Reserve Bank Of New Zealand Preview: Cutting In The Dark

The Reserve Bank of New Zealand (RBNZ) meets on 8 October, and we are aligned with consensus in expecting a 25bp cut to 2.75%. Market pricing is 32bp, showing some modest speculation on a larger move after two members voted for a 50bp cut at the August meeting.

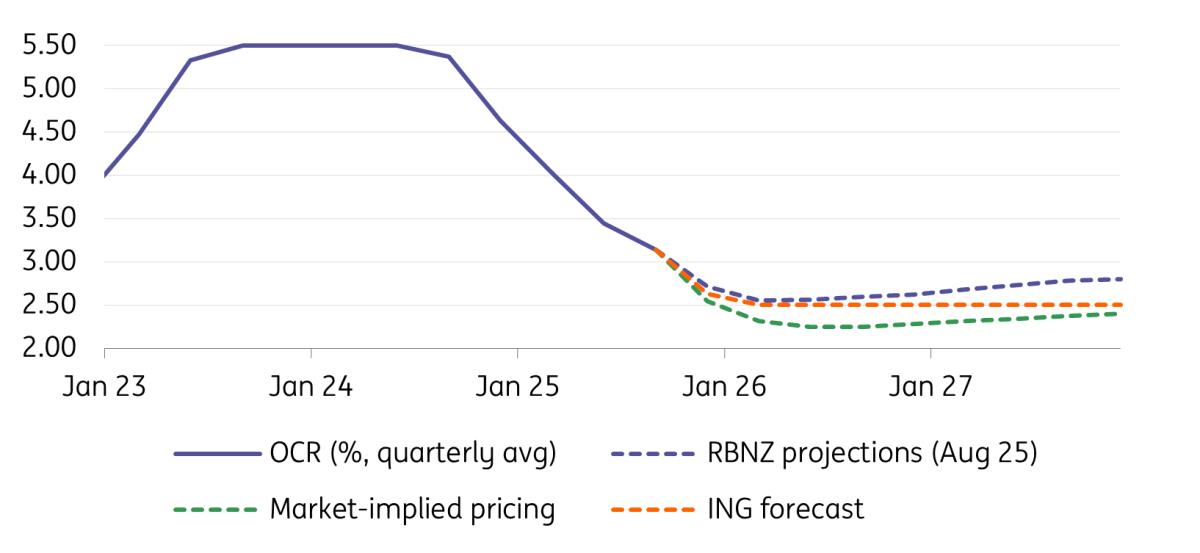

We expect this October move to be followed by a final 25bp cut in November, to a terminal rate of 2.50%. Market pricing is more dovish, expecting an additional cut in February. We admit the risks are finely balanced: the RBNZ has sounded dovish, but data is yet to confirm the urgency for additional easing.

Weak GDP has been the only input since AugustOne of the key challenges with the RBNZ is its reliance on infrequent data releases. Markets need to wait until 19 October for the crucial third-quarter CPI report, which can steer rate expectations more than any forward guidance at next week's meeting. Third quarter employment data won't be available until 4 November.

What currently vindicates the dovish stance taken at the August meeting – and expectations of a cut in October – is the sharp 0.9% contraction in Q2 GDP. That was far deeper than both market expectations (-0.2%) and the RBNZ's own forecast (-0.3%). The downturn was broad-based, led by steep declines in manufacturing (-3.5%), construction (-1.8%), and exports (-1.2%).

Business sentiment and labour market indicators reinforce the weak outlook. The latest PMI readings show manufacturing slipping back into contraction at 49.9, while services fell to 47.5.

Dovish bets look a bit prematureIn August, the RBNZ predictably cut rates to 25bp, but surprised on the dovish side as two out of four members voted for a 50bp cut. The new rate projections point to a good chance of 25bp reductions in October and November, taking rates to 2.50%.

Market expectations for an additional cut are now based mostly on the somewhat outdated Q2 GDP contraction. What might be playing a role on the margin are expectations of a dovish tilt by incoming governor and current Riksbank dovish-leaner Anna Breman, who takes over on 1 December.

All these considerations appear premature without hard third-quarter data, and we don't think it's warranted to revise our terminal call below 2.50% for now. We suspect the RBNZ will also feel somewhat restrained in signalling more than one extra cut at this meeting.

RBNZ rate forecast vs market and ING's expectations

Source: ING, RBNZ, Refinitiv

As mentioned, incoming inflation data can be more important than in-meeting RBNZ guidance. We estimate year-on-year headline CPI at 2.9% in 3Q and 2.8% in 4Q, close to the RBNZ's 3.0% and 2.7% projections. It will be up to services price dynamics in the coming months to determine whether the RBNZ will revise its 2026 inflation forecasts lower, justifying cuts below 2.50%.

Kiwi dollar has some upside potentialWe may not get much more dovish guidance at this October meeting, but if two members dissent again and vote for a 50bp cut, then we can see some short-term pressure on the Kiwi dollar.

However, the NZD curve has shifted materially lower of late, now fully embedding three cuts from the current 3.0% OCR. As discussed in this note, there is a non-negligible risk that the RBNZ will match those market expectations, but data must validate them first.

With easing already well priced into the curve, we think the outlook by year-end for NZD/USD is good, also considering our bearish USD call. We are sticking to our 0.60 target.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Ethereum-Based Defi Crypto Mutuum Finance (MUTM) Reaches 50% Completion In Phase 6

- Casper (CSPR) Is Listed On Gate As Part Of Continued U.S. Market Expansion

- Ethereum-Based Defi Crypto Mutuum Finance (MUTM) Raises Over $16 Million With More Than 720M Tokens Sold

- Tokenfi And New To The Street Announce National Media Partnership To Reach 219M+ Households

- Flexm Recognized As“Highly Commended” In The Regtech Category At The Asia Fintech Awards Singapore 2025

- Forex Expo Dubai 2025 Conference To Feature 150+ Global FX And Fintech Leaders

Comments

No comment