Outsourced Accounts Payable Services By IBN Technologies Transform Business Financial Operations

"AP/AR [USA]"Companies are increasingly implementing outsourced accounts payable services to optimize invoice processing, reduce errors, and improve vendor coordination. The approach provides access to specialized expertise, standardized procedures, and real-time visibility into financial obligations, allowing organizations to strengthen operational efficiency and reliability in finance and procurement functions.

More businesses are looking for options to improve accuracy, improve workflows and relationships with suppliers, and internal finance teams are getting overwhelmed with the volume of invoices to process across multi-location companies with complicated supplier networks. Outsourced accounts payable services deliver expertise, standardized Accounts Payable processes, and tracking tools to organizations. Faster processing time, decreased errors, and the ability to have clear visibility of commitments are a few of the benefits outsourcing provides organizations. When companies use an outsourced service, organizations see they can improve measurable workflow efficiency and reliability in payment. Moving accounts payable to the expedition of workflow, customer relationships, or smaller supplier networks, is how organizations can change internal units from the back-office to strategic value.

Enhance accuracy and streamline financial workflows Get a Free Consultation:

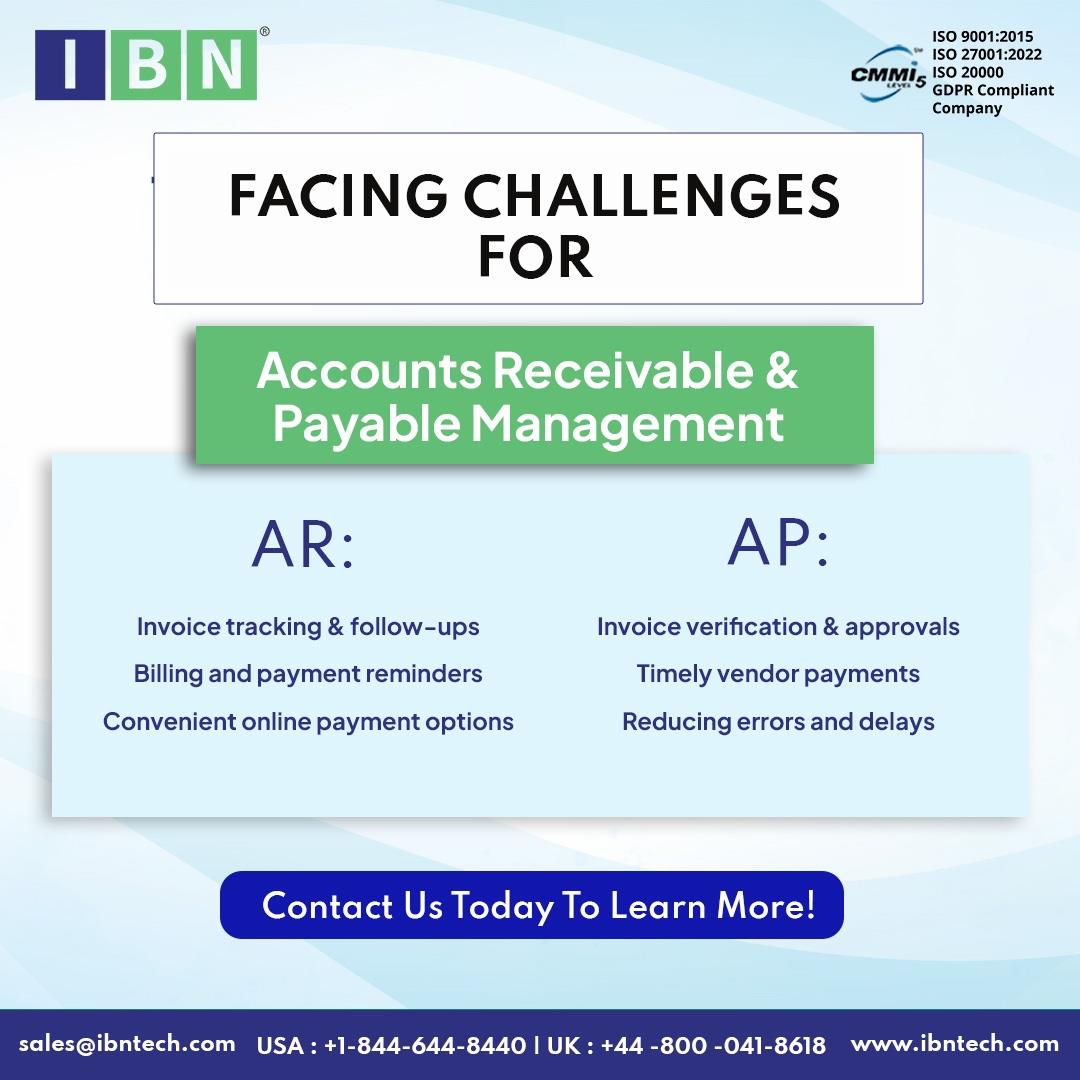

Industry Challenges in Accounts Payable Management

Despite its importance, many organizations face persistent challenges in managing accounts payable:

Manual invoice entry leading to errors and delays

Lack of real-time visibility into outstanding liabilities and vendor balances

Difficulty maintaining compliance with tax and regulatory documentation

Inconsistent accounts payable management practices across locations

Increased exposure to accounts payable risks and audit discrepancies

These challenges create inefficiencies, delay payments, and strain supplier relationships, emphasizing the need for structured, reliable solutions.

IBN Technologies' Outsourced Accounts Payable Solutions

IBN Technologies has positioned itself as a leading provider of outsourced accounts payable services, delivering a structured and comprehensive approach to modern finance operations. By leveraging their expertise, companies can streamline invoice processing, automate validation and approval workflows, and maintain precise accounts payable audit records. Key elements of IBN Technologies' solution include:

✅ Complete invoice management tailored to vendor payment schedules

✅ Multi-site accounts payable monitoring for unified retail finance teams

✅ Accurate invoice verification with three-way matching across departments

✅ Instant insights into pending liabilities and vendor account balances

✅ Assistance in capturing early payment discounts through scheduled payments

✅ Centralized access for reconciliations, audits, and internal reviews

✅ Handling of peak seasonal payment loads and brief procurement cycles

✅ Adherence to all tax, vendor, and payment documentation requirements

✅ Ongoing reporting for management to enhance expenditure visibility

✅ Direct support from experienced accounts payable process professionals

By integrating these capabilities, IBN Technologies enables finance teams to reduce manual effort, mitigate risks, and gain actionable insights. Businesses experience greater operational efficiency, predictable payment cycles, and improved supplier satisfaction.

Retail Payables Advancements in Florida, USA

Retail companies in Florida are experiencing notable gains in financial accuracy and vendor management. Several organizations are enhancing their AP workflows through outsourced accounts payable services, supported by structured solutions provided by firms like IBN Technologies.

● Invoice processing times reduced by 40%

● Manual entry tasks replaced with verified multi-stage approval workflows

● Vendor response efficiency improved through predictable payment notifications

Partnering with IBN Technologies has allowed retail teams to handle disbursements more reliably. Transitioning to outsourced accounts payable services ensures streamlined operations, consistent record-keeping, and improved results across procurement and finance functions.

Benefits of Outsourcing Accounts Payable Services

Outsourcing accounts payable delivers tangible advantages:

Streamlined workflows reduce errors and administrative burdens

Enhanced compliance and adherence to accounts payable procedures

Improved cash flow visibility and stronger vendor relationships

Minimization of accounts payable risks and audit challenges

Access to specialized expertise without increasing headcount

This strategic approach allows organizations to redirect resources toward core business priorities while maintaining financial control and accuracy.

Strategic Financial Operations with IBN Technologies

As the financial landscape becomes increasingly complex, companies require solutions that go beyond traditional bookkeeping. Outsourced accounts payable services from IBN Technologies equip businesses with a scalable, efficient, and compliant framework for managing invoices and payments. By adopting these services, organizations achieve faster processing, fewer errors, and a centralized view of obligations across multiple locations.

IBN Technologies' approach combines automation with hands-on expertise, offering tailored solutions for industries ranging from retail and logistics to professional services. Through consistent application of accounts payable management standards and real-time reporting, finance teams can identify process gaps, capture early payment discounts, and maintain accurate accounts payable audit trails. Businesses also benefit from reduced exposure to accounts payable risks, ensuring smoother operations during audits and regulatory reviews.

With growing demand for precise and compliant financial management, outsourcing accounts payable is no longer just a cost-saving measure-it is a strategic choice that drives performance, reliability, and competitive advantage. By leveraging IBN Technologies' expertise, businesses gain the confidence and tools needed to optimize their finance workflows while focusing on long-term growth.

Related Service:

Outsourced Bookkeeping Services:

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 26 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Salvium Solves The Privacy Paradox: Salvium One Delivers Mica-Compliant Privacy That Exchanges Can List

- Cregis At TOKEN2049 Singapore 2025: Unlocking The Next Frontier Of Adoption

- Moonbirds And Azuki IP Coming To Verse8 As AI-Native Game Platform Integrates With Story

- CEA Industries ($BNC) Announces BNB Holdings Of 480,000 Tokens, And Total Crypto And Cash Holdings Of $663 Million

- SPAYZ.Io White Paper Explores Opportunities, Challenges And Ambitions In Payments Industry

- Solstice Announces Strategic Collaboration With Chainlink And Leading Custody And Venture Firms To Enhance Ecosystem Ahead Of USX Stablecoin Launch

Comments

No comment