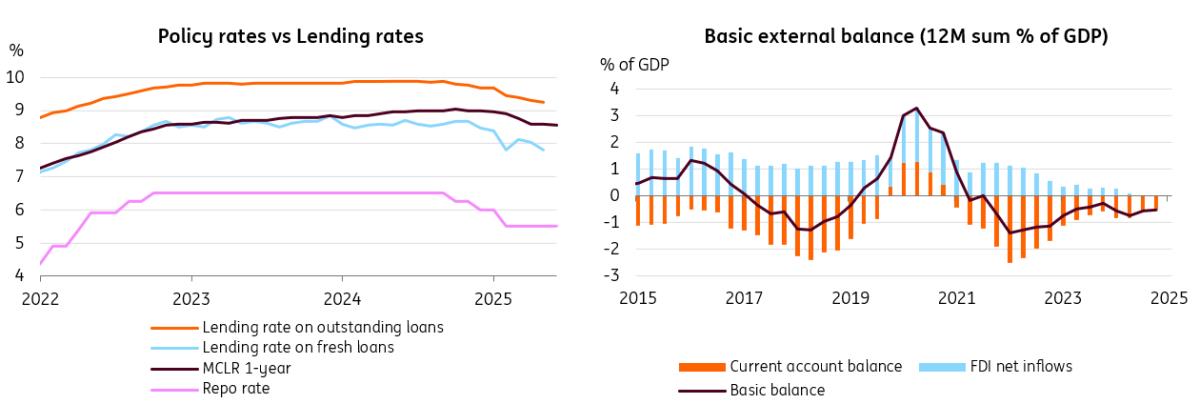

Stronger monetary policy transmission since the last RBI meeting: The easing cycle that began in February 2025 has gained traction. Banks steadily reduced repo-linked lending rates, while the marginal cost of funds-based lending rate (MCLR) – which typically adjusts more slowly – has also declined. Notably, the 1-year median MCLR for scheduled commercial banks has fallen by 45bp since February. In turn, the weighted-average lending rate on new rupee loans dropped by about 80bp, while rates on outstanding loans eased by roughly 60bp over the same period. The transmission of lending rates to the market has accelerated significantly since October, when the RBI held rates unchanged.

Better transmission of GST rate cuts: October CPI inflation data suggests that the goods and services tax (GST) reductions announced in September have been partially passed on to consumers. Lower prices, particularly for automobiles and electronic goods, helped drive down inflation. Prices of 30 out of 54 daily-use items monitored by the government, including electronics and food items, have seen reductions being made further than expected; others are yet to fully reflect the intended benefits.

We estimate that this partial pass-through, combined with sharply lower food prices, will keep inflation well below the RBI's target for the remainder of the full-year 2025-2026.

Signs of weakening GDP growth: Growth momentum is set to moderate in the coming quarters amid external and domestic headwinds. Export performance has deteriorated sharply. Indian shipments to the US fell by over 30% in September compared to July, following the imposition of 50% tariffs. Despite both sides signalling progress on trade negotiations, no agreement has materialised, leaving exporters exposed.

Manufacturing weakness is evident in industrial production, which grew just 1.2% year-on-year in September, well below expectations. This reflects the early impact of tariffs. While recent tax cuts may cushion the impact, limited export diversification means the drag from US tariffs will likely intensify from the fourth quarter of 2025, adding downside risk to GDP growth. We expect India's GDP growth to slow to 6.5% YoY in 2026 from 7.6% this year.

Better transmission to lending rates; external balances remain healthy

Source: CEIC

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment