403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Comcast Stock Signal 22/07: Should You Buy The Dip? (Chart)

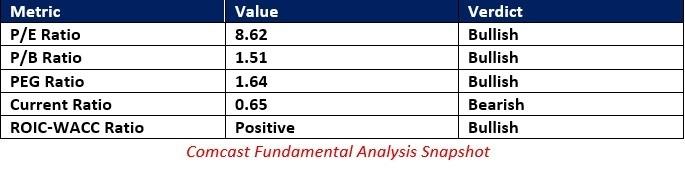

(MENAFN- Daily Forex) Long Trade IdeaEnter your long position between 34.28 (the upper band of its horizontal support zone) and 35.10 (yesterday's intra-day high).Market Index Analysis

- Comcast (CMCSA) is a member of the NASDAQ 100, S&P 100, and the S&P 500. All three indices remain near record highs, but bearish trading volumes are rising. The Bull Bear Power Indicator of the S&P 500 shows a negative divergence.

- The CMCSA D1 chart shows price action bouncing off a horizontal support zone. It also shows support from the ascending 50.0% Fibonacci Retracement Fan level. The Bull Bear Power Indicator is bearish but should move higher inside an ascending triangle. The trading volume on the bounce higher eclipsed average selling volumes. CMCSA corrected as the S&P 500 rallied to fresh highs, a significant bearish development, but volumes remain bullish.

- CMCSA Entry Level: Between 34.28 and 35.10 CMCSA Take Profit: Between 43.30 and 45.31 CMCSA Stop Loss: Between 31.44 and 32.20 Risk/Reward Ratio: 3.18

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Fitell Corporation Launches Solana (SOL) Digital Asset Treasury With $100M Financing Facility, With Focus On Yield And On-Chain Defi Innovation

- Tradesta Becomes The First Perpetuals Exchange To Launch Equities On Avalanche

- Dubai At The Centre Of Global Finance: Forex Expo 2025 Redefines The Trading Landscape

- Kucoin Appeals FINTRAC Decision, Reaffirms Commitment To Compliance

- Forex Expo Dubai 2025 Conference To Feature 150+ Global FX And Fintech Leaders

- Daytrading Publishes New Study Showing 70% Of Viral Finance Tiktoks Are Misleading

Comments

No comment