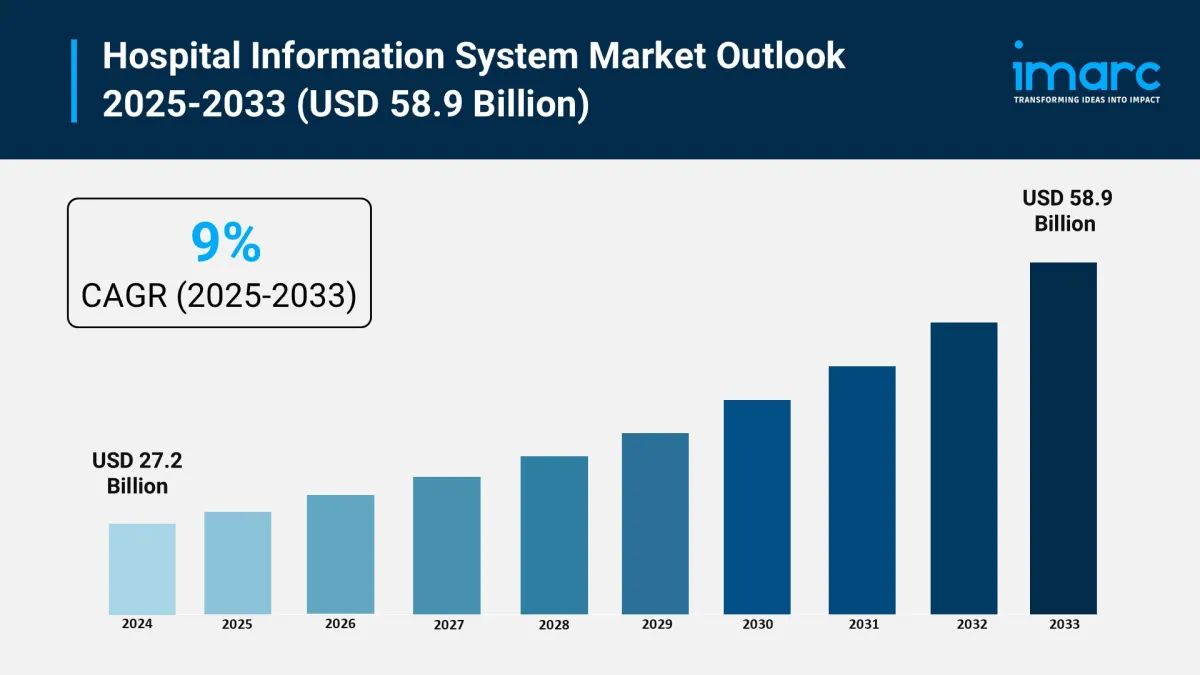

Hospital Information System Market Size To Hit USD 58.9 Billion In 2033 Grow CAGR By 9%

The hospital information system market is experiencing rapid growth, driven by rising demand for efficient patient data management, government investments in healthcare digitization, and increasing focus on cybersecurity in healthcare. According to IMARC Group's latest research publication, “Hospital Information System Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, The global hospital information system market size reached USD 27.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 58.9 Billion by 2033, exhibiting a growth rate CAGR of 9% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Claim Your Free“Hospital Information System Market” Analysis Sample Report Here

Our report includes:

-

Market Dynamics

Market Trends And Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the Hospital Information System Market

-

Rising Demand for Efficient Patient Data Management:

Hospitals are dealing with massive amounts of patient data every day, and that's pushing the need for better hospital information systems. Right now, over 90% of hospitals in the U.S. use some form of electronic health records, but many are upgrading to more integrated systems to handle everything from admissions to billing seamlessly. For instance, the Indian government's Ayushman Bharat Digital Mission has connected more than 200 million health IDs, making it easier for hospitals to share data and reduce errors. Companies like Cerner have reported a 15% increase in their HIS implementations this year, helping facilities cut administrative costs by up to 20%. This isn't just about tech-it's about saving time for doctors and improving patient outcomes. With chronic diseases affecting 1 in 3 adults globally, these systems are crucial for tracking treatments and preventing readmissions. Overall, the push for data efficiency is transforming how hospitals operate, making care faster and more reliable.

-

Government Investments in Healthcare Digitization:

Governments worldwide are pouring money into digitizing healthcare, which is a huge boost for the hospital information system industry. In the U.S., the Centers for Medicare & Medicaid Services have incentivized hospitals with over $40 billion in payments for adopting meaningful use of electronic systems. Similarly, the UK's NHS Digital program is rolling out integrated care records to 50 million people, streamlining operations across trusts. Epic Systems, a key player, recently announced partnerships with several European governments to deploy their HIS, resulting in a 25% improvement in data interoperability. Statistics show that digitized hospitals reduce medication errors by 50%, directly impacting patient safety. In Asia, China's Healthy China 2030 initiative has led to widespread HIS adoption in over 8,000 hospitals. These schemes aren't just funding tech; they're creating standards that make systems more secure and user-friendly. It's all about building a connected healthcare ecosystem that benefits everyone from patients to providers.

-

Increasing Focus on Cybersecurity in Healthcare:

Cyber threats are rampant in healthcare, driving hospitals to invest in robust information systems with top-notch security features. Recent stats reveal that healthcare data breaches affect over 100 million records annually, prompting a surge in demand for secure HIS platforms. For example, IBM's latest report notes that the average cost of a healthcare breach is $10 million, pushing companies like McKesson to enhance their systems with AI-driven threat detection, which has blocked 30% more attacks for their clients. Government efforts, such as the EU's GDPR compliance requirements, mandate hospitals to use encrypted systems, with fines up to 4% of global revenue for non-compliance. In the U.S., the HIPAA Security Rule updates have led to over 70% of hospitals upgrading their HIS. Real-world news from Meditech shows they've secured contracts with 500 facilities this year by emphasizing zero-trust architecture. This factor is critical because protecting patient data builds trust and ensures uninterrupted care, making it a non-negotiable for modern hospitals.

Key Trends in the Hospital Information System Market

-

Integration of AI and Machine Learning in HIS:

AI is shaking up hospital information systems by making them smarter and more predictive. For example, systems like those from Allscripts now use machine learning to analyze patient data in real-time, flagging potential issues like sepsis early and reducing mortality rates by 20%. In a busy hospital, this means doctors get alerts on their dashboards, saving precious minutes. Numerical insights show that AI-integrated HIS can process diagnostics 50 times faster than manual methods, as seen in deployments at Mayo Clinic where they've handled over 1 million scans annually with higher accuracy. Real-world applications include chatbots for patient triage, which have cut wait times by 40% in emergency departments. It's not just hype-companies are embedding AI to automate routine tasks, freeing up staff for complex care. This trend is making healthcare more proactive, turning data into actionable insights that improve everything from treatment plans to resource allocation.

-

Shift Towards Cloud-Based HIS Solutions:

Cloud technology is becoming the go-to for hospital information systems because it's flexible and cost-effective. Take Oracle's cloud HIS, which has been adopted by over 2,000 hospitals globally, allowing seamless access to records from any device and reducing on-site hardware costs by 30%. In practice, this means rural clinics can connect with urban specialists without lag, as demonstrated in Australia's eHealth program where cloud systems have linked 90% of public hospitals. Numerical data highlights that cloud HIS can scale to handle 10 times more data volume during peaks, like flu seasons, without crashes. Real-world examples include Amazon Web Services partnering with healthcare providers to migrate systems, resulting in 99.99% uptime. It's user-friendly too-staff can update records on the fly, improving collaboration. This trend is democratizing advanced tech, making it easier for smaller hospitals to compete and deliver high-quality care without breaking the bank. (143 words)

-

Emphasis on Interoperability and Data Sharing:

Interoperability is a big trend in hospital information systems, focusing on seamless data exchange between different platforms. For instance, FHIR standards are now used in over 80% of new HIS deployments, enabling hospitals to share patient info securely across networks. A concrete example is the U.S. Veterans Affairs system, which connects with private providers to serve 9 million veterans, reducing duplicate tests by 25%. Numerical insights indicate that interoperable systems cut healthcare costs by $30 billion annually through better coordination. In Europe, the eHealth Network has facilitated cross-border data sharing for 27 countries, with real-world applications like instant access to allergy records during travel emergencies. Companies like InterSystems are leading with their HealthShare platform, integrating data from disparate sources for holistic views. This isn't just technical-it's about creating a unified patient journey, minimizing errors, and enhancing care quality in an increasingly connected world.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=2189&flag=E

Leading Companies Operating in the Global Hospital Information System Industry:

-

Agfa-Gevaert Group. (Dedalus Holding S.p.A.)

Allscripts Healthcare Solutions Inc.

Carestream Health Inc. (Koninklijke Philips N.V.)

Cerner Corporation

Comarch SA.

Computer Programs and Systems Inc.

Epic Systems Corporation (Compass Group plc)

GE Healthcare Inc. (Danaher Corporation)

McKesson Corporation

Medical Information Technology Inc.

Nextgen Healthcare Inc.

Wipro Limited

Hospital Information System Market Report Segmentation:

By Component:

-

Hardware

Software

Services

Software represents the largest segment as it facilitates seamless integration of clinical and administrative processes and improves operational efficiency, patient care quality, and healthcare outcomes.

By Deployment Type:

-

On-premises

Web-based

Cloud-based

Cloud-based holds the biggest market share on account of the rising focus on flexible, scalable, and cost-effective healthcare IT infrastructure.

By System Type:

-

Clinical Information System

Administrative Information System

Electronic Medical Record

Laboratory Information System

Radiology Information System

Pharmacy Information System

Others

Laboratory information system accounts for the largest market share due to its ability to facilitate the management and automation of laboratory processes, including sample tracking, result reporting, quality control, and inventory management.

By End User:

-

Hospitals

Insurance Companies

Others

On the basis of the end user, the market has been divided into hospitals, insurance companies, and others.

Regional Insights:

-

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America enjoys a leading position in the hospital information system market, driven by the presence of advanced healthcare infrastructure.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment