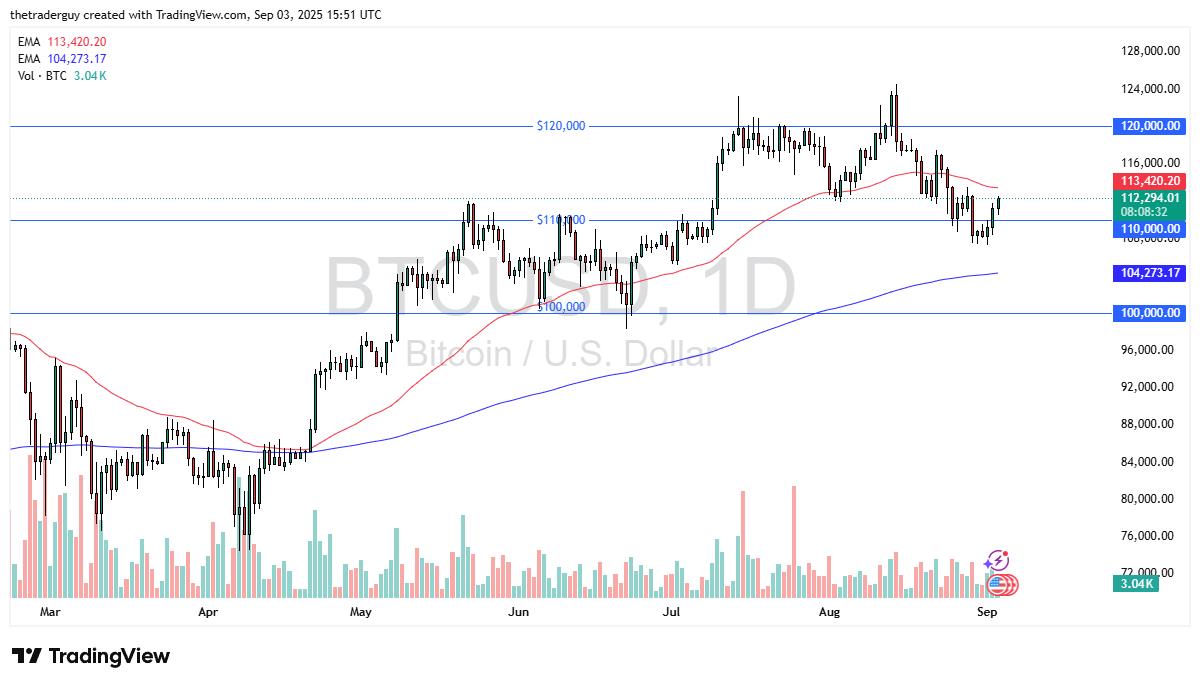

BTC/USD Forecast 04/09: Rallies To Continue Recovery (Chart)

- Bitcoin has had a positive Wednesday to continue the overall recovery that it has been attempting. This is a market that has been very noisy overall, and therefore it's not overly surprising to see that we had a bit of a bounce. After we broke down below the $110,000 level, it probably was a bit of a wake-up call for a lot of traders. However, Wall Street has returned from vacation season, and institutional traders will more likely than not continue to have something to say about the overall direction.

At this point, I think we need to ask the question as to whether or not this is a real recovery, or if it is just simply a bounce after a big selloff. I think at this point in time it looks more like a recovery, but it's also worth noting that the 50 Day EMA sits just above current pricing and could have something to say as to how traders look at this market and perhaps even“feel about it.”

EURUSD Chart by TradingViewIf we can get above that level, then I think it will have a traders feeling a little bit more bullish and confident, which will help Bitcoin rally from here. Keep in mind that we also have the Non-Farm Payroll announcement in the United States on Friday, so that could help fuel the recovery as well, especially if it looks like the Federal Reserve is going to have to be ultra-loose with its monetary policy. There's a lot going on at the same time so it's not a huge surprise to see a little bit of confusion.On the downside, if we were going to continue to fall from here, we would need to break down below the $107,000 level. The next support level would be the $104,270 region, where we have the 200 Day EMA currently residing. Ultimately, breaking down below that changes the entire outlook for this market. I think at this point in time there is still significant demand.Ready to trade daily BTC/USD forecast & predictions ? We've made a list of the best Forex crypto brokers worth trading with.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Daytrading Publishes New Study On The Dangers Of AI Tools Used By Traders

- Primexbt Launches Empowering Traders To Succeed Campaign, Leading A New Era Of Trading

- Wallpaper Market Size, Industry Overview, Latest Insights And Forecast 2025-2033

- Excellion Finance Scales Market-Neutral Defi Strategies With Fordefi's MPC Wallet

- ROVR Releases Open Dataset To Power The Future Of Spatial AI, Robotics, And Autonomous Systems

- Ethereum-Based Meme Project Pepeto ($PEPETO) Surges Past $6.5M In Presale

Comments

No comment