AUD/USD Forex Signal 04/09: Bearish Price Channel (Chart)

(MENAFN- Daily Forex) Today's AUD/USD SignalsShort Trade Idea

- Short entry between $0.65207 and $0.65351, the latest intra-day low that confirmed the bearish price channel, and an intra-day high touching the mid-level. Place your stop loss level 10 pips above your entry level. Adjust the stop loss to break even once the trade is 25 pips in profit. Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

- Long entry if price action breaks out above $0.65588, ten pips above the intra-day high of the last confirmation of the upper band of the bearish price channel. Place your stop loss level 10 pips below your entry level. Adjust the stop loss to break even once the trade is 25 pips in profit. Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

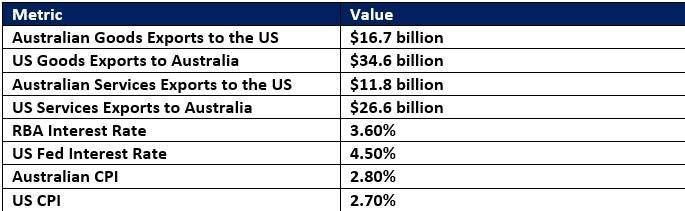

- The Australian trade surplus surprised to the upside, as exports rose 3.3% and imports decreased by 1.3%, resulting in a surplus of A$7.310 billion. Economists expected a trade surplus of A$4.880 billion. Today's US ADP report will capture the focus of traders, expected to show only 73K job creations in the private sector for August, down from July's low reading of 104K. Additional labor data includes initial jobless claims, the Challenger Job Cuts report, and second-quarter unit labor costs and non-farm productivity. The ISM Non-Manufacturing PMI for August could also move the US Dollar. Economists expect an increase from July's 50.1 to 50.9. Traders should also monitor the Prices Paid component. The S&P Global Services PMI and the S&P Global Composite PMI will also be released. July's US trade deficit is expected to widen to $77.7 billion from June's deficit of $60.2 billion.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Daytrading Publishes New Study On The Dangers Of AI Tools Used By Traders

- Primexbt Launches Empowering Traders To Succeed Campaign, Leading A New Era Of Trading

- Wallpaper Market Size, Industry Overview, Latest Insights And Forecast 2025-2033

- Excellion Finance Scales Market-Neutral Defi Strategies With Fordefi's MPC Wallet

- ROVR Releases Open Dataset To Power The Future Of Spatial AI, Robotics, And Autonomous Systems

- Ethereum-Based Meme Project Pepeto ($PEPETO) Surges Past $6.5M In Presale

Comments

No comment