Hungary Can't Shift Its Labour Woes

| 4.6% |

Unemployment rate

Aug to Oct, ING estimate 4.5% / Previous 4.5% |

The latest labour market statistics from the Hungarian Central Statistical Office (HCSO) show a slight decline in the monthly unemployment rate in October, which is broadly in line with market expectations. The model estimate is 4.4%, while the official survey-based three-month moving average indicates an unemployment rate of 4.6% for the period from August to October. Based on these figures, the slight upward trend in the unemployment rate observed since the beginning of the year appears to be continuing. The latest data represents the highest figure in the past year. Statistics suggest that around 220,000 people were unemployed. The three-month average of the number of unemployed people is also at its highest point in a year.

To the details, then, and the monthly data shows that the decline in the working-age population continues. At the same time, however, the number of employed has also increased, albeit within the margin of statistical error. This increase was driven by those entering the labour market, while the number of unemployed people decreased by a minimal amount each month. The October indicators are consistent with the seasonal pattern observed in previous years and do not suggest any structural change.

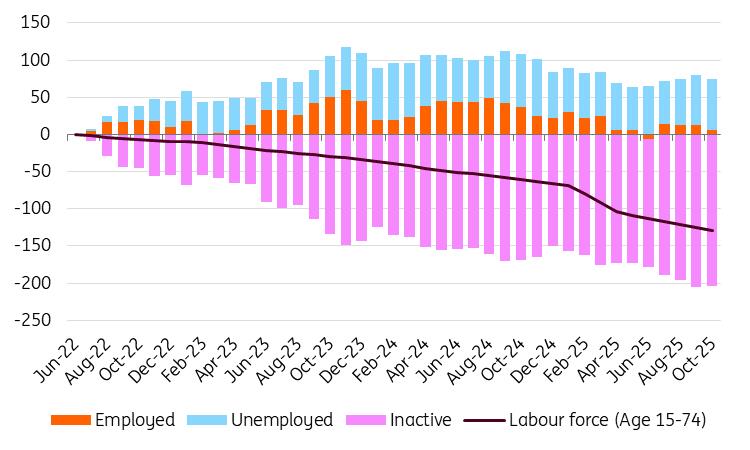

Changes in the labour market since mid-2022'000, 3-m moving average

Source: HCSO, ING

A more serious long-term problem is emerging in the Hungarian labour market. Since mid-2022, the working-age population has fallen by almost 130,000 due to population decline. This is roughly equivalent to the population of Hungary's sixth-largest city. Meanwhile, the number of unemployed people has risen by around 69,000, and by autumn 2025, the number of people in employment had fallen back to the level seen in summer 2022.

As demand and supply in the labour market have recently declined together, activity and employment rates have remained stable. The labour market, therefore, remains tight, placing companies in an extremely challenging position as they attempt to manage the significant increase in wage costs amid economic stagnation. The revised minimum and guaranteed minimum wage agreements will only provide limited relief compared to the higher figures negotiated at the end of 2023. The 2026 minimum wage increase for unskilled labour is set at 11%, which is 2ppt lower than the previous agreement.

Meanwhile, the minimum wage for skilled labour will increase by 7%, the same as in 2025. As the social contribution tax will not be reduced next year, contrary to previous suggestions, this will not give companies more room for manoeuvre in wage negotiations.

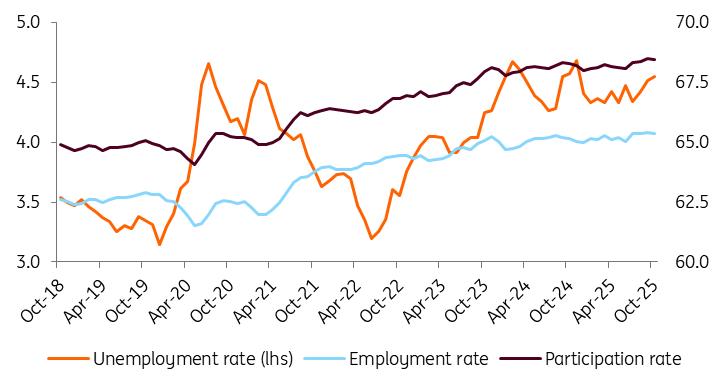

Historical trends in the Hungarian labour market (%)

Source: HCSO, ING

Looking ahead, we do not anticipate any significant changes to labour market supply. No demographic shifts are anticipated, particularly since the total fertility rate was estimated at 1.31 children per woman between January and October 2025, down from 1.39 a year earlier. However, rising labour costs and a lack of economic recovery could further reduce labour market demand. The main risk to the labour market is that if economic growth does not pick up next year, companies will attempt to offset the expected wage increases by reducing or freezing total wage costs. This would lead to a reduction in the number of employees. Additionally, there is a possibility of more significant price increases to offset labour cost increases, since companies cannot increase revenue through higher sales volumes and will therefore have to raise selling prices.

In light of the latest data, we are maintaining our labour market forecast, which predicts that the unemployment rate will remain at around 4.5% for the remainder of the year. We anticipate a modest decline in unemployment next year, driven by an expected improvement in overall economic performance and the addition of new export production capacity. However, as previously mentioned, the balance of risks favours weaker labour market indicators in the near future.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment