Defillama Removes Aster Perpetual Futures Volume Data: What You Need To Know

- DeFiLlama has delisted Aster's perpetual futures volume data due to concerns over data transparency and potential wash trading. Aster's trading volume recently hit a record $60 billion in a single day, reflecting growing interest and demand for crypto derivatives. Despite the volume surge, questions remain about the platform's actual trading activity and the correlation with Binance 's volumes. Aster's native token remains volatile, with analysts forecasting significant growth potential in the coming months. The platform's rise highlights intense competition and innovation within the DeFi derivatives sector on the blockchain.

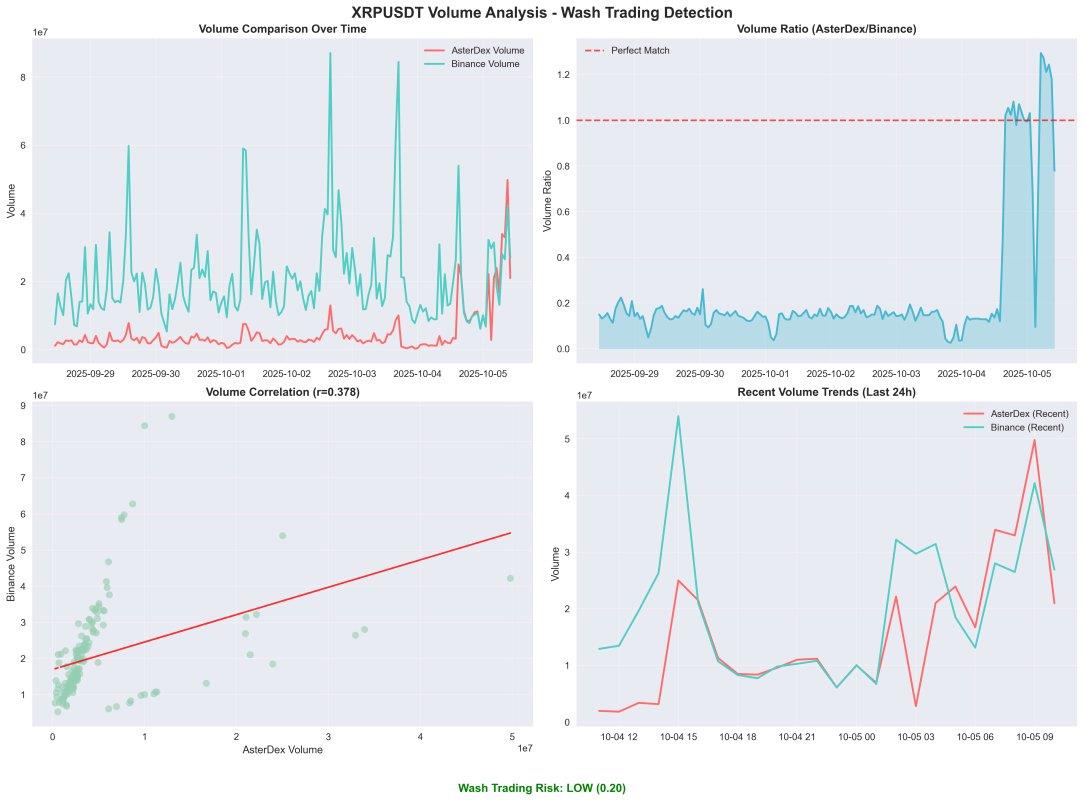

Decentralized finance analytics firm DeFiLlama has decided to remove the perpetual futures trading volume data for Aster, citing ongoing concerns over data integrity. This decision follows observations that Aster's reported trading volumes are mirroring those of Binance's derivatives trading, raising suspicions about the authenticity of the activity.

0xngmi, a pseudonymous co-founder of DeFiLlama, explained that Aster's trading volume appears to be“mirroring Binance Perp volumes almost exactly.” The correlation ratio between the two exchanges is approximately one, which is unusual in a genuine trading environment. He stated:

Source: 0xngmi

While Aster has attracted attention as a competitor to Hyperliquid -a well-established decentralized perpetual crypto futures platform-details about its trading activity remain opaque. The company did not respond to requests for comment at the time of publication. Nonetheless, Aster's rise has sparked debate within the crypto community, especially given its connections to Binance founder CZ and the platform's sudden trading volume surge.

Aster DEX and Binance volume analysis. Source: 0xngmi

Despite the controversy, Aster has experienced a meteoric rise in trading interest. Its open interest jumped more than 33,500% in less than a week during late September, signaling explosive demand for crypto derivatives on its platform. Daily trading volumes on Aster hitting $60 billion marked an all-time peak, showcasing its rapid growth and popularity in the DeFi space.

Market analysts believe that Aster's native token could see remarkable appreciation, potentially increasing by up to 480%, supported by recent price movements. Currently trading at about $1.83, it remains below its all-time high of over $2.30. Experts predict the token may rally further, possibly hitting new highs in October, traditionally a strong month for crypto assets.

Overall, Aster's rapid ascent underscores the fierce competition in the DeFi derivatives market, pushing the boundaries of innovation in blockchain-based crypto trading platforms. As the sector matures, maintaining transparency remains critical to ensure sustained growth and investor confidence in the crypto markets.

Crypto Investing Risk Warning

Crypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment