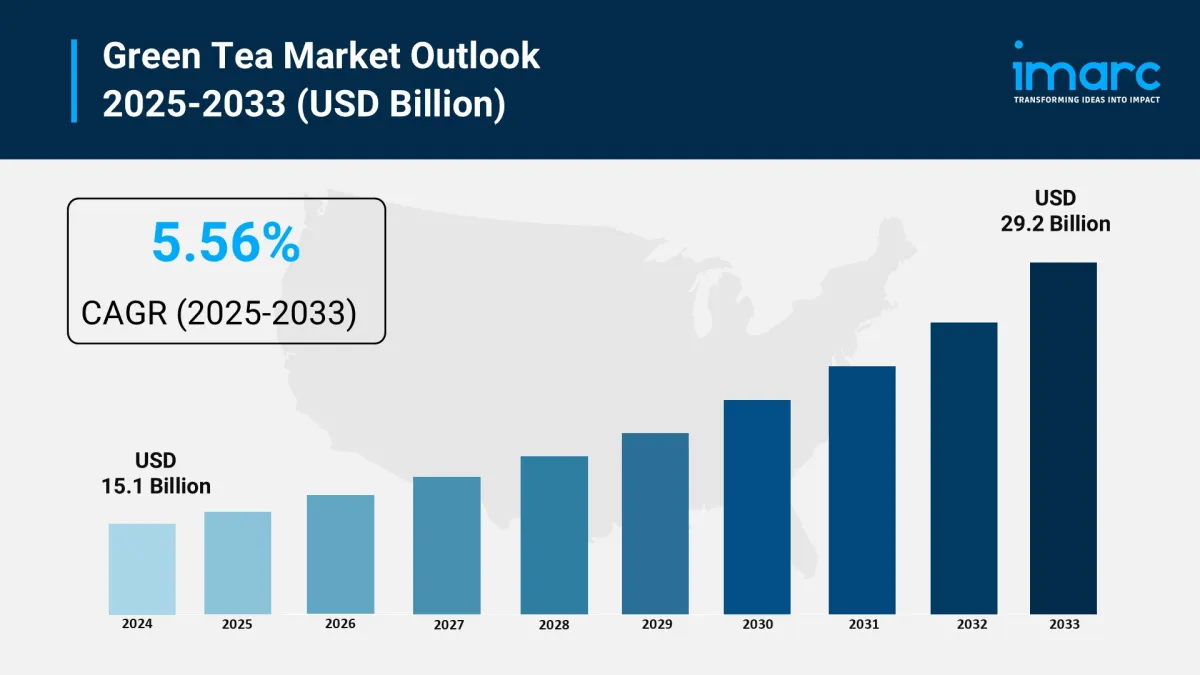

Global Green Tea Market Report 2025: Size Projected USD 29.2 Billion, CAGR Of 5.56% By 2033.

The global green tea market reached a value of USD 17.0 Billion in 2024 and is projected to grow to USD 29.2 Billion by 2033 , expanding at a CAGR of 5.56% during 2025–2033 , according to the latest report by IMARC Group. This growth is driven by increasing consumer awareness of the health benefits of green tea, the rise in wellness-oriented lifestyles, and innovations in flavors, formulations, and packaging. As green tea becomes a global staple in the health and wellness industry, the market is witnessing rapid expansion across both developed and emerging regions.

Key Stats

-

Market Value (2024): USD 17.0 Billion

Projected Market Value (2033): USD 29.2 Billion

CAGR (2025–2033): 5.56%

Leading Segment (2025): Green Tea Bags and Flavored Green Tea expected to dominate

Top Regions: Asia Pacific (largest), North America and Europe (established), Latin America and Middle East (emerging)

Key Players: Unilever, The Coca-Cola Company, Tata Global Beverages, ITO EN, Arizona Beverage Company, and others

Request Free Sample Report: https://www.imarcgroup.com/green-tea-market/requestsample

Growth Drivers

Rising Health Awareness:Green tea is widely recognized for its antioxidant-rich profile, notably catechins, which contribute to heart health, metabolism, immunity, and weight management. The increasing preference for healthy, natural, and low-caffeine beverages is a key factor driving market growth.

Lifestyle & Wellness Trends:A growing global focus on fitness, weight loss, detoxification, and mindfulness has driven higher consumption of functional beverages such as green tea. The trend toward clean-label and organic products has also fueled demand for premium variants like matcha and sencha.

Product Innovation:Green tea manufacturers are launching innovative blends infused with herbs, spices, and superfoods to cater to changing consumer tastes. Fortified green teas with vitamins, adaptogens, and probiotics are expanding market appeal.

Expansion of Distribution Channels:Online platforms and e-commerce are significantly boosting market accessibility, offering consumers a wide variety of products and personalized blends. Offline channels like specialty stores and supermarkets remain strong drivers in mature markets.

AI or Technology Impact

Technology is playing a pivotal role in optimizing the green tea supply chain:

-

Precision Agriculture: AI-powered tools are being used in tea cultivation to optimize yield, reduce waste, and improve leaf quality through better soil and climate monitoring.

Automated Harvesting: Robotics and mechanized plucking systems are reducing labor costs and increasing consistency in tea leaf selection.

Processing Innovations: Freeze-drying, vacuum sealing, and nitrogen-flush packaging are preserving flavor, aroma, and nutritional value.

Eco-Packaging: Advances in biodegradable and recyclable packaging materials are aligning with sustainable practices and attracting eco-conscious consumers.

These innovations not only ensure product quality but also enhance operational efficiency and support global sustainability goals.

Segmental Analysis

By Type:

-

Green Tea Bags – Dominant segment due to convenience and ease of use.

Instant Mixes – Gaining popularity among on-the-go consumers.

Iced Green Tea – Expanding rapidly as a ready-to-drink (RTD) health beverage.

Loose Leaf – Preferred by traditional tea enthusiasts seeking richer taste.

Capsules & Others – Offering convenience in functional formats like supplements.

By Flavour:

-

Lemon, Jasmine, Aloe Vera, Cinnamon, Vanilla, Wild Berry, Basil, Others

Flavored green tea is growing as consumers seek novelty and added health benefits.

By Distribution Channel:

-

Supermarkets/Hypermarkets – Remain the largest distribution point.

Specialty Stores – Key for premium and organic variants.

Convenience Stores – Offer smaller, quick-purchase formats.

Online Stores – Fastest-growing channel due to personalized selections and convenience.

Others – Includes health food stores and direct-to-consumer models.

Regional Insights

Asia Pacific:

Holds the largest market share, driven by traditional tea culture, rising disposable incomes, and premiumization. Countries like China, Japan, and India are key contributors.

North America:

A mature market with rising demand for organic, RTD, and fortified green tea. U.S. consumers are increasingly adopting wellness beverages.

Europe:

Growth driven by herbal and detox variants. The UK, Germany, and France are among the major consumers.

Latin America:

Emerging as a strong growth region due to rising health trends and improved urban lifestyles in Brazil and Mexico.

Middle East and Africa:

Market expansion is supported by urbanization, young population, and the increasing influence of global health trends.

Market Dynamics

Drivers:

-

Growing preference for plant-based beverages

Increasing popularity of weight-loss and detox products

Rapid urbanization and disposable income growth in emerging markets

Restraints:

-

Price sensitivity in cost-conscious regions

Limited awareness in remote or underdeveloped areas

Key Trends:

-

Functional green tea products (e.g., with collagen, probiotics, or adaptogens)

Shift toward sustainable, biodegradable packaging

Surge in premium and single-origin green tea offerings

Growth of green tea-based cosmetics and wellness products

Leading Companies

Unilever – Known for Lipton and Pure Leaf brands, expanding into premium organic blends. Tata Global Beverages – Offers a wide range of green teas under Tata Tea and Tetley. The Coca-Cola Company – Markets Honest Tea and RTD green tea beverages globally. Arizona Beverage Company – Leading iced green tea manufacturer in North America. ITO EN – Japanese leader in matcha and RTD teas, expanding internationally. AMORE Pacific Corp – Blending green tea with skincare and cosmetics lines. Associated British Foods – Offers Twinings brand with a strong presence in herbal and green teas. Numi Organic Tea – Focused on organic, fair-trade, and sustainable green tea offerings. Honest Tea Inc. – Acquired by Coca-Cola; known for organic bottled teas. Frontier Natural Products Co-Op – Supplies organic bulk herbs and green teas. Finlays Beverages Ltd. – A global supplier of tea extracts for RTD beverages. Kirin Beverage Corp. – Innovating with functional green teas in Japan. Yogi Tea – Combines green tea with Ayurvedic herb blends. Celestial Seasonings – Offers unique flavored green tea infusions. Cape Natural Tea Products – Specializes in premium South African herbal and green teas.Recent Developments

-

2024: Unilever expanded its Lipton Green Tea portfolio with new functional blends infused with vitamin C and probiotics.

2024: Tata Consumer Products launched organic matcha tea sticks for on-the-go consumption in India and Southeast Asia.

2023: ITO EN introduced a premium cold brew matcha RTD product in the U.S. market.

2023: Arizona launched a new range of sugar-free iced green tea drinks with natural sweeteners.

2023: Numi Organic Tea rolled out compostable tea bags and zero-waste packaging initiatives.

2023: Coca-Cola increased distribution of Honest Tea green tea variants in Latin American countries.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment