Deal Hunt In The Global Food Sector Reignites In Wake Of Trump's Tariffs

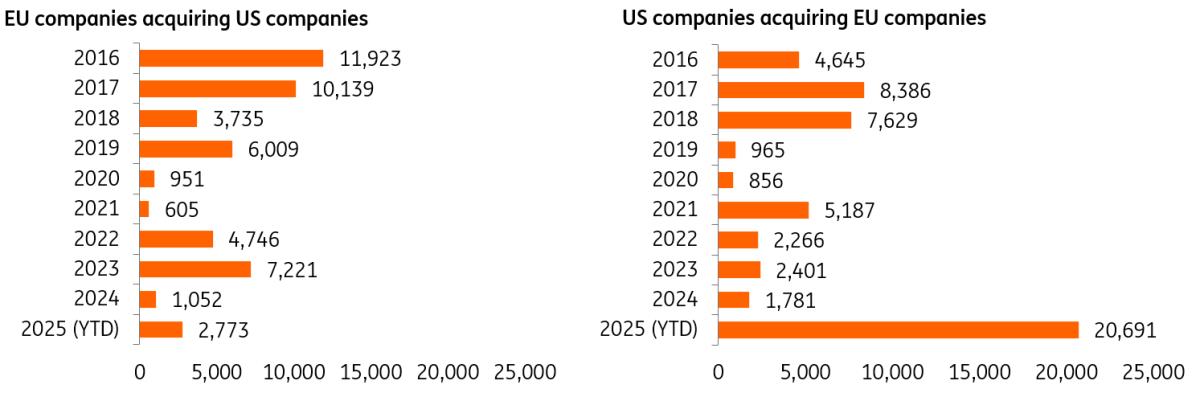

What a year of extremes we've had as far as Mergers & Acquisitions are concerned in the transatlantic food and beverage industry... and it's not over yet. Deal activity slowed strongly in the first half as tariffs made companies wary and added extra costs and time to complete negotiations. This was followed by a blockbuster summer with several billion-euro deals in breakfast cereals, think Ferrero and WK Kellogg, potato products, with Simplot and Clarebout, and beverages. In fact, the Keurig Dr Pepper and JDE Peet's deal helped push up the year-to-date value for transatlantic M&A to a record high of almost €25 billion.

The number of deals is less extraordinary, which is no surprise given the slowdown in the first half of 2025. However, market sentiment has greatly improved. So the final months of 2025 will likely have more in store, with potential divestments of Nestlé's global water division and DSM-Firmenich's Animal nutrition and Health business pending.

Value of transatlantic deals in the food and beverage sector approaches €25 billionDeal value in €m

Source: MergerMarket, ING Research M&A as a tool to navigate increased geopolitical risks

Geopolitical considerations are gaining importance for corporate strategy in the food sector. Previously, we've looked at how these companies are managing the associated risk, but geopolitical considerations are also increasingly prominent in corporate dealmaking. It can make M&A more attractive, for example, when it helps to reduce or offset the tariff impact, improve supply chain resilience or benefit from a more favourable regulatory environment.

A recent KPMG survey on companies' M&A plans showed that tariffs prompted roughly 1 in 4 US corporates and private equity funds to change the type of business and the countries they're considering.

Other catalysts for EU to US M&A besides tariffsThe US has been a key market for many EU food and beverage companies seeking growth and diversification, given its market size and affluent households. Currently, tariffs are not the only catalyst for companies to weigh M&A options in the US. Macro and market developments also create momentum. The outlook for the US economy is still strong compared to the Eurozone, as you can see in our current forecasts, despite the economic challenges posed by tariffs.

We expect several interest rate cuts in the US in 2025 and 2026, which are generally considered a stimulus for M&A. European companies looking for deals in the US will also find confidence in the continued weakness of the dollar, which is expected to persist into 2026. Additional favourable factors include the continuation of low corporate taxes and more supportive antitrust regulation. The latter is especially relevant for larger transactions.

Continued strength expected for the EUR in 2026EUR/USD spot rate

Source: ING Research Key areas of interest for EU companies in the US

Due to the general level of consolidation in the US food market, only a select group of EU businesses can acquire large assets there. Most EU-based producers seeking entry into the US market will look for smaller existing entities or set up their own local production facility. Both options have advantages and disadvantages. However, acquiring existing assets allows buyers to avoid the challenges associated with hiring workers in a tight US manufacturing labour market, a situation that is further influenced by stricter immigration controls.

Two areas for M&A are of particular interest to EU-based buyers.

In food and beverage production, it usually makes economic sense to produce close to the raw materials or the end consumer. Still, for products that are exempt from tariffs under USMCA, producing in Mexico can be a good alternative for the North American market. The EU has invested in closer trade ties with Mexico and a recently modernised trade agreement, which creates greater certainty for companies and paves the way for increased mutual investment.

Mexico offers a sizeable, expanding domestic market with manufacturing production costs about 50% lower than in the US and Canada, making it attractive for export-focused operations. In the past, this has attracted companies like Nestlé, Heineken, and AB InBev, with Nestlé also reconfirming its presence earlier in 2025 by announcing a 1 billion EUR investment in the country over the next three years.

Key areas of interest for US companies in the EU: large assets and buy and buildWhile EU companies are mulling their options in the US, American companies are clearly making their presence felt in the European market. The deals between Simplot & Clarebout and Keurig Dr Pepper & JDE Peet's show that US companies can acquire some of the largest EU food and beverage companies when they see a strategic fit. While these two deals involve strategic buyers, US private equity firms also have a strong track record in M&A in Europe, including ED&F Man (soft commodities trade), Flora Foods (plant-based spreads), Refresco (beverages), Europe Snacks (savoury snacks), and Malteries Soufflet (malt).

So when large European food companies are considering divesting business units or selling the company outright, American strategic buyers and private equity firms are likely candidates. The relatively fragmented European market provides private equity firms with the opportunity to buy and build larger 'platforms'. Such consolidation is currently happening in ice cream production and in soft commodities trading.

The US-EU trade deal looks set to stimulate US food & agri exports to the EU as it includes the intention to provide preferential market access for US products such as fish, corn, soybean oil, and nuts into the European Union. While that could reduce the need for US corporates in these subsectors to look for processing assets in Europe, they might be in the market for more distribution capacity.

The strategic autonomy push to filter through to M&A in the food sectorFood is increasingly considered a strategic sector on both sides of the Atlantic; hence, the push by policymakers in the EU and the US to strengthen the resilience of domestic food production. Concerns about strategic autonomy and national security narrow the list of acceptable buyers for agricultural and food processing assets, with non-Western entities obviously losing appeal.

When geopolitical tensions rise, investments tend to shift to countries that are 'more geopolitically close '. Meaning that European and American companies will do a larger share of their investments in their home market or in other Western economies as a response to geopolitical uncertainty. In that sense, the changing geopolitical landscape also influences both Foreign Direct Investment flows and M&A.

Changes in the geopolitical landscape a stimulus for transatlantic M&AWe've seen several major transatlantic tie-ups between EU and US food and beverage companies so far in 2025. Looking ahead, we expect geopolitical factors, such as tariffs, to be a catalyst for more transatlantic deals. Tariffs, rate cuts, and the stronger euro are factors pushing European companies to assess their position in the US market.

M&A has multiple drivers, but it also becomes a tool to manage geopolitical and trade-related risks. With a provisional EU-US trade deal in place and no big elections planned on both sides of the Atlantic, we enter a period of relative calm. Deals that can be executed quickly and integrated easily, of course, have the advantage and 2025 has proven that the market can rapidly shift and adapt.

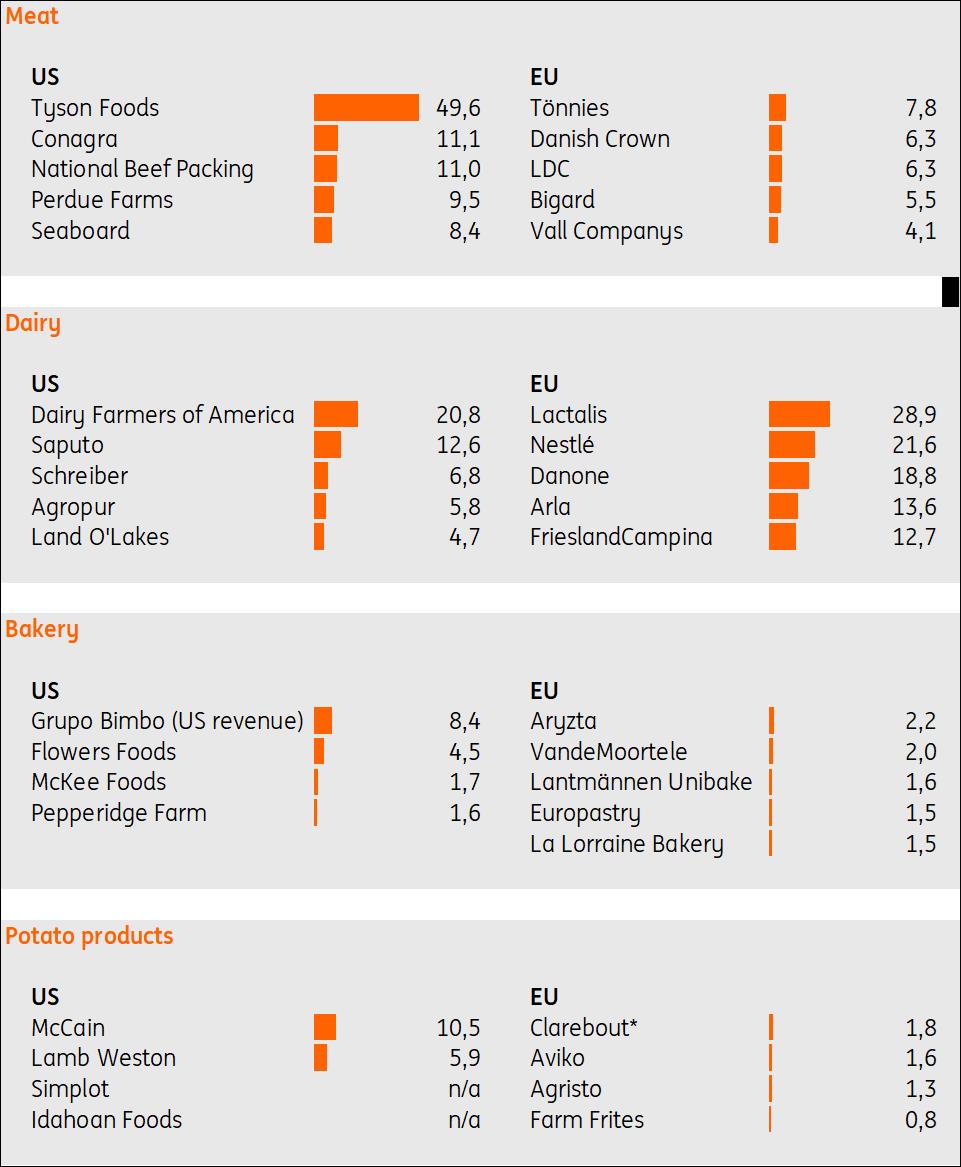

Major food companies in US tend to be larger than European counterpartsCompany revenue (billion EUR) in most recent year in several subsectors

Source: Source: company information, ING estimates. Diversified companies like Cargill that don't report subsector specific revenue data are exluded. *Clarebout Potatoes acquisition by Simplot completed on Oct 31 Annex: EU and US food market similar in size with some major differences

Total food and beverage expenditure by households reached €2.26 trillion in the US and €2.34 trillion in the EU and UK in 2024. Still, there are considerable differences between the two markets that food and beverage makers should be aware of.

Concentration ratios in the food sector point to a more consolidated market in the US than in the EU. US companies have more scale when you look at the revenues of key players in meat, bakery and potato processing. Dairy is an exception. Out-of-home consumption is far more important in the US. There, it accounts for 59% of total food spending versus 33% in the EU. The largest clients for EU producers are usually food retailers, while for US-based producers, quick-service restaurants and food service companies are more important. Brands have a much stronger position in US food retail, and private label is less developed. Private-label products account for 21% of total sales in US food retail, compared to 39% in key European countries. In both markets, private label has been gaining market share.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment