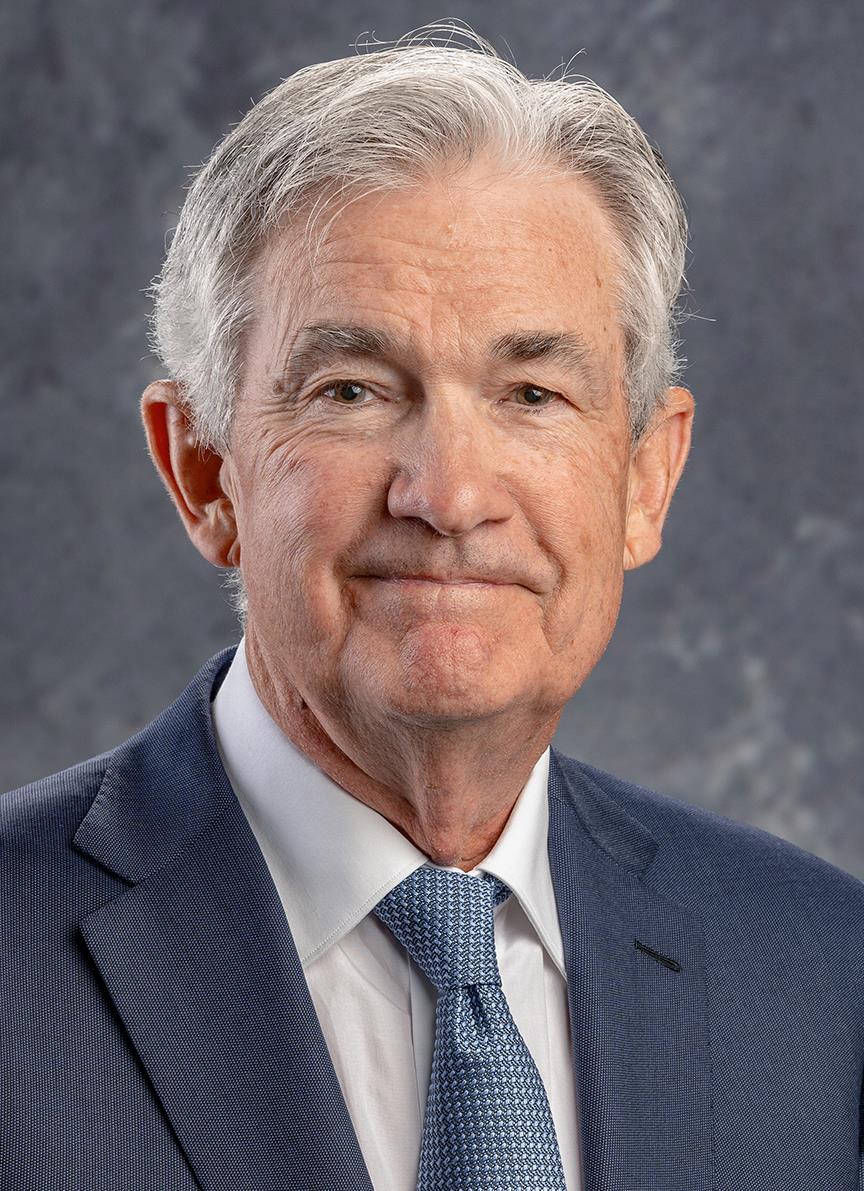

Markets Rally As Powell Signals Rate Easing Ahead

Wall Street surged on Friday as Federal Reserve Chair Jerome Powell's address at the Jackson Hole symposium signposted a shift in policy direction, lifting the Dow to its highest closing level of 2025. The Dow climbed by around 1.9 per cent, the S&P 500 rose 1.5 per cent, and the Nasdaq jumped by roughly 1.9 per cent. This rally reversed a recent downturn and came amid rising expectations for an interest-rate cut in September.

Investor sentiment pivoted sharply as Powell acknowledged mounting economic headwinds. He emphasised that with growth slowing to approximately 1.2 per cent in the first half of the year and inflation climbing-tariff effects lifting core PCE prices to 2.9 per cent year-on-year-downside risks to employment and upside pressures on inflation have become more pronounced. Despite these challenges, he maintained that monetary policy remains data-dependent and underscored that the shift in the balance of risks“may warrant adjusting our policy stance”.

Market reactions were swift. The Dow added over 800 points to mark its first record close of the year, while S&P and Nasdaq also advanced strongly. Small-cap stocks outperformed, exemplified by a 3.9 per cent rise in the Russell 2000, as investors placed renewed bets on rate-sensitive sectors. Futures markets priced in an approximately 83–85 per cent likelihood of a rate cut at the September meeting, up sharply from 75 per cent just prior to Powell's remarks.

The speech drew cautious optimism, with analysts noting that Powell maintained the central bank's flexibility. Nigel Green of deVere Group observed that Powell“kept the door open” to easing, offering reassurance to households and businesses that the Fed remains attentive to evolving conditions. Yet others warned that one cut alone might not significantly stimulate consumer spending and flagged risks from rising tariffs.

See also White House Joins TikTok Amid Ongoing ControversyBeyond macro trends, specific market segments stood out. Technology and regional banking stocks showed strong gains, while defensive sectors underperformed. Intel shares rose around 5.5 per cent following reports of a U. S. government stake acquisition, while Zoom posted its strongest quarterly revenue in nearly three years, garnering a nearly 13 per cent share price jump.

Despite the wave of bullishness, concerns linger. Analysts cautioned that the upswing may be a classic“late-summer rally,” driven by short-term optimism amid thin participation-conditions that could reverse in coming months. Retirees and fixed-income investors face frustration. With bond yields falling in response to the dovish tone, savers reliant on income streams are seeing diminished returns, even as inflation remains above the Fed's long-term objective.

Powell's comments also highlighted domestic political pressures. He signalled concerns over tariffs and immigration policies, warning they could exacerbate inflationary trends and suppress labour force growth. He reiterated the importance of the Fed's independence, even as internal dissent grows-with two governors voting against the last rate decision.

Notice an issue? Arabian Post strives to deliver the most accurate and reliable information to its readers. If you believe you have identified an error or inconsistency in this article, please don't hesitate to contact our editorial team at editor[at]thearabianpost[dot]com . We are committed to promptly addressing any concerns and ensuring the highest level of journalistic integrity. Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment