Starbucks Signal 03/09: Bearish Price Channel Valid (Chart)

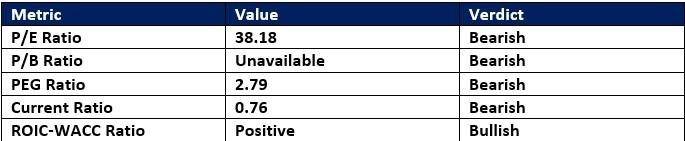

(MENAFN- Daily Forex) Short Trade IdeaEnter your short position between $87.18 (yesterday's intra-day low) and $89.99 (yesterday's intra-day high).Market Index Analysis

- Starbucks (SBUX) is a member of the NASDAQ 100, the S&P 100, and the S&P 500 indices. All three indices move away from all-time highs, as bearish pressures dominate. The Bull Bear Power Indicator of the S&P 500 turned bearish.

- The SBUX D1 chart shows a price action inside a bearish price channel. It also shows price action challenging between its ascending 50.0% and 61.8% Fibonacci Retracement Fan levels. The Bull Bear Power Indicator is bearish with a descending trendline. The average bearish trading volumes are higher than the average bullish trading volumes. SBUX corrected more than the S&P 500, a bearish trading signal.

- SBUX Entry Level: Between $87.18 and $89.99 SBUX Take Profit: Between $71.55 and $75.50 SBUX Stop Loss: Between $94.85 and $98.89 Risk/Reward Ratio: 2.04

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Daytrading Publishes New Study On The Dangers Of AI Tools Used By Traders

- Primexbt Launches Empowering Traders To Succeed Campaign, Leading A New Era Of Trading

- Wallpaper Market Size, Industry Overview, Latest Insights And Forecast 2025-2033

- Excellion Finance Scales Market-Neutral Defi Strategies With Fordefi's MPC Wallet

- ROVR Releases Open Dataset To Power The Future Of Spatial AI, Robotics, And Autonomous Systems

- Ethereum-Based Meme Project Pepeto ($PEPETO) Surges Past $6.5M In Presale

Comments

No comment