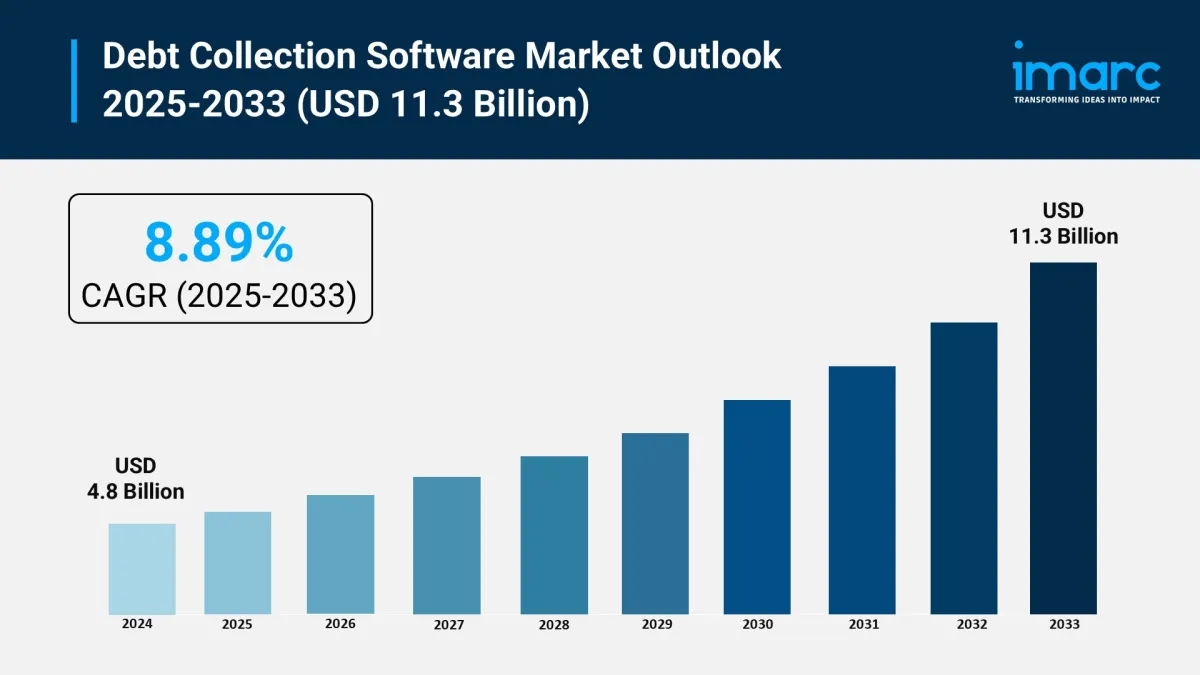

Debt Collection Software Market Size To Surpass USD 11.3 Billion By 2033 With A 8.89% CAGR

The debt collection software market is experiencing rapid growth, driven by increasing debt portfolios and defaults, push for automation and AI-driven solutions, and government support and digital payment ecosystem. According to IMARC Group's latest research publication, “Debt Collection Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2025-2033”, The global debt collection software market size was valued at USD 4.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.3 Billion by 2033, exhibiting a CAGR of 8.89% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Claim Your Free“Debt Collection Software Market” Analysis Sample Report Here

Our report includes:

-

Market Dynamics

Market Trends and Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the Debt Collection Software Market

-

Increasing Debt Portfolios and Defaults

One of the major growth factors for the global debt collection software industry is the surge in bad debts and complex portfolios across both consumer and commercial sectors. Banks, utilities, and lending institutions are all grappling with the growing volume of overdue accounts, leading to a greater need for more effective and automated collection tools. In places like Europe and North America especially, financial pressures and macroeconomic shifts have resulted in more defaults. This creates an urgent demand for software that streamlines recovery and minimizes unpaid balances. According to recent market insights, institutions now handle substantially higher data volumes, and efficient automation has become a primary strategy for improving recovery rates and lowering operational costs. These challenges are driving businesses to quickly adopt digital solutions that can handle large-scale, multi-channel engagement and real-time reporting to manage diverse borrower profiles more proficiently.

-

Push for Automation and AI-Driven Solutions

Embracing advanced automation and artificial intelligence is another key driver behind the industry's momentum. Organizations increasingly expect their software partners to provide machine learning-powered features, including predictive analytics, automated communication, and intelligent prioritization of accounts. Integrating AI means teams can focus less on labor-intensive processes and more on strategic collections, while ML models help to forecast debtor behavior and customize communication for better outcomes. Automation not only increases speed but also ensures compliance and consistency throughout the recovery workflow. Recent launches from companies like FICO, Experian, and Banqsoft highlight how real-time analytics and AI-driven automation are now seen as essential to operational efficiency. These approaches let agencies cut costs while simultaneously improving both recovery rates and customer experience.

-

Government Support and Digital Payment Ecosystem

The rise of digital payment platforms and supportive government schemes is propelling adoption as well. Initiatives such as Pradhan Mantri Jan Dhan Yojana in India, and legislative action authorizing centralized debt collections elsewhere, are modernizing how debts are managed and recovered. Digital payment integration provides debtors with visibility on their balances and enables instant settlement options that streamline the process for both consumers and agencies. Automated reminders, real-time data analytics, and interoperability with payment gateways are now standard, making the entire journey less intrusive and far more efficient, with improved transparency. Governments are also pushing technology adoption for compliance, transparency, and public sector efficiency, turning digitization into a strategic imperative for both private and government debt collectors.

Key Trends in the Debt Collection Software Market

-

Shift Toward Personalized, Empathetic Collections

Debt collection software isn't just about hounding late payments anymore-it's moving toward a much more personalized and human approach. Companies are now using AI-driven sentiment analysis to tailor communications and payment plans to each customer's unique circumstances. For instance, instead of standard scripts, software recommends the best channel, tone, and timing for every interaction. This makes debtors more receptive, driving higher engagement and recovery rates while lowering complaint volumes. According to recent industry insights, roughly 60% of collection companies are adopting or evaluating AI solutions that allow for greater empathy and customer satisfaction, transforming the old adversarial dynamic into more of a partnership.

-

Seamless Integration with Broader Financial Ecosystems

A powerful trend in 2025 is the push for debt collection software that plugs directly into existing accounting systems, CRMs, and digital payment gateways. This level of integration eliminates silos, ensures real-time updates, and gives finance teams a comprehensive view of each debtor's status and payment history. For instance, companies like Emagia and TDX Group now offer platforms that sync with ERP and banking solutions, automatically reconciling payments and enabling proactive outreach the moment an account risks delinquency. These integrations not only cut down on manual errors but also provide organizations with rich analytics, supporting smarter strategic decisions and more agile operations in finance and collections management.

-

Mobile-First and Self-Service Capabilities

The rise of mobile-first design and self-service options is reshaping debtor experiences in real time. Leading platforms now offer debtors portals where they can check balances, set up payment plans, or communicate directly with agents, all from their smartphones. This always-available convenience leads to faster resolutions, more satisfied customers, and, ultimately, a higher percentage of successful recoveries. Companies like Katabat, Tietoevry, and Comtronic Systems have invested in expanding mobile and self-service functionality, often with features like chatbots or automated negotiation tools. User data shows that digital self-service options directly correlate with increased on-time payments and better overall recovery statistics, as debtors are empowered to manage their obligations privately and efficiently.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=4528&flag=E

Leading Companies Operating in the Global Debt Collection Software Industry:

-

AgreeYa.com

Chetu Inc.

Debtrak

EbixCash Financial Technologies

Experian Information Solutions Inc.

Fair Isaac Corporation

Katabat Corporation (Ontario System)

Nucleus Software Exports Ltd.

Pegasystems Inc.

Seikosoft

TietoEVRY

TransUnion LLC

Debt Collection Software Market Report Segmentation:

By Component:

-

Software

Services

Software leads with 65.2% market share in 2024, driven by digital transformation in financial institutions that enhances debt recovery processes through advanced functionalities and integration.

By Deployment Mode:

-

On-premises

Cloud-based

On-premises solutions dominate due to their security and control advantages, allowing organizations to manage sensitive data internally and integrate seamlessly with existing systems.

By Organization Size:

-

Small and Medium Enterprises

Large Enterprises

Large Enterprises hold 55.0% market share in 2024, requiring robust debt collection software to manage extensive financial data, optimize recovery strategies, and accommodate diverse debtor profiles.

By End User:

-

Financial Institutions

Collection Agencies

Healthcare

Government

Telecom and Utilities

Others

Financial Institutions lead the market by utilizing debt collection software to manage customer debts efficiently, improve cash flow, enhance customer relationships, and leverage data-driven insights.

Regional Insights:

-

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America captures over 30.7% market share in 2024, fueled by the adoption of advanced technologies, a robust ecosystem of key players, and the integration of cloud-based solutions for efficient debt recovery.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment