Data Centre Incentive Boost? Anant Raj Surges On Tax Exemption Reports

Shares of Anant Raj surged 13% on Monday after reports emerged that the Indian government is considering incentives for data centre developers. It posted its biggest intra-day gain in nearly three years.

Government Incentive

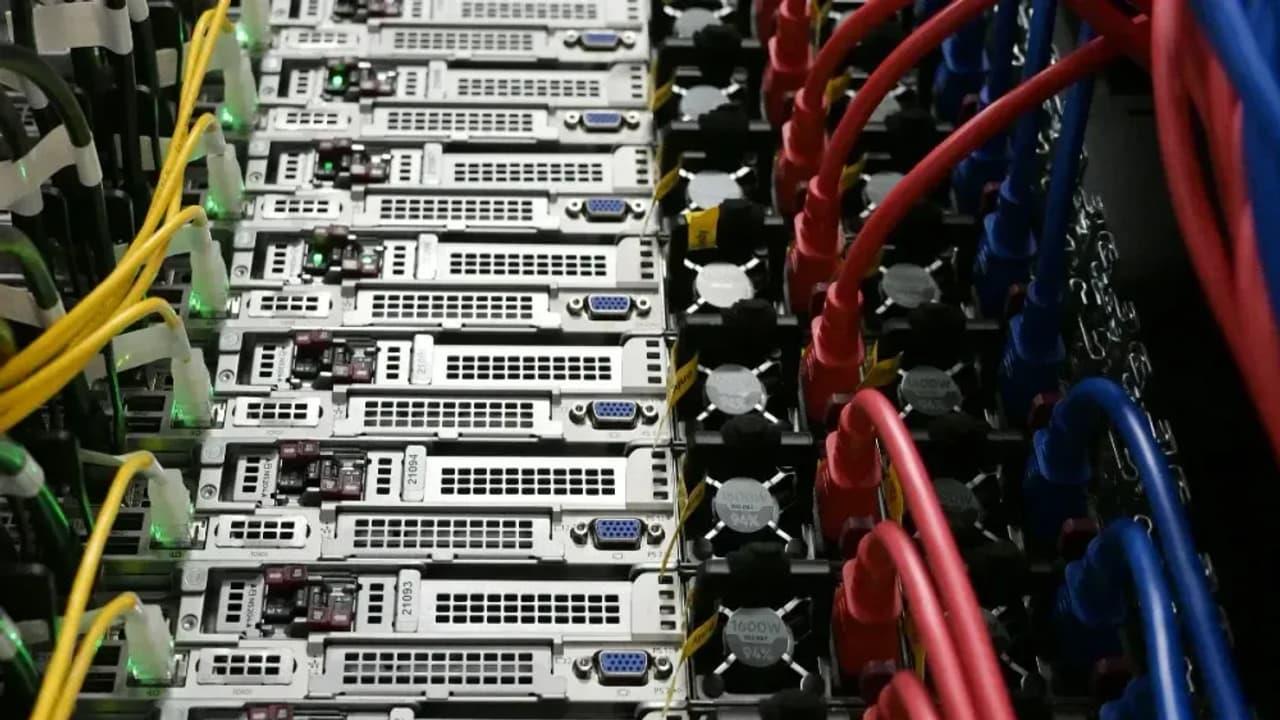

The Indian government has proposed up to 20 years of tax exemption for data centre developers under the draft National Data Centre Policy, provided they achieve targets in capacity build-out, power-use effectiveness, and employment generation, a report by Business Standard read.

The draft also includes a proposal to allow input tax credit (ITC) on GST paid for capital assets such as construction, HVAC systems, and related infrastructure. These incentives aim to attract investment and boost the growth of India's data centre ecosystem.

Analyst View

Anant Raj has been in a strong uptrend since 2020, and after a brief pullback, the stock is showing renewed momentum. In just four sessions, it surged from ₹536 to ₹596, reflecting robust buying interest, noted SEBI-registered analyst Mayank Singh Chandel.

On the technical side, ₹657 is the key breakout level for short-term traders, with potential upside targets of ₹900, while long-term investors can consider entering at current levels with a stop-loss below ₹376, he added.

Beyond real estate, Anant Raj is diversifying into digital infrastructure, including data centres and cloud services, opening new growth avenues. With Q2 FY25 revenue up 54%, profit up 75%, and net debt reduced to ₹95 crore, the company's improving financials and expansion plans strengthen its outlook, the analyst said.

Long-term Risk

Renowned Indian investor Shankar Sharma stated that the excitement surrounding data centres is largely speculative, similar to the telecom tower model, where heavy capital expenditure is followed by leasing capacity to clients.

In a post on X, Sharma said that despite a broader customer base, the bargaining power usually lies with clients, pressuring data centre operators to accept lower rates. Ultimately, this is a leasing business with risks such as high leverage, falling returns, and often negative cash flows. Investors may choose to ride the trend, but the underlying economics remain unattractive, he added.

What Is The Retail Mood?

Retail sentiment on Stocktwits turned 'bullish' from 'neutral' a day earlier, amid 'high' message volumes. It is a top-three trending stock on the platform.

Year-to-date, Anant Raj shares have tanked nearly 30%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- What Does The Europe Cryptocurrency Market Report Reveal For 2025?

- United States Kosher Food Market Long-Term Growth & Forecast Outlook 20252033

- Utila Triples Valuation In Six Months As Stablecoin Infrastructure Demand Triggers $22M Extension Round

- Meme Coin Little Pepe Raises Above $24M In Presale With Over 39,000 Holders

- FBS Analysis Highlights How Political Shifts Are Redefining The Next Altcoin Rally

- 1Inch Becomes First Swap Provider Relaunched On OKX Wallet

Comments

No comment