Europe Medical Cannabis Market Growth Driven By Regulatory Advances In 2025

Key Highlights

-

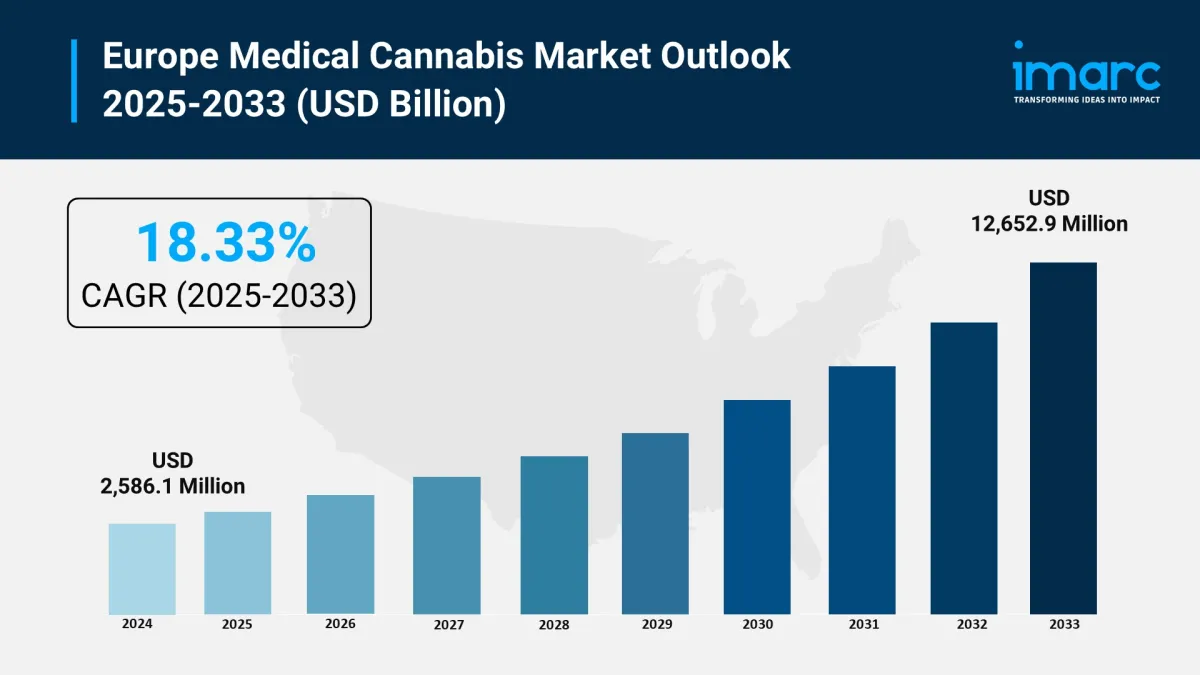

Market size (2024): USD 2,586.1 Million

Forecast (2033): USD 12,652.9 Million

CAGR (2025–2033): 18.33%

Germany market share (2024): 26.7%

Legal reforms and rising patient volumes driving medical cannabis adoption

Advanced cultivation and extraction technologies boosting pharmaceutical-grade output

Key companies operating in the European medical cannabis market include Canopy Growth Corporation, Aurora Cannabis Inc., Tilray, Inc., Demecan GmbH, Panaxia Pharmaceutical Industries Ltd, Little Green Pharma, Cannamedical Pharma GmbH, Sapphire Medical, Althea Group, Bedrocan International, etc.

How Is Legalization Transforming the Medical Cannabis Market in Europe?

Europe's evolving cannabis landscape is being reshaped by progressive legalization and healthcare integration. In countries like Germany, medical cannabis is becoming more accessible due to:

-

Decriminalization and regulatory clarity for physicians and patients

Surging import volumes and local production to meet rising demand

Integration of cannabis-based treatments in therapeutic areas such as chronic pain, cancer, epilepsy, and mental health

Combined with strong public awareness and physician education programs, the region has witnessed consistent year-on-year growth in prescriptions and patient registrations.

Key Market Trends and Drivers

-

Legalization Momentum: Ongoing regulatory approvals and de-scheduling of cannabis in major markets like Germany are expanding access and legitimacy.

Therapeutic Expansion: Physicians are prescribing cannabis for a growing range of chronic and neurological conditions.

Investment in R&D: Companies are investing in clinical research to develop targeted and high-efficacy formulations.

Advanced Cultivation & Extraction: High-tech indoor cultivation and pharmaceutical-grade extraction methods are ensuring consistent product quality.

Strategic Partnerships: M&A activity, cross-border collaborations, and vertical integration are helping companies scale across Europe.

Download a sample copy of the report: https://www.imarcgroup.com/europe-medical-cannabis-market/requestsample

Europe Medical Cannabis Industry Segmentation:

Analysis by Species:

-

Indica

Sativa

Hybrid

Analysis by Derivative:

-

Cannabidiol (CBD)

Tetrahydrocannabinol (THC)

Others

Analysis by Application:

-

Cancer

Arthritis

Migraine

Epilepsy

Others

Analysis by End Use:

-

Pharmaceutical Industry

Research and Development Centers

Others

Analysis by Route of Administration:

-

Oral Solutions and Capsules

Smoking

Vaporizers

Topicals

Others

Analysis by Country:

-

Germany

France

United Kingdom

Italy

Spain

Others

Latest Developments in the Industry

-

In April 2024 , Germany officially removed cannabis from its narcotics list, allowing easier prescribing and dispensing for medical purposes-resulting in a significant increase in import volumes.

At the Medical Cannabis Europe Conference 2025 (Amsterdam, June) , over 90 exhibitors from 25 countries showcased clinical-grade products, automation in cultivation, and cannabinoid-based pharmaceuticals. Several collaboration deals and MOUs were announced.

Multiple start-ups and global cannabis brands are setting up local production hubs in Germany , leveraging favorable regulatory conditions and public health demand.

Investment in patient education platforms and e-prescription systems is helping streamline medical access and physician-patient engagement.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment