Risks To Czech Inflation From Wages And Emission Allowances

Czech consumer prices rose by 0.1% month-on-month and 2.5% year-on-year in August, according to a preliminary estimate. Annual inflation eased mainly due to softening food prices, driven in part by another monthly decline in unprocessed foodstuffs such as fruit and vegetables. Energy prices also dropped in August compared to the preceding month, affected by lower Brent crude prices and a stronger koruna against the dollar. August's headline inflation is below the Czech National Bank's expectation of 2.7%, with a significant impact from weaker food prices than expected, as well as marginally softer core inflation, as per our estimate. Still, one swallow doesn't make a summer, especially as the volatile part of foodstuffs is to blame.

Meanwhile, service prices experienced another monthly increase in August, marking uninterrupted gains since the beginning of the year and adding 4.7% annually. These are far too punchy dynamics, as a 3.5% YoY growth rate is consistent with long-term price stability for a converging economy. Annual price dynamics of goods eased to 1.1%, aligning well with the inflation target ordinance.

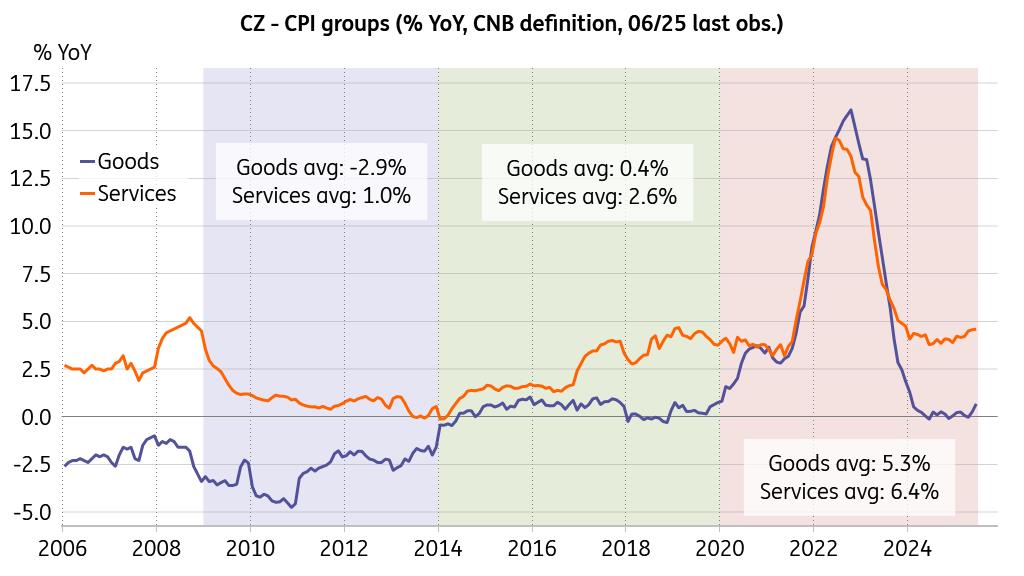

When looking at the CNB definition, we see some structural shifts in the longer time horizon, with goods declining by 2.9% and services growing by 1% on average between 2009-13, and goods increasing by 0.4% and services by 2.6% on average between 2014-19. While the price dynamics of goods returned to calmer annual rates in 2024, price growth in services is not backing off, hovering stubbornly around 5%, driven by robust wage growth and upbeat spending. This results in persistently elevated core inflation, likely at 2.7% in August. The longer consumers observe these upbeat dynamics in service prices, the more likely it becomes embedded in their expectations. And once they stop wondering why their hairdresser's bill is 5% higher than a year ago, things start to get really tough for the guardians of price stability.

Service price dynamics have become structurally elevated

Source: CNB, Macrobond

We believe that the August reading marks the low point for Czech inflation, which is expected to gradually increase towards the end of the year. As the economic rebound gains traction and the labour market starts flipping again into a tightening mode in the coming quarters, the punchy wage growth and resilient core inflation will not allow for any monetary policy easing. On the contrary, the reasons for caution remain in place, as the introduction of emission allowances for households and small firms is coming into sight. The implementation of the second phase of the EU Emissions Trading System (ETS2) poses a significant upward risk for the 2027 CPI, which is well within the CNB's monetary policy horizon.

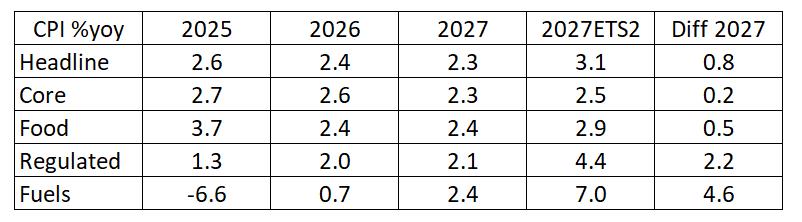

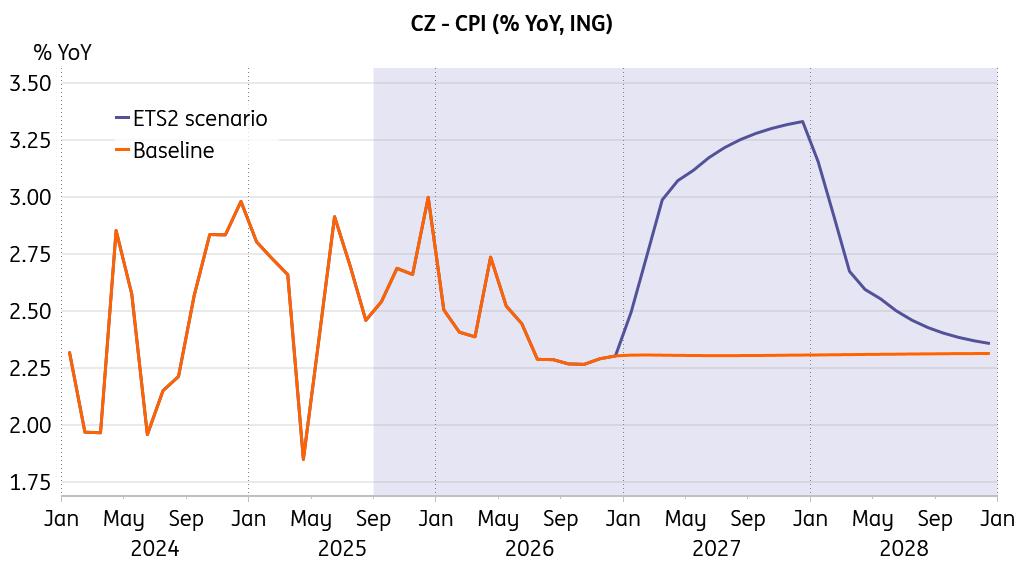

Emission allowances for households will push up pricesIn the longer term, inflation is set to gradually cool to 2.3% in 2027, amid conditions of solid economic expansion and a gradually tightening labour market. However, the introduction of ETS2 is a serious risk to Czech inflation, especially via increased energy prices. Our estimate of the overall full effect on annual inflation is 1.2ppt in 2027, should the price of allowances reach the limit level of EUR 57/t CO2 in the same year. This is somewhat stronger than the CNB's estimate of 0.9ppt full impact.

The maximum price of an allowance in 2020 prices is set to EUR 45. However, this has to be adjusted for EU inflation, which was 22.6% in 2024 compared to 2020. Assuming 2% inflation for the following years, the resulting cap on the allowance price is approximately EUR 57.

Immediate and secondary ETS2 effects will affect CPI

Source: ING, Macrobond

That said, we discount the full effect, as some still unspecified government measures could mitigate the impact on CPI, possibly a reduction of fuel taxes or something in that direction. So, we take on board two-thirds of the full impact, plugging a 0.8ppt effect into headline inflation in 2027, with 0.5pp as a direct effect via fuel and regulated prices and 0.3ppt as an indirect effect via food and core inflation. Given the possibility of front-loading price increases related to ETS2 into 4Q26, the upward risks for CPI are not as distant as they seem, especially for a forward-looking institution such as the central bank, at least per definitionem.

ETS2 poses an upward risk to 2027 inflation outlook

Source: CZSO, ING, Macrobond Wage growth becomes a candidate for surprises

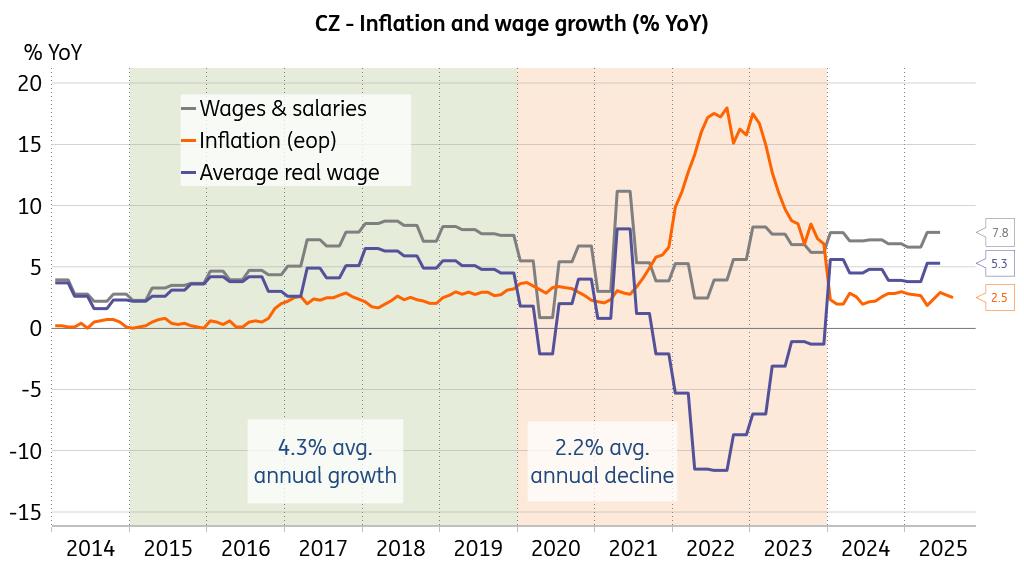

With the Czech economic expansion gradually entering a fully-fledged recovery, with improving sentiment, reviving new orders, and bottoming-out investment expectations in manufacturing, the re-tightening of the labour market could provide solid ground for upbeat wage demands, with wage growth becoming a decent candidate for upward surprises to general expectations over 2026. That said, the government and unions negotiate public wage increases for the next year, with the government proposing a 5% general wage increase and a 7% rise for lower-paid workers. Meanwhile, the unions are demanding 7% and 13%, respectively, which is well above the general outlook for 2026 of around 5.5%, including the CNB view.

Nominal and real wages growth fuel spending

Source: CZSO, Macrobond

The odds are perhaps tilted in favour of the union's side, as the government does not want to risk protests just before the elections. With the outcome setting a precedent for others, continued robust wage increases would drive household budgets, leaving more for discretionary spending. We don't see such a setup as an environment for further disinflationary processes in the services sector and expect core inflation to hover just below the upper bound threshold of the inflation target tolerance band. I mean, with such a setup, the economy humming, and the upward price risks ahead: why would you reduce interest rates and erode your potential to support the economy should things go south? Rate stability is the optimal answer at this point if nothing else goes out of control, such as the overheating housing market.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Daytrading Publishes New Study On The Dangers Of AI Tools Used By Traders

- Primexbt Launches Empowering Traders To Succeed Campaign, Leading A New Era Of Trading

- Wallpaper Market Size, Industry Overview, Latest Insights And Forecast 2025-2033

- Excellion Finance Scales Market-Neutral Defi Strategies With Fordefi's MPC Wallet

- ROVR Releases Open Dataset To Power The Future Of Spatial AI, Robotics, And Autonomous Systems

- Ethereum-Based Meme Project Pepeto ($PEPETO) Surges Past $6.5M In Presale

Comments

No comment