E*Trade To Launch Crypto Trading In 2026 With Zerohash: What You Need To Know

- E*Trade plans to launch cryptocurrency trading in 2026, offering Bitcoin, Ethereum, and Solana through a partnership with Zerohash. The move signifies Morgan Stanley's deeper involvement in digital assets amidst increasing regulatory clarity. Zerohash, backed by a recent $104 million funding round, will provide crypto infrastructure, including wallet solutions for E*Trade clients. Wall Street giants like Morgan Stanley are actively exploring and expanding their presence in blockchain and DeFi markets. The U.S. crypto regulation landscape is evolving, supporting the growth of stablecoins and comprehensive frameworks for digital assets.

After years of cautious observation, Morgan Stanley's E*Trade is gearing up to introduce cryptocurrency trading for retail clients by mid-2026. The brokerage, now part of Morgan Stanley since a $13 billion acquisition in 2020, will leverage Zerohash - a blockchain infrastructure provider that recently raised $104 million at a $1 billion valuation - to build this new service. Clients will be able to trade established digital assets like Bitcoin (BTC ), Ether (ETH ), and Solana (SOL ) in the first half of 2026, according to a Morgan Stanley spokesperson.

Initially reported by Bloomberg on May 1, the plan to incorporate crypto trading was in early development stages, with E*Trade exploring infrastructure partnerships. Zerohash, although less recognized in mainstream crypto circles, specializes in tokenization and stablecoin infrastructure, positioning itself as a key partner for financial institutions seeking to adopt blockchain technology. The platform will also develop a comprehensive wallet solution for E*Trade users, enhancing security and ease of access.

Source: Matthew SigelIn the competitive landscape, Robinhood remains E*Trade's primary rival, having rapidly expanded into crypto trading and recently acquiring Bitstamp for $200 million, signaling strong retail market engagement with digital assets.

While E*Trade's debut marks one of Morgan Stanley's first direct retail ventures into cryptocurrencies, the firm has been actively cultivating its blockchain presence. Since August 2024, Morgan Stanley has permitted wealth advisers to recommend spot Bitcoin ETFs to qualified clients. During the World Economic Forum in Davos earlier this year, CEO Ted Pick indicated ongoing exploration into crypto transaction services.

Interestingly, Morgan Stanley has not joined the list of banks exploring stablecoin joint initiatives, such as JPMorgan and Bank of America, which are studying ways to integrate digital currencies into traditional finance. Yet, Morgan Stanley's digital asset head, Andrew Peel, recently argued that stablecoins could reinforce the U.S. dollar's dominance globally, aligning with recent regulation efforts like the bipartisan GENIUS Act, which aims to formalize stablecoin legislation in the United States.

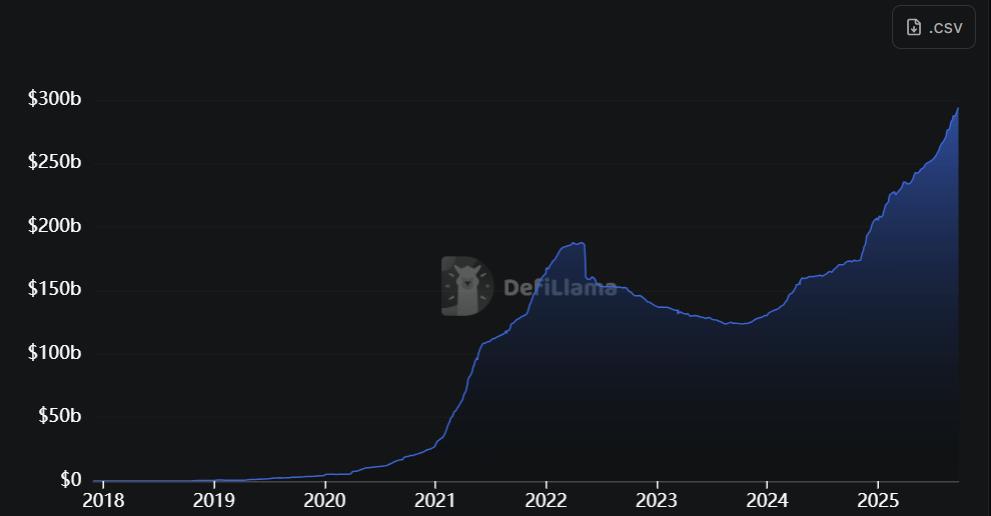

The stablecoin market is valued at approximately $300 billion. Source: DefiLlama

The expanding emphasis on blockchain and crypto markets, including stablecoins and DeFi applications, indicates Wall Street's recognition of digital assets as integral to future financial systems. Morgan Stanley's move exemplifies the increasing mainstream embrace of cryptocurrency trading amid evolving regulation and institutional adoption.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment