USCM Retains Haynes Cobalt Asset In Idaho Amid US Stockpiling And Lack Of Domestic Production

| Hole ID | Result |

| HS-80-2A | 1.77m of 0.53% cobalt |

| HS-81-3F | 1.52m of 0.35% cobalt |

| HS-81-3G | 1.83m of 0.45% cobalt |

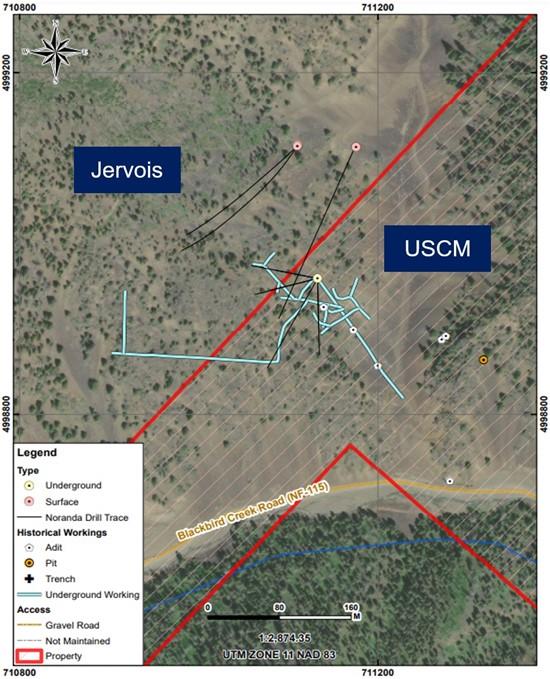

Additional reconnaissance work by Noranda in 1980 defined a two-kilometer trend of tourmaline-bearing breccia rocks on the Property. Tourmaline-bearing breccia is related to cobalt mineralization at the historical workings, and elsewhere in the ICB. Two samples were collected along this trend approximately 1.5 kilometres away from the historical adits and follow-up drilling by Noranda. The two samples are described in Table 4 below6.

Table 4. Historical Noranda Sampling form 1980

| Sample | Cobalt (%) | Description |

| 8583 | 1.0 | 0.61 metre wide tourmalinized breccia, 5% euhedral cobaltite |

| 8592 | 0.1 | Fluidized sediments, adit 12 metres long, abundant erythrite present |

Historical samples from the Property also contain heavy Rare-Earth Element (" REE ") mineralization in the form of xenotime and is associated with cobaltite mineralization. This observation of a correlation between REE and cobaltite mineralization has not yet been investigated as an exploration target and represents an intriguing aspect to the Property. A USCM Qualified Person has not done enough work to verify the results of the historical exploration.

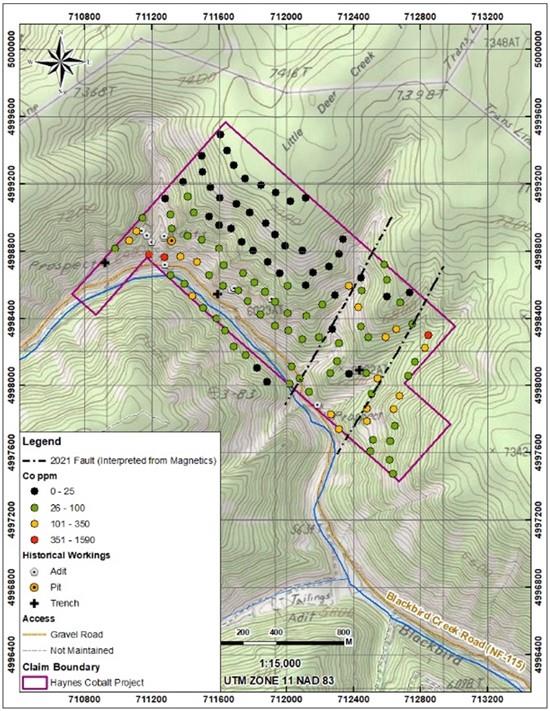

In 2021, USCM collected rock samples from the Property with continued positive results. A total of 76 rock samples were collected from historical workings including pits, trenches and adits, as well as non-mineralized outcrops. Assay results from a select few rock samples collected in 2021 are shown in table and map below. USCM is currently planning its next phase of exploration for the Property7.

Table 5. Summary of 2021 Rock Sample Results with Significant Results

| Sample ID | Rock Type | Co (%) | Au (g/t) | Cu (ppm) | As (ppm) | Y (ppm) |

| HS21SD-006 | Altered Metasediment | 0.219 | 0.276 | 114 | 4230 | 359 |

| HS21SD-007 | Tourmaline Breccia | 0.4 | 0.091 | 605 | 7540 | 69.6 |

| HS21SD-010 | Tourmaline Breccia | >1.0 | 0.908 | 53.8 | > 10000 | > 500 |

| HS21SD-011 | Tourmaline Breccia | 0.502 | 1.28 | 52.8 | > 10000 | > 500 |

| HS21SD-046 | Tourmaline Breccia | 0.238 | 0.44 | 16.4 | 6300 | 90.7 |

| HS21SD-073 | Tourmaline Breccia | 0.415 | 0.017 | 166 | 8740 | 95.7 |

Figure 6. Map Summary of Cobalt Sample Results

To view an enhanced version of this graphic, please visit:

Reference 1: U.S. Geological Survey. (2025). Mineral commodity summaries 2025: Cobalt. U.S. Geological Survey.

Reference 2: Reuters. (2025, August 21). U.S. Defense Department to buy cobalt for up to $500 million. Reuters.

Reference 3: MP Materials - MP Materials Announces Transformational Public-Private Partnership with the Department of Defense to Accelerate U.S. Rare-Earth Magnet Independence. Available at

Reference 4: Jervois Global. (n.d.). Idaho Cobalt Operations. Jervois Global. Retrieved September 3, 2025, from

Reference 5: Gardulski, A.F., (1982), Exploration Evaluation of The Breccia Systems of The Haynes-Stellite Prospect (0479) Blackbird Mining District, Lemhi County, Idaho., Report for Noranda Exploration, Inc., Belt District.

Reference 6: Ater, P., (1981), A Field Investigation of Tourmalinized Breccias within Sections 1, 2, & 3, T20N, R18E and Portions of Sections 35 & 36, T21N, R18E (No. 0477), Blackbird District, Lemhi County, Idaho., Report for Noranda Exploration, Inc., Cobalt, Idaho.

Reference 7: See NI 43-101 Technical Report on the Haynes Cobalt Project dated January 25, 2022, which is available on the Company's profile on Sedarplus .

The comparable information about other issuers in this press release was obtained from public sources and has not been verified by the Company. Comparable means information that compares an issuer to other issuers. The information is a summary of certain relevant operational attributes of certain mining and resource companies and has been included to provide an overview of the performance of what are expected to be comparable issuers. The comparables are considered to be an appropriate basis for comparison with the Company based on their industry, commodity mix, jurisdiction, and additional criteria. The comparable issuers face different risks from those applicable to the Company. Relevant material concerning any adjacent or comparable properties included in this press release is limited to information publicly disclosed by the owner or operator for such adjacent or comparable property. The Company has relied on the Qualified Persons responsible for such information and has not independently verified such information. The Company cautions that past production, mineral reserves, resources, or occurrences on adjacent or comparable properties are not indicative of the mineralization on the Company's properties. Readers are cautioned that the past performance of comparables is not indicative of future performance and that the performance of the Company may be materially different from the comparable issuers. You should not place undue reliance on the comparable information provided in this press release.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Robert J. Johansing, BSC. geology, MSc economic geology, who is a qualified person as defined in NI 43-101. Mr. Johansing is a consultant of the Company.

About US Critical Metals Corp.

USCM is focused on mining projects that will further secure the U.S. supply of critical metals and rare earth elements, which are essential to fueling the new age economy. Pursuant to investments and option agreements with private Canadian and American companies, USCM's projects include the Long Canyon Uranium and Vanadium Property in Idaho, the Sheep Creek located in Montana, the McDermitt Lithium Property in Nevada, the Clayton Ridge Lithium Property located in Nevada, and the Haynes Cobalt Property located in Idaho. A significant percentage of the world's critical metal and rare earth supply comes from nations with interests that are contrary to those of the U.S. USCM intends to explore and develop critical metals and rare earth assets with near- and long-term strategic value to the advancement of U.S. interests.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment