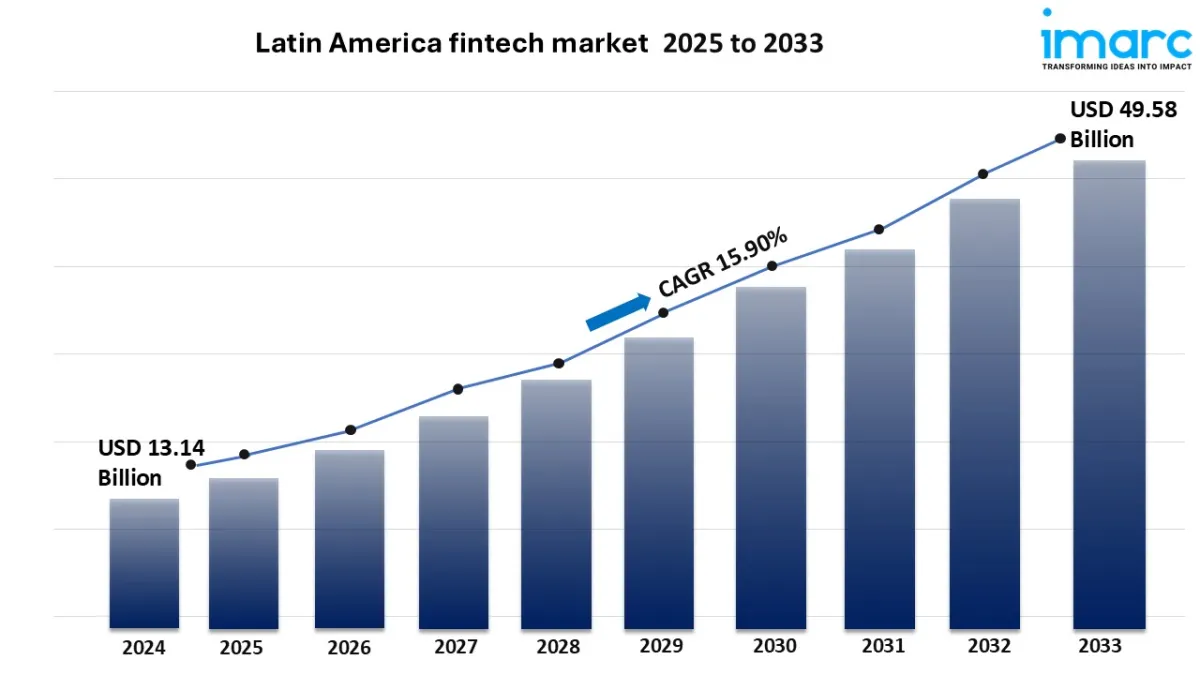

Latin America Fintech Market To Surge To USD 49.58 Billion By 2033

Market Size in 2024: USD 13.14 Billion

Market Forecast in 2033: USD 49.58 Billion

Market Growth Rate (2025-2033): 15.90%

The Latin America fintech market size reached USD 13.14 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 49.58 Billion by 2033, exhibiting a growth rate (CAGR) of 15.90% during 2025-2033.

Latin America Fintech Market Trends and Drivers:

The Latin America fintech market is changing rapidly. Virtual innovation is transforming how clients and companies interact with financial services. Fintech companies are using mobile technology, cloud systems, and big data analytics. They aim to offer personalized, accessible, and efficient financial solutions. Cellular use is rising in the region. As a result, virtual wallets, neobanking, and peer-to-peer lending are becoming popular. This shift benefits underserved and unbanked groups. Financial inclusion is growing fast. Fintech groups are reaching areas that traditional banks have ignored. Improvements in cybersecurity and fraud detection are making transactions safer. This boosts consumer trust and speeds up adoption. More businesses are using embedded finance solutions. This helps them streamline operations and provide smooth payment experiences. Online habits and tech services are creating a new, sustainable marketplace.

In Latin America, regulators are supporting fintech by creating smart rules. These guidelines encourage innovation and protect customer interests. Brazil, Mexico, and Colombia lead in open banking and virtual ID. This helps startups work with established banks under a unified system. Regulatory changes are boosting quick product development and strong partnerships. This is especially true in areas like decentralized finance and blockchain-based services. Teaming up with third-party companies helps businesses enhance customer experience and streamline operations. Venture capitalists and personal fairness buyers see the region's potential. They are investing in fintech startups. These startups are changing price gateways, credit score models, and insurance structures. This economic support is driving a new wave of innovation. It focuses on customer-centered, tech-based solutions. These solutions aim to meet the unique economic challenges of Latin America.

In countries like Brazil and Argentina, the fintech market is thriving. This growth comes from a mix of social and economic factors, along with digital progress. This is especially true in retail banking, mobile payments, and funding structures. Argentina faces monetary volatility. Fintech solutions offer new credit scoring models and multi-currency digital accounts. Local trends are pushing fintech companies to adjust their services. They are working with national pricing systems. They are also enhancing economic products that meet urgent needs. Latin American clients are becoming more tech-savvy. They demand intuitive and user-friendly systems. Fintechs are tailoring their services to meet local needs. This trend makes the marketplace an important part of economic modernization. Innovation, regulation, and demand are making fintech key to Latin America's economic future.

For an in-depth analysis, you can refer sample copy of the report:

https://www.imarcgroup.com/latin-america-fintech-market/requestsample

Latin America Fintech Market Industry Segmentation:

Deployment Insights:

-

On-premises

Cloud Based

Technology Insights:

-

Application Programming Interface

Artificial Intelligence

Blockchain

Robotic Process Automation

Data Analytics

Others

Application Insights:

-

Payment and Fund Transfer

Loans

Insurance and Personal Finance

Wealth Management

Others

End User Insights:

-

Banking

Insurance

Security

Others

Regional Insights:

-

Brazil

Mexico

Argentina

Colombia

Chile

Peru

Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

-

Market Performance (2019-2024)

Market Outlook (2025-2033)

COVID-19 Impact on the Market

Porter's Five Forces Analysis

Strategic Recommendations

Historical, Current and Future Market Trends

Market Drivers and Success Factors

SWOT Analysis

Structure of the Market

Value Chain Analysis

Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment