Monitoring Hungary: Trapped In Stagnation

-

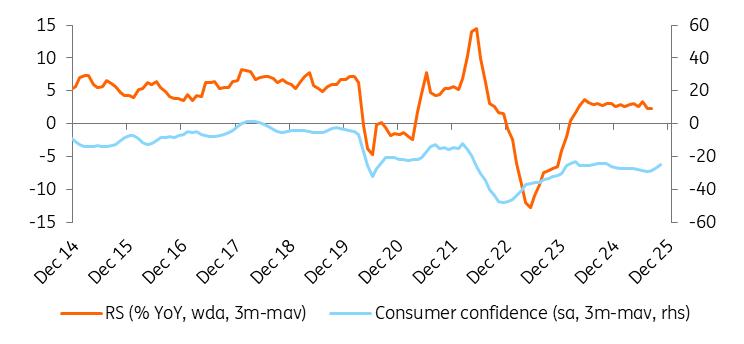

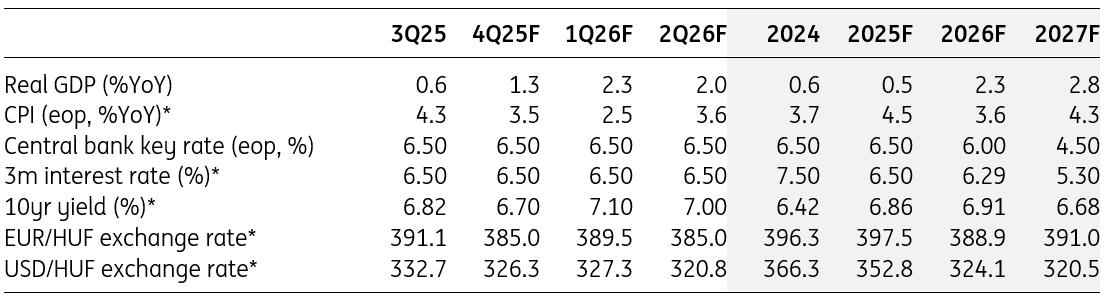

Third-quarter GDP growth came as a negative surprise with a quarter-on-quarter stagnation. The weak outing and the lack of green shoots pushed us to downgrade the outlook to 0.5% and 2.3% in 2025–2026, a 0.2–0.2ppt downgrade respectively.

Retail sales are still the bright spot, while all the other sectors, such as agriculture, industry and construction, are suffering for various reasons.

The labour market is still tight as demand and supply shrink in parallel. Corporates are facing tough decisions next year with looming double-digit minimum wage increases in 2026 and 2027.

External balances are still looking good, but it is rather because of the lack of domestic demand limiting import growth, while export lacks external demand.

We overhauled our inflation forecast as mandatory margin freezes on food and household goods were extended and expanded to more food items. After a 3.6% average inflation next year, we see an acceleration to 4.3% in 2027.

The central bank will look through the inflation dip in early 2026, with inflation likely to heat up at the end of the monetary policy horizon. We now forecast a 6.00% base rate by the end of 2026, 50bp higher than our previous call.

We continue to see a fiscal slippage of around 0.5% of GDP in 2025 and only a minor improvement in the budget balance next year, which is an election year. We forecast a 4.6 and 4.5% deficit-to-GDP ratio in 2026-2027 with no financing issues.

The forint remains supported by favourable positioning and carry appeal going into the year-end, and we predict range trading of EUR/HUF in the 385-395 range in 2026.

The IRS curve will price in more NBH rate cuts amid expectations of lower inflation in Q1 2026 and a weak economy, resulting in a steepening. Bonds look cheap vs. CEE peers, but the term premium is unwinding only slowly.

Source: National sources, ING estimates Hungary's economy can't find its way out

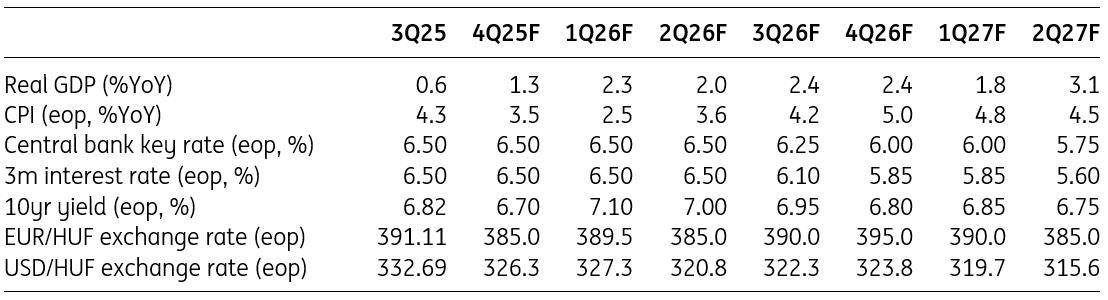

In the third quarter of 2025, the Hungarian economy failed to gro on a quarterly basis. While it is worth noting that the year-on-year index improved from the second quarter, this is only due to the base effect. This 0.6% growth in 3Q is hardly impressive, and the overall picture remains disappointing.

The economy's performance was held back most by agriculture and industry, while services contributed positively. Based on third-quarter data, we have revised our 2025 growth forecast downwards once again. The Hungarian economy is expected to grow by around 0.5% this year. This is calculated based on a strong fourth-quarter showing in government measures to boost consumption. Due to the weaker carry-over effect and lack of green shoots in sectors, we now expect a growth rate of 2.3% in 2026, an 0.2ppt downward revision.

Real GDP (% YoY) and contributions (ppt)

Source: HCSO, ING Industry once again on downward trajectory

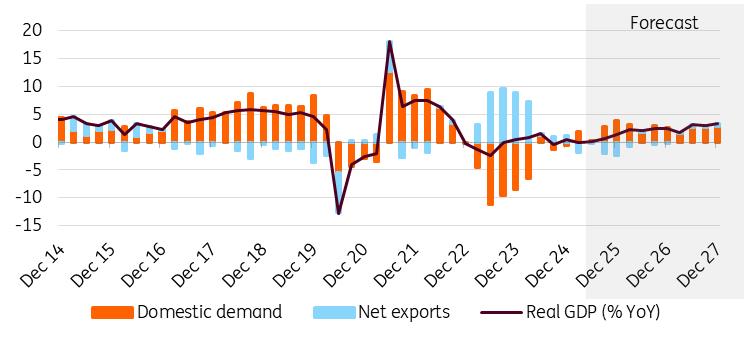

After the positive surprise in July, August brought a negative correction in Hungarian industry. However, the weak performance is hardly surprising, given that this is the typical period for summer shutdowns. Production is currently 4.6% lower than last year and 8.2% lower than the monthly average for 2021. Production declined in all sub-sectors except electronics. Output in vehicle manufacturing fell significantly.

Furthermore, German industrial order data suggests that order books are empty, which does not bode well for the short-term future of the export sector. The industry is expected to negatively impact Hungary's economy in 2025, though 2026 could see a slight improvement. However, we only see a modestly positive impact on GDP growth.

Industrial production (IP) and Purchasing Manager Index (PMI)

Source: HALPIM, HCSO, ING Retail data may indicate the start of a positive trend

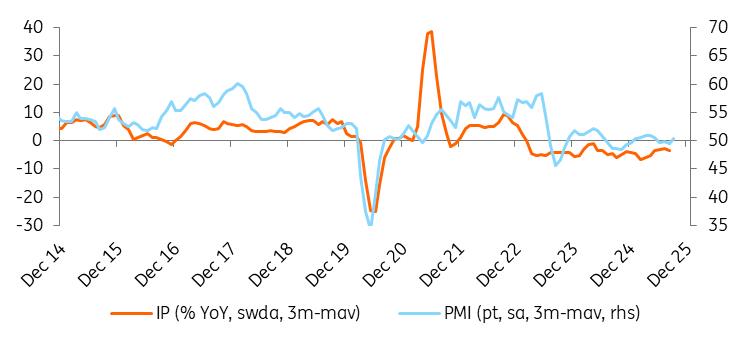

Following a weak performance in July, Hungarian retail sales recovered in August. Sales volume increased by 0.8% month-on-month, surpassing market expectations. Although there have been some fluctuations, retail sales volume has been growing steadily since the end of 2023. However, the fixed-base index remains below this year's April peak and has fluctuated within a range since then, raising concerns. Nevertheless, we can conclude that retail sales remain a positive factor for the economy.

Some government measures have already affected households' finances, and more impactful measures will boost the sector's performance in the coming months. It is worth noting that consumer confidence remains relatively low, though it has shown some improvement, which supports the positive outlook here.

Retail sales (RS) and consumer confidence

Source: Eurostat, HCSO, ING The labour market situation is heating up

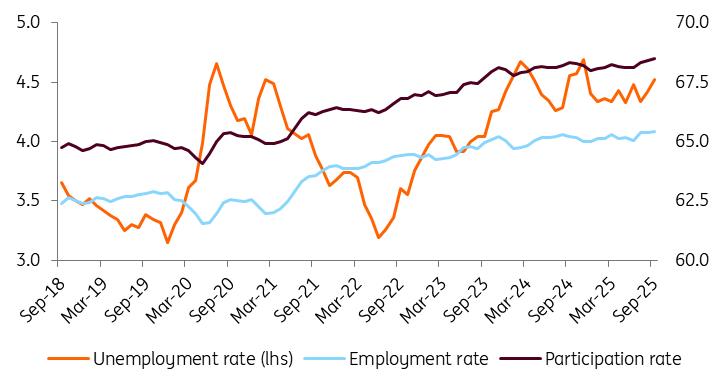

The unemployment rate rose to 4.5% between July and September, with the number of people in employment continuing to decrease to its lowest level since the beginning of 2022. This is due to demographic trends and a slowdown in labour market activity. There is no evidence of a drastic change in the employment rate itself. The stagnation of the employment rate indicates that supply constraints are becoming increasingly prevalent in the Hungarian labour market.

Demand is also weakening alongside supply due to economic stagnation since mid-2022. With expected minimal wage increases of over 10% in 2026 and 2027, companies are facing a significant challenge, which could result in layoffs and/or price increases. We predict that the unemployment rate will remain at around 4.5% for the rest of the year, before slipping to 4.3% by the end of 2026.

Historical trends in the Hungarian labour market (%)

Source: HCSO, ING Current account balance remains in surplus

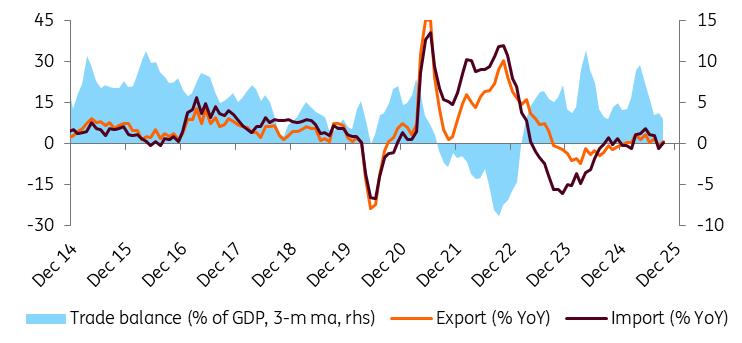

During the first nine months of 2025, export volumes stagnated while imports increased by 2.1% year-on-year. The external goods balance is now only €0.7 billion higher than a year ago, standing at €7.8 billion. Looking ahead, it is increasingly unlikely that new export-oriented manufacturing production capacities will emerge in the economy this year. However, despite some issues with order books, next year will see some improvement in the form of factory openings, albeit less than we had expected earlier.

Taking this into account alongside the expected increase in domestic demand (mostly consumption), net exports will remain a minor drag on growth in 2026. Consequently, both the trade and current account balances will remain comfortably in surplus, providing a welcome offset to the overall negative picture of economic performance.

Trade balance (3-month moving average)

Source: HCSO, ING Inflation picture gets more complicated

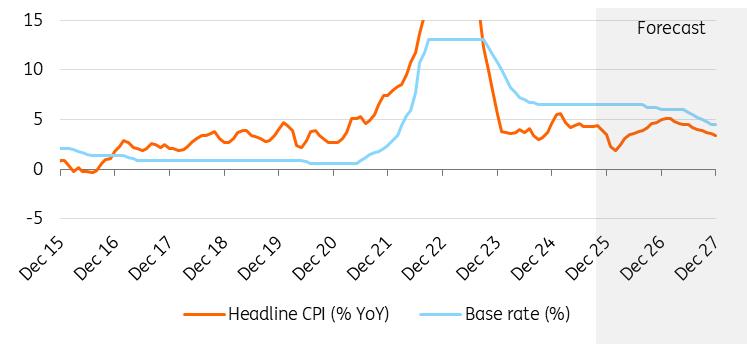

The latest headline inflation was in line with expectations at 4.3% in September, showing stability for three months. Despite the government's price shield measures, inflation remains above the central bank's tolerance band, and Hungary continues to have high structural inflation. In more detail, we saw an upside surprise in consumer durables, while the fuel group pulled inflation back the most in September. Despite four months of low repricing, households' inflation expectations have not improved.

The announcement of the extension of margin freezes (until the end of February) and the addition of 14 new items to the list (more food products) made us change our forecast. We now expect inflation to fall to 2.2% on average in 1Q26 followed by a significant acceleration, hitting 5% YoY in the year-end. After an average of 3.6% in 2026, we see an uptick to 4.3% in 2027 as companies adjust prices after the end of price shield measures.

Inflation and policy rate

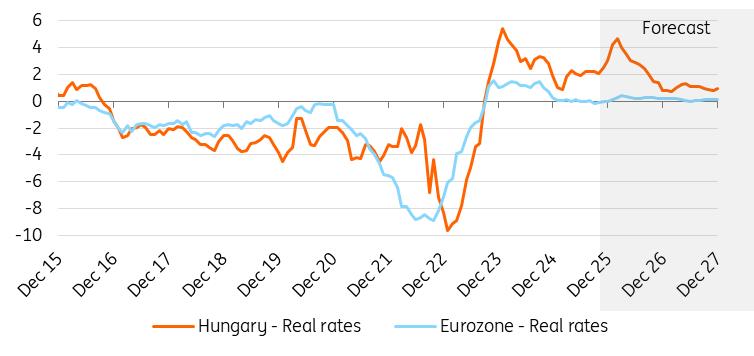

Source: NBH, ING We shift to a more hawkish monetary policy outlook

In October, the National Bank of Hungary kept its base rate at 6.50% for the thirteenth consecutive month. The general tone remained hawkish. According to the Monetary Council, underlying repricing remains too strong, and household inflation expectations are still too high. As a result of our updated inflation profile, we have revised our base rate forecast. Although inflation is expected to dip below the central bank's target in the first quarter of 2026, this is not a sustainable move. Without government intervention, inflation would be much higher, and it is only a matter of time before a new wave of pressures emerges.

For this reason, we are forecasting a more hawkish monetary policy in 2026, with the base rate reaching 6.00% by the end of the year - 50 basis points higher than previously predicted. This could provide the positive real interest rate needed further down the line to avoid market stability issues, which are a key factor in monetary policy.

Real rates (%)

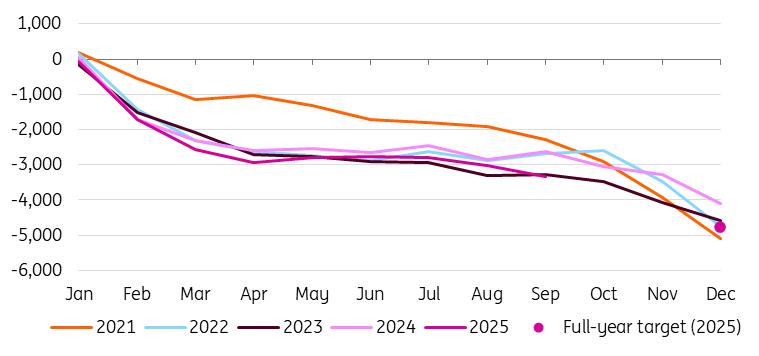

Source: ECB, NBH, ING Hungarian budget under pressure

The monthly budget deficit was HUF 303.2 billion in September, bringing the general government's cash-flow deficit to date to HUF 3.33 trillion. This equates to 70% of the full-year target for 2025. Recent data indicates that September saw the second-worst monthly balance of the 21st century. We still consider the government's deficit target of 4.1% to be achievable, albeit with considerable effort. Instead of rebalancing measures, we expect this year's budget deficit to be around 4.6% of GDP.

From an economic perspective, there are more risks ahead, and the upcoming election could affect fiscal decisions. However, it is highly likely that the government will ensure a deficit below last year's level of 5.0% of GDP. Moreover, the recent strength of the forint and technical adjustments still make it plausible that the debt-to-GDP ratio won't increase.

Budget performance in cash-flow perspective (year-to-date, HUFbn)

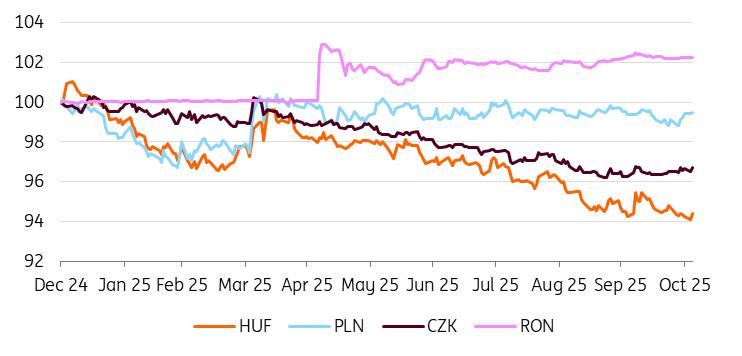

Source: Ministry for National Economy, ING The forint continues to outperform its CEE peers

The forint remains a popular currency in the region, consistently outperforming its CEE peers. Despite some weaker economic data and political noise, the HUF retains market favour and is testing new highs. This confirms the new market narrative, which does not seem likely to change anytime soon. Even the global turnaround in the US dollar has not shaken the EUR/HUF too much, while other currencies in CEE are stagnating or losing ground.

The main differences are clearly the hawkish NBH and the high carry. At the same time, positioning may not have been so heavy, and more activity can rather be seen in the options market as pre-election views or hedges. Still, positioning is clearly heaviest in the CEE region, but it does not seem likely to change much in the near future unless the global story surprises big time.

CEE FX performance vs EUR (31 Dec 2024 = 100%)

Source: NBH, ING

For now, a strong currency helps to tame underlying inflation and can slowly but surely reduce both perceived inflation and inflation expectations. This would support more market bets on rate cuts. However, it seems that the correlation between rates and FX has weakened and may not necessarily mean a weaker HUF later on. We predict a EUR/HUF range of 385–395 in 2026, with peaks around the spring general election and in autumn, when the possibility of an easing cycle emerges.

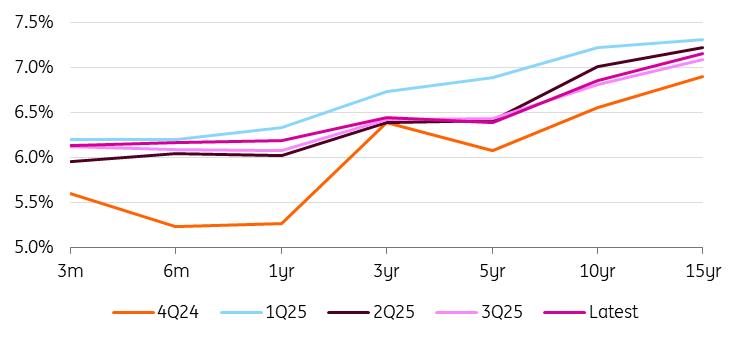

Curve will steep at the prospect of NBH rate cutsGiven the persistent hawkish tone of the NBH, the market has repriced the IRS curve upwards, especially at the front end. The market is currently pricing in only 70bp of rate cuts over the next two years and a terminal rate of 5.80%, which we believe creates downside risk given the weakness of the economy and low inflation in 1Q26. Although we think the central bank will look through this, the probability of rate cuts is increasing from the market's perspective.

On the other hand, at the long end of the curve, the market is maintaining some term premium due to the upcoming elections and political headlines. Therefore, we expect the IRS curve to steepen from current levels by the end of the year, with 2s10s moving closer to CEE peers.

Hungarian sovereign yield curve (end of period)

Source: GDMA, ING

In the bond space, the debt agency is on the safe side with funding despite some fiscal risk, and HGBs are meeting strong demand supported by local technicals. Given the rally in POLGBs and the significant narrowing of the HGBs vs. ROMGBs spread, we see bonds as cheap at current levels, but we can assume that the aforementioned term premium will unwind only slowly.

Forecast summary

*Quarterly data is eop, annual is avg. Source: National sources, ING estimates

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment