Qualcomm Stock Signal 21/07: Breakout On Horizon? (Chart)

(MENAFN- Daily Forex) Long Trade IdeaEnter your long position between 151.80 (the intra-day low of its last bearish candle) and 155.43 (its latest intra-day high).Market Index Analysis

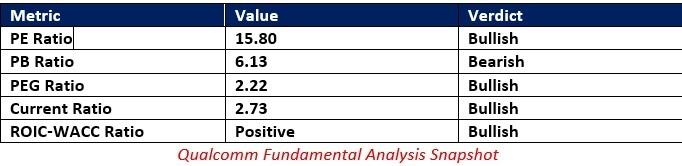

- Qualcomm (QCOM) is a member of the NASDAQ 100, S&P 100, and the S&P 500. All three indices remain near record highs with rising bearish trading volumes. The Bull Bear Power Indicator of the NASDAQ 100 shows a negative divergence.

- The QCOM D1 chart shows price action ascending inside a bullish price channel. It also shows support from the ascending 38.2% Fibonacci Retracement Fan level. The Bull Bear Power Indicator is bearish, but bullish pressures are rising. The trading volume on the bounce at support was higher than average selling volume. QCOM corrected as the S&P 500 rallied to fresh highs, a significant bearish development, adding to short-term volatility issues.

- QCOM Entry Level: Between 151.80 and 155.43 QCOM Take Profit: Between 182.10 and 193.84 QCOM Stop Loss: Between 141.77 and 135.21 Risk/Reward Ratio: 3.02

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- BTCC Summer Festival 2025 Unites Japan's Web3 Community

- Ethereum Based Meme Coin Pepeto Presale Past $6.6 Million As Exchange Demo Launches

- Ecosync & Carboncore Launch Full Stages Refi Infrastructure Linking Carbon Credits With Web3

- Invromining Expands Multi-Asset Mining Platform, Launches New AI-Driven Infrastructure

- BTCC Announces Participation In Token2049 Singapore 2025, Showcasing NBA Collaboration With Jaren Jackson Jr.

- Innovation-Driven The5ers Selects Ctrader As Premier Platform For Advanced Traders

Comments

No comment