Ethzilla Aims To Raise $350M To Grow Ether Holdings And Boost Yield Strategy

According to CEO McAndrew Rudisill, the company's strategy involves deploying Ether (ETH ) into income-generating assets within the Ethereum network, such as layer-2 protocols and tokenized real-world assets. Rudisill emphasized,

This shift reflects a broader trend among digital asset companies seeking to actively participate in the ecosystem, moving beyond mere holding of crypto assets towards yield generation - a dynamic that could fuel a new DeFi summer, as noted by industry executives.

ETHZilla Already Profiting from Ecosystem ParticipationThe company has accrued approximately 1.5 million in unnamed tokens from its strategic investments within the Ethereum ecosystem. ETHZilla's financial disclosures reveal ongoing deployment of capital across various protocols that support innovation, network growth, and diversified yield opportunities.

Previously, the firm raised $156.5 million through convertible bonds. Combining this with the latest capital, ETHZilla now manages over $506 million in assets. If the entire $350 million is used to buy more ETH , the firm could acquire an additional 120,000 tokens, supplementing its existing stash of around 102,000 ETH - valued at over $428 million.

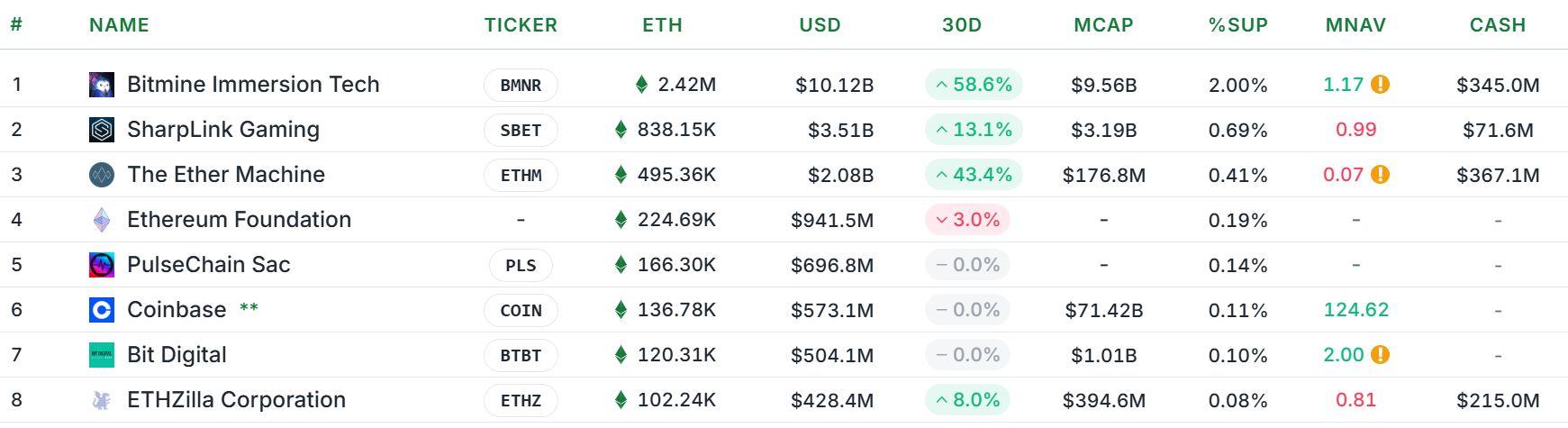

ETHZilla's Growing Role in Ethereum Treasury HoldingsFormerly known as Life Sciences Corp, a Nasdaq -listed biotech firm, the company rebranded as ETHZilla in July to focus on crypto and Ether investments. It ranks as the eighth-largest Ether treasury holder among 69 entities, collectively owning over 5.25 million ETH worth more than $22 billion - approximately 4.25% of the circulating supply.

ETHZilla is the eighth-largest Ether treasury company with over 102,000 tokens. Source: StrategicETHReserve

Leading Ether holders include Tom Lee's BitMine Immersion Technologies with 2.4 million ETH and Sharplink Gaming with 838,000 tokens.

From Biotech to Blockchain: Stock PerformanceOriginally launching as a biotech company in 2016, Life Sciences went public in 2020 but experienced a steep decline, with its stock collapsing over 99% across five years due to limited revenue, ongoing losses, and dilution. However, recent performance shows a modest recovery, with a 31% increase for the year and a peak in August at $10.70.

ETHZilla stock is up 31% year to date. Source: Google Finance

This latest session saw ETHZilla's stock dip 5% during trading but rebound with a 2% increase after hours, closing at $2.45. The firm's transformation illustrates how legacy biotech companies are pivoting into the crypto sector, leveraging digital assets as a strategic asset class.

Crypto Investing Risk Warning

Crypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment