Carry In 26: Crossing Into The Final Frontier

2025 is proving to be a surprisingly good year for emerging markets. Neither the dollar nor benchmark US Treasury yields have surged, nor has global trade collapsed as much as first feared at the start of the year. Low interest rate volatility has favoured the carry trade in many asset classes, including in FX, developed credit and emerging markets. Popular local currency EM bond indices, such as the JPM GBI-E, are up around 16% year-to-date – matching the AI-powered S&P 500 rally.

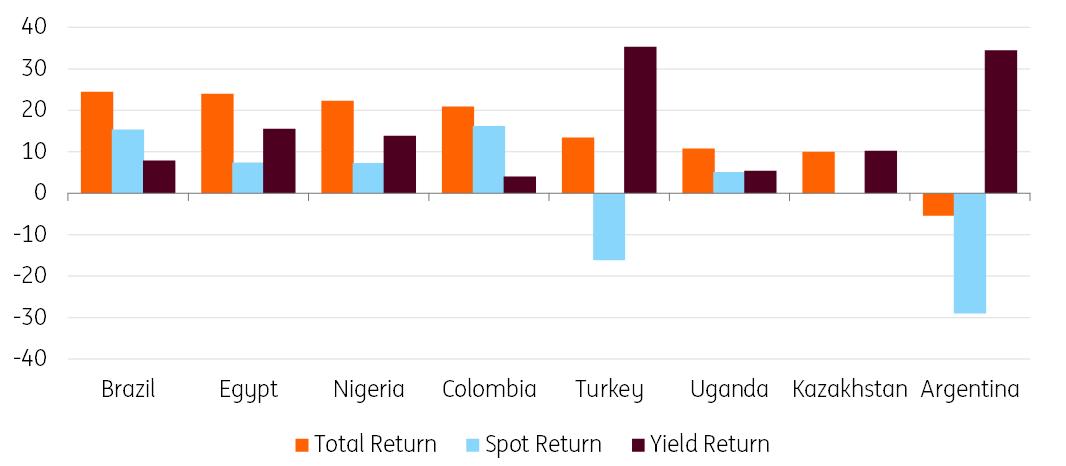

And in FX markets, investors have pushed even further out the credit curve and into high-yield EM. Turkey has been a familiar carry trade story for quite a few years, but now the hot markets are the Egyptian pound and the Nigerian naira. These two countries, along with Brazil, have delivered 20% total returns year-to-date when funded out of the dollar. The two also represent the 'frontier' basket of currencies, those higher-yielding/low-rated EM currencies which do not make it into indices like the JPM GBI-EM. Indeed, we are seeing the creation of more frontier indices now based on investor demand.

YTD carry trade performance in 2025, funded out of USD

Source: ING

But as we know with carry trading investing, it can be like picking up pennies in front of a steamroller. And the risk and reward increase the further one moves along the EM credit curve. Speaking to customers recently, we're hearing more interest in the currencies of Kazakhstan, Uzbekistan, Uganda and even recovery plays in the widow-making Argentine peso.

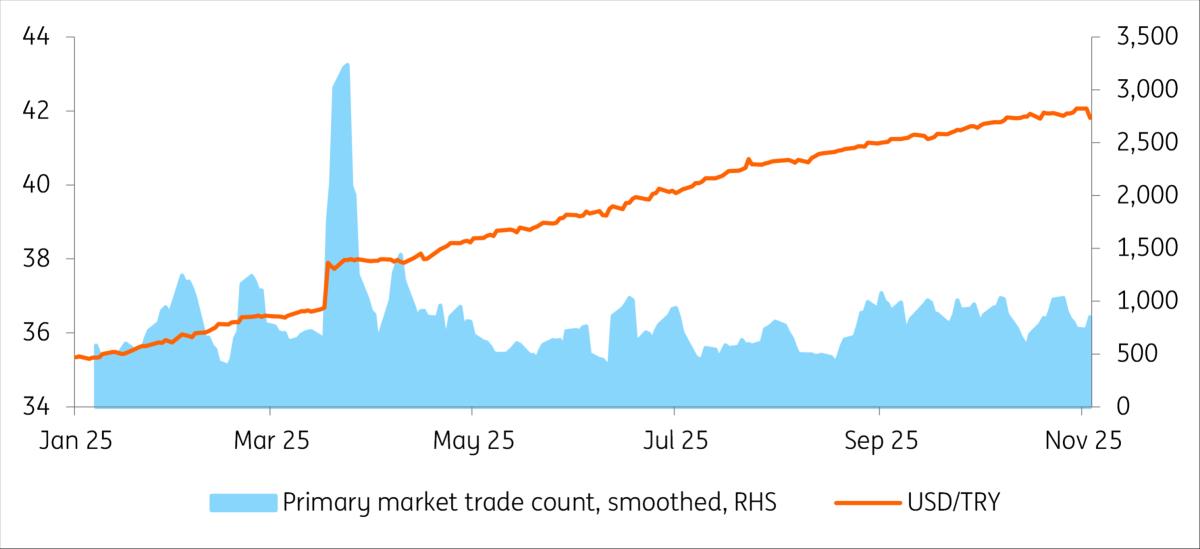

To help customers navigate through some of the 2026 risks associated with these existing and new carry trade stories, below we provide a high-level overview and also some indication of trading volumes in this year's sell off in the Turkish lira.

High reward, high riskAny play in the Argentine peso would be similar, too, by expecting the managed ARS depreciation to be less than priced into the forward curve. Egypt and Nigeria are proving different propositions – these offer high yields and have delivered nominal appreciation too. So has the Brazilian real.

Before looking at the individual currencies, their regimes and their risks, first some transaction data. Data on daily USD/TRY trading volumes shows how crowded positions were unwound in March this year. The arrest of the Istanbul mayor prompted a rush to the exits from long lira positions, with state banks briefly losing control of the currency. That saw an intra-day 12% drawdown in spot lira positions and much more for those positioned further out the forward curve. The ability to understand the size of positioning and the local central bank's commitment to defending the target currency's downside are therefore two important variables here.

USD/TRY versus trade count data

Source: Reuters, ING The outlook for key carry trade targets

Turkey (TRY)

When adjusted for carry-to-volatility, the Turkish lira remains one of the more appealing carry trade opportunities among emerging market currencies, despite a decline in its return over time with the Central Bank of Turkey's rate cuts.

Looking ahead to next year, this favourable positioning is likely to persist. The CBT is likely to maintain elevated real interest rates for an extended period; the prevailing story is slower-than-expected disinflation, as we have seen this year so far. In fact, investor positioning in the carry trade has recently stood at around $47bn after a drop in the third week of October. This was the largest weekly move since the political developments in March – though still approximately $10bn higher than levels seen before the March volatility.

The challenge is that there may be limited room left for further appreciation of the lira. For disinflation efforts to succeed, improvements in pricing behaviour and inflation inertia will be necessary; relying solely on exchange rate stability will not be sufficient. Also, while political developments have had a relatively muted impact on Turkish assets since early September, it would be premature to dismiss the possibility of more significant political news affecting markets in the future. Still, the CBT is considerably better equipped in terms of reserves, rates and macroprudential instruments to support FX stability in the event of outflows. We also do not anticipate a significant rise in dollarisation as the bank continues to manage the exchange rate with a prudent approach.

Hungary (HUF)

All good things must come to an end, and we see a decent chance that the Hungarian forint's rally will end in 2026. While our base case scenario sees the National Bank of Hungary sitting tight until next autumn, weak economic activity and temporarily low inflation (due to government measures) may prove too tempting to resist, prompting a change in the recent hawkish monetary policy setup. An unexpected interest rate cut would swiftly have a negative impact on the forint.

Besides monetary policy, politics could also come into play, altering market sentiment. The possibility of one of the factors behind the strength of the HUF being pre-election positioning cannot be ruled out. For the first time in a long time, there might be a change of government. The market views a potential victory for the opposition party in spring 2026 as favourable for the forint due to its pro-EU stance and the prospect of a Polish-style overhaul of EU funding. Against this backdrop, if national-conservative Fidesz wins the election, or if there is a strong indication before the election that it will win, market players will likely start to question the feasibility of accessing the full EU fund envelope. This could limit the possibility of a continued, sentiment-driven HUF rally in 2026.

Another risk stems from the sovereign credit rating. We cannot rule out a sovereign credit downgrade. Moody's is set to review Hungary's rating on 28 November, followed by Fitch on 5 December. Due to weaker-than-expected short- and mid-term economic activity and a weaker fiscal situation than projected earlier, Moody's may downgrade Hungary to 'Baa3'. This would see Moody's join S&P in keeping Hungary just above the non-investment grade line. Such a move could prompt a rules-based sell-off by investors with conservative policies.

While all of these risks skew towards a weaker forint, it is still possible that none of them will materialise. It is still possible that market players will keep calm and carry (trade) on. Nevertheless, we predict a EUR/HUF range of 390-395 in the second half of 2026, acknowledging that some combination of these risks, or even their mere existence, will influence investors' thinking and positioning in the coming quarters.

Egypt (EGP)

Egypt has returned as an investor darling over the past year, with reforms improving the outlook following the huge disbursement of Gulf money seen in early 2024. Since then, the currency has been allowed to float relatively freely, a key condition for IMF support. After some further weakness following last year's sharp devaluation of the pound, the currency has gradually strengthened since April this year.

Alongside the exchange rate flexibility, the central bank has maintained a fairly tight policy stance, gradually reducing its policy rate from 27.75% to 21.5%, while inflation has fallen sharply to below 12% from 24% at the start of the year. This policy setup has made Egypt an obvious choice for the carry trade, and sentiment is likely to remain positive, with the current account deficit narrowing, FX reserves rising, and growth momentum improving. The sovereign risk premium has also narrowed markedly, with sovereign credit spreads now at near 360bp on average, from over 1500bp in mid-2023.

Against this backdrop, a key risk here is the heavy positioning and consensus nature of the bullish view of Egyptian local debt. Egyptian T-bills are an investor favourite, with foreign holdings of almost $40bn equivalent on a fairly lagged basis (latest data May 2025), representing some 40% of the total stock. At the same time, progress on fiscal consolidation has remained fairly slow, with high government debt levels above 80% of GDP and a fiscal deficit of 7.1%, driven by enormous interest costs. Geopolitical risk also remains a topic that could flare up again, with the Suez Canal disruption weighing on export receipts in recent years – although some optimism has at least come from the US-brokered peace deal in Gaza.

Nigeria (NGN)

Despite recent headline noise and threats from the US about military action over religiously motivated violence from militant groups, Nigeria has also firmly reestablished itself among investor favourites, given decent reform progress. Similar to Egypt, exchange rate flexibility has formed the cornerstone of market liberalisation. The central bank has recently started easing monetary policy, although inflation has proved somewhat stickier.

Nigeria has also seen a credit rating improvement, and the naira has consistently strengthened since April. This has seen the nation's Real Effective Exchange Rate (REER) strengthen by 35% YoY, but shouldn't signal currency overvaluation given the size of devaluation seen across late 2023 – especially when coupled with a solid current account surplus. Other strengths include robust FX reserve coverage that stands out versus frontier market peers, along with strong headline fiscal metrics (primary surplus, government debt below 40% of GDP).

Along with the renewed political risk from President Trump's comments, Nigeria does suffer from poor revenue generation, in particular outside of hydrocarbon receipts. In terms of headline risk, elections are also scheduled for early 2027, which are also driving some expectations of fiscal loosening next year.

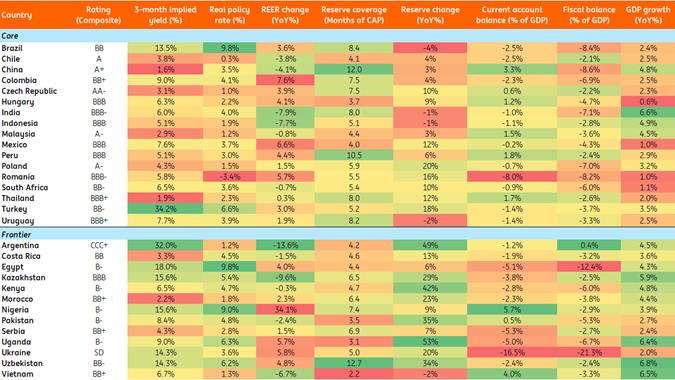

EM sovereign fundamental heatmap

CA, fiscal, growth data is IMF WEO forecast for 2025; reserve data is latest available; real policy rate uses current realised inflation Source: Macrobond, Refinitiv, IMF, Bruegel, National sources, ING calculations

Uganda (UGX)

A less high-profile name, but Uganda has recently generated decent investor interest, in particular given expectations for growth momentum to increase in the coming years on the back of oil sector development. At the same time, local markets are fairly well developed compared to many peers in Africa, with credible central bank inflation targeting offering elevated real rates that have been relatively stable in recent years.

The exchange rate has been relatively flexible in recent years, strengthening by some 13% since early 2024. Meanwhile, the nation's current account deficit is expected to narrow and has largely been covered by FDI inflows. The domestic market offers a well-developed yield curve out to 20-year maturities, while the majority of external debt is on concessional terms to official creditors.

However, FX reserves are relatively low, which presents a risk alongside persistent twin deficits. The nation has restarted talks with the IMF over a potential new deal, after the last funding package ended in 2024 without all funds being disbursed. The composition of government debt is worsening, with less concessional financing available, while debt servicing costs have also been rising. In terms of event risk, elections in January 2026 could also see the potential for opposition-led protests and political instability.

Kazakhstan (KZT)

Kazakhstan's exchange rate regime is officially free-floating, though domestic FX dynamics are influenced by government and central bank operations. The sovereign wealth fund (NFRK) sells some of the FX it collects as oil tax to finance part of the fiscal deficit, while the National Bank of Kazakhstan (NBK) conducts net FX operations linked to the state pension fund management and domestic gold purchases. Currently, combined state net FX sales amount to about $1.0-1.5bn per month, providing structural support to the tenge.

Looking ahead, if fiscal consolidation materialises in 2026, these FX sales will decline, leaving the tenge more reliant on private trade and capital flows. Without simultaneous improvement in the current account (currently in deficit) and liberalisation of foreign access to domestic securities, liquidity in the local FX market could tighten, amplifying volatility risks.

Uzbekistan (UZS)

Uzbekistan's exchange rate regime operates as a crawl-like system, with the central bank actively smoothing short-term volatility and acting as the priority buyer of domestically produced gold. Despite these interventions, structural pressures have driven a long-term depreciation: the Uzbekistani som lost 81% of its value against the USD between 2014 and 2024, making it the weakest performer in the CIS space. In 2025, however, a surge in global gold prices, fiscal consolidation, and moderating inflation enabled the UZS to appreciate 7% in January through to October 2025, attracting speculative interest. If gold prices remain near $4,000/oz, gold exports could double by 2026 versus 2024, improving investor sentiment. Still, Uzbekistan remains a twin-deficit economy with elevated CPI, warranting caution on the durability of this appreciation trend.

Azerbaijan (AZN)

Azerbaijan maintains a stabilised arrangement, according to the IMF, with the manat pegged at 1.70 per USD since 2017. External buffers are substantial: combined assets of the central bank and SOFAZ oil fund total about $80bn (c.100% of GDP) as of mid-2025, providing a strong defence against short-term shocks, as seen during the 2020 oil price collapse. However, the current account surplus is narrowing amid stagnant exports and rising imports, pushing the breakeven oil price from $40/bbl in 2021 to around $60/bbl today. Prolonged weakness in global oil prices could revive questions about the sustainability of the peg, though near-term risks remain contained given Azerbaijan's sizeable reserves.

Argentina (ARS)

As a consistent headline generator, Argentina has seen its roller coaster ride continue for much of President Javier Milei's term so far. The economic programme had seen plenty of successes in the run-up to midterm elections, with ratings upgrades, IMF disbursements, rapid fiscal adjustment and a more flexible exchange rate regime. The peso has been allowed to float within a moving band since earlier this year, leading to general currency weakness amid a modest current account deficit and persistent USD demand from locals.

The most recent bout of volatility saw sovereign credit spreads spike to over 1500bp from below 600bp at the start of the year, with the peso touching the weak end of its band vs the USD. Investor concern was driven by a poor showing for Milei in provincial elections in Buenos Aires in September, before a strong showing of US support (including $20bn swap line) and a big win for Milei in the midterm elections drove a rapid turnaround. Now, the question remains as to whether the Argentine authorities will be willing – or able – to shift to a more traditional managed floating exchange rate, which could see more short-term pain (if current pressure on the peso continues) but help to correct external imbalances on a medium-term basis.

On the positive side for investors, inflation has fallen significantly from almost 300% YoY to 32% and the fiscal balance has moved into surplus, while the strong performance for Milei in the midterm elections appears to have solidified the US resolve for support, and the country's IMF programme appears to be on track. That being said, risks remain high given that FX reserve coverage is still limited by most measures, while external debt levels and financing needs are elevated. Investors will need to be ready for continued volatility if trying to earn the carry on offer from Argentina's local markets.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment